Impact of new rates on Real-estate Developers

Impact of new rates on Real-estate Developers:

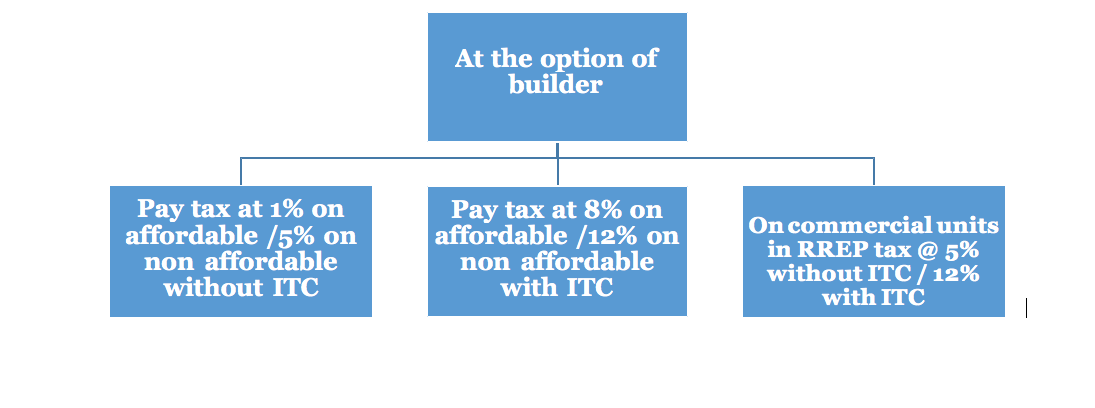

On-going Residential Real-estate Projects (RREP) & Residential units in other Real-estate Projects (REP):

Conditions for exercise of option by the builder for an on-going project:

- One-time Option to be exercised by filing specified form before 10th-May-

- On non-filing of specified options, the project shall be taxable at 1%/5%.

- If opting for new scheme then, proportionate project wise ITC reversal as per the prescribed method to be done before the due date for furnishing of the return for the month of September following the end of financial year 2018-19.

- Builder can pay tax @ 1%/5% on installments received from 1st April to 10th

“ongoing project” shall mean project which meets all the following conditions, namely-

- commencement certificate issued on or before 31st March, 2019 and it is certified by any of the following that construction of the project has started on or before 31st March, 2019:-

- an architect

- a chartered engineer

- a licensed surveyor of the respective local body of the city or town or village or development or planning

- where commencement certificate is not required, it is certified by any of the authorities specified in sub clause (a) above that construction of the project has started on or before the 31st March, 2019

- completion certificate has not been issued or first occupation of the project has not taken place on or before the 31st March, 2019;

- apartments being constructed under the project have been, partly or wholly, booked on or before the 31st March,

– Construction of a project shall be considered to have started on or before the 31st March, 2019, if the earthwork for site preparation for the project has been completed and excavation for foundation has started on or before the 31st March, 2019.

– An apartment booked on or before the 31st March, 2019 shall mean an apartment which meets all the following three conditions, namely-

- part of supply of construction has time of supply on or before the 31st March, 2019 and

- at least one instalment has been credited to the bank account of the registered person on or before the 31st March, 2019 and

an allotment letter or sale agreement or any other similar document evidencing booking of the apartment has been issued on or before the 31st March, 2019.

On-going Commercial units in other Real-estate Projects (REP)

- Tax @ 12% with proportionate

![01.GST Summary of New rates (2).docx [Compatibility Mode] 2019-04-15 16-18-01](https://www.consultease.com/wp-content/uploads/2019/04/01.GST-Summary-of-New-rates-2.docx-Compatibility-Mode-2019-04-15-16-18-01.png)

![01.GST Summary of New rates (2).docx [Compatibility Mode] 2019-04-15 16-19-00](https://www.consultease.com/wp-content/uploads/2019/04/01.GST-Summary-of-New-rates-2.docx-Compatibility-Mode-2019-04-15-16-19-00.png) Conditions for paying tax at reduced rates of 1%/5%:-

Conditions for paying tax at reduced rates of 1%/5%:-

-

- Tax @ 1%/5% has to be paid through

- ITC can-not be availed for units on which tax @ 1%/5% is

- ITC not availed has to be reported in GSTR 3B

- 80% of value of input and input services [other than TDR, long term lease, FSI, electricity, high speed diesel, motor spirit, natural gas], used shall be received from registered supplier

- If less than 80% of value of input and input service is procured from unregistered dealer then:-

- RCM @ 18% on services and goods other than cement;

- RCM @ 28% on cement,

to be paid by the developer. The calculation of 80% criteria has to be done at the end of every financial year.

- If capital goods are procured from unregistered dealer then, RCM at applicable rates to be paid by the

- Developer has to maintain project wise accounts including project wise records of inwards supplies received from registered and unregistered

- In affordable housing projects, if the contractor has opted to pay GST @ 12% as per entry (va) of Notification 11/2017 and the conditions specified therein is violated then, the developer shall pay differential 6% tax on RCM

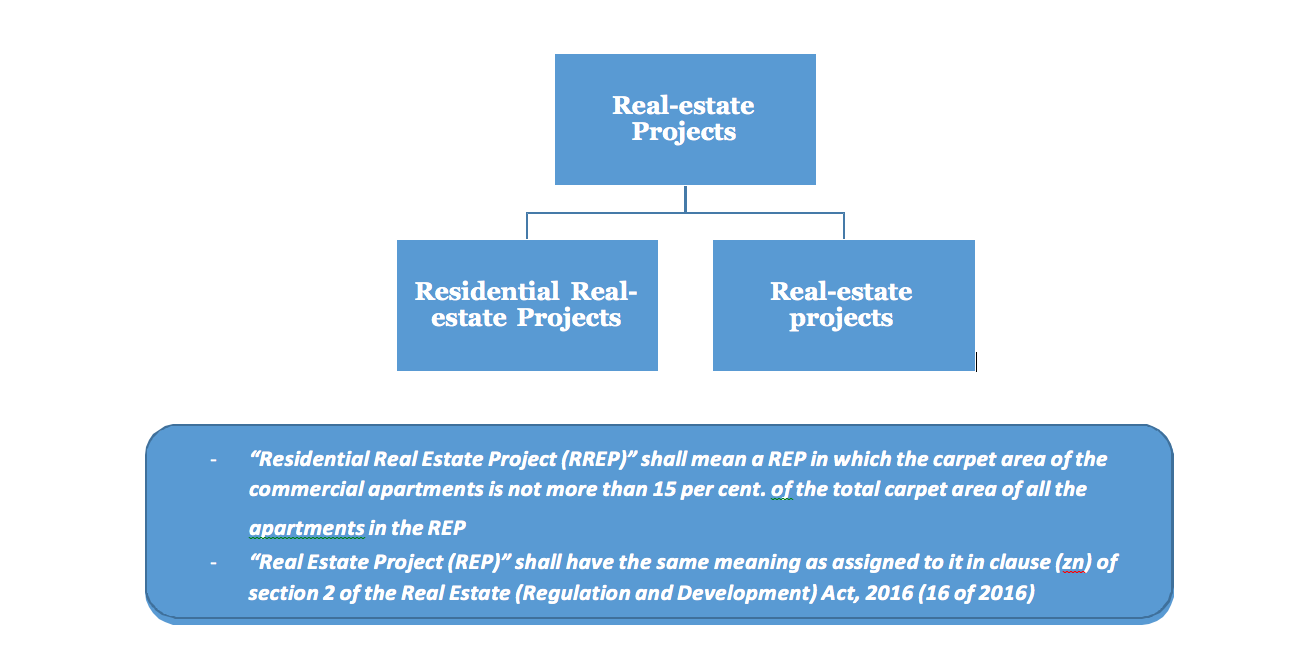

Some relevant definitions:-

- “Apartment” shall have the same meaning as assigned to it in clause (e) of section 2 of the Real Estate (Regulation and Development) Act, 2016 (16 of 2016);

“Section 2(e) of RERA :- “apartment” whether called block, chamber, dwelling unit, flat, office, showroom, shop, godown, premises, suit, tenement, unit or by any other name, means a separate and self-contained part of any immovable property, including one or more rooms or enclosed spaces, located on one or more floors or any part thereof, in a building or on a plot of land, used or intended to be used for any residential or commercial use such as residence, office, shop, showroom or godown or for carrying on any business, occupation, profession or trade, or for any other type of use ancillary to the purpose specified.”

“Affordable residential apartment” shall mean, –

- an apartment being constructed in an ongoing project under any of the schemes specified in sub-item (b), sub-item (c), sub-item (d), sub-item (da) and sub-item (db) of item (iv); sub-item (b), sub-item (c), sub-item a residential apartment in a project which commences on or after 1 st April, 2019, or in an ongoing project in respect of which the promoter has not exercised option to pay tax at 12%, as the case may be, having carpet area not exceeding 60 square meter in metropolitan cities or 90 square meter in cities or towns other than metropolitan cities and for which the gross amount charged is not more than forty five lakhs rupees.

[Metropolitan cities are Bengaluru, Chennai, Delhi NCR (limited to Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, Faridabad), Hyderabad, Kolkata and Mumbai (whole of MMR) with their respective geographical limits prescribed by an order issued by the Central or State Government in this regard]

(b) an apartment being constructed in an ongoing project under any of the schemes specified in sub-item (b), sub-item (c), sub-item (d), sub-item (da) and sub-item (db) of item (iv); sub-item (b), sub-item (c), sub-item (d) and sub-item (da) of item (v); and sub-item (c) of item (vi), against serial number 3 of the Table above, in respect of which the promoter has not exercised option to pay tax at 8%, as the case may be.

“Commencement certificate” means the commencement certificate or the building permit or the construction permit, by whatever name called issued by the competent authority to allow or permit the promoter to begin development works on an immovable property, as per the sanctioned

Pooja Jajwani

Pooja Jajwani

Ahemdabad, India