Impact Analysis for changes recommended in 33rd Council Meeting

Impact Analysis for changes recommended in 33rd Council Meeting

We have done the Impact Analysis for changes recommended in 33rd Council Meeting held on 24th Feb 2019. Following is the Analysis for changes recommended in 33rd Council Meeting:

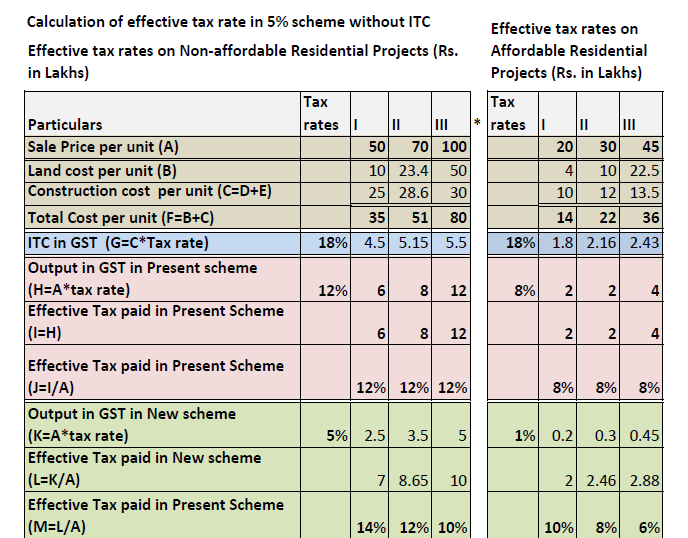

Summary of calculation of effective tax rate in 5% scheme without ITC:

| For Builders | For Developers | ||||||||||||

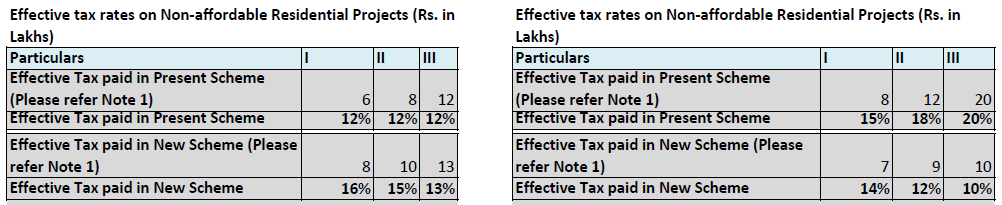

| Impact on non affordable residential projects |

Impact on non affordable residential projects |

Area Sharing | Revenue Sharing | ||||||||||

| Options | I | II | III | I | II | III | I | II | III | I | II | III | |

| Effective tax paid in new scheme (A) | 14% | 12% | 10% | 10% | 8% | 6% | 16% | 15% | 13% | 14% | 12% | 10% | |

| Effective tax paid in present scheme (B) | 12% | 12% | 12% | 8% | 8% | 8% | 12% | 12% | 12% | 15% | 18% | 20% | |

| Difference in effective tax rates (Increase)/Decrease (C=B‐A) | -2% | 0% | 2% | -2% | 0 | 2% | -4% | -3% | -1% | 2% | 5% | 10% | |

Summary of options:‐

Option 1 ‐ Low price house with less than 30% of land component.

Option 2 ‐ Mid price house with less than 50% of land component.

Option 3 ‐ High price house with less than 65% of land component.

Conclusion:

GST is implemented with an intent to consolidate all the indirect taxes so that the effective tax rates borne by the consumer is reduced to some extent. Looking at this objective, the scheme proposed by the GOM may not be summarized as an optimum scheme because it results into increase in cost by 2% in less budget residential houses. The Government’s decision of reducing tax rate does not complement intention behind housing for all by 2020 as low cost houses will suffer in the new scheme.

Further, to avail the benefits of Notification 4/2018 CGST (Rate) dated 25.1.2018, developers opted for area sharing model however, under the new scheme, as per above calculations, revenue sharing model would be more appropriate.

Assumptions:‐

1. The figures of sales price, construction cost, material and labour proportion in the construction cost and deemed profit margin are assumed.

2. Some of the inputs is taxed at the rate of 28% and most of the inputs and input services

are taxable at 18% under GST. Therefore, an average rate of 18% is assumed for inputs and

input services. The rate of 18% is assumed after taking into consideration the requirement

of credit reversal on 1/3rd value of land.

Notes:‐

1. ITC shall not be allowed in the new scheme and therefore, effective tax rate is the addition of GST ITC lost and output tax paid under GST.

2. In the new scheme, the tax rates are 5% and 1% for non‐affordable and affordable housing projects respectively. Affordable projects are proposed to be defined as follows:‐

“A residential house/flat of carpet area of upto 90 sqm in non‐metropolitan cities / towns and 60 sqm in metropolitan cities having value upto Rs. 45 lacs (both for metropolitan and non‐metropolitan cities).”

3. In the present scheme, applicable GST rate on output side is 18% with deduction of 1/3rd amount for the land value. So the effective tax rate on output is 12%.

Notes:

1. The figures of effective tax paid is taken from earlier working as done in sheet named as “Tax @ 5% with No ITC”.

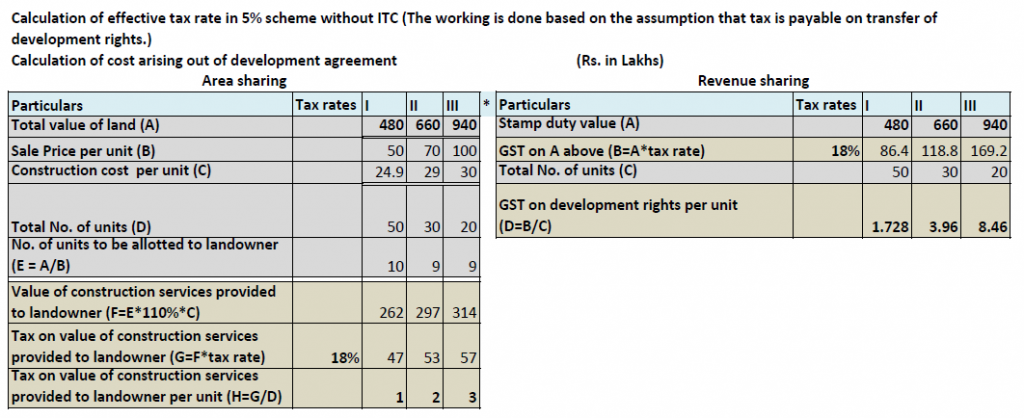

2. Under area sharing joint development agreement, tax paid on construction services provided by developer was available as credit to the landowner and the landowner could use such credit to discharge tax on development rights. Therefore, GST on construction services provided to landowner was possible to be passed on to landowner. However, under new scheme as transfer of development rights is not taxable, the landowner will not bear the tax liability on construction services provided by developer in an area sharing arrangement and resultantly, the cost per unit for the developer will go up.

3. As per Rule 27 read with Rule 30 of valuation rules, the construction service provided by developer to landowner is valued at construction cost + 10%.

4. Under revenue sharing arrangement, tax on development rights was a cost for developer because the developer would have a huge sum as input tax credit and as the refund of unutilised ITC is blocked for builders, the developer would recover it from his customers. Further, under the new scheme, transfer of development rights is proposed to be exempted.

5. This working is not done for affordable housing projects as the changes would be similar in both as far as development agreements are concerned.

Pooja Jajwani

Pooja Jajwani

Ahemdabad, India