Income Tax (8th Amendment) Rules, 2018

Income Tax (8th Amendment) Rules, 2018

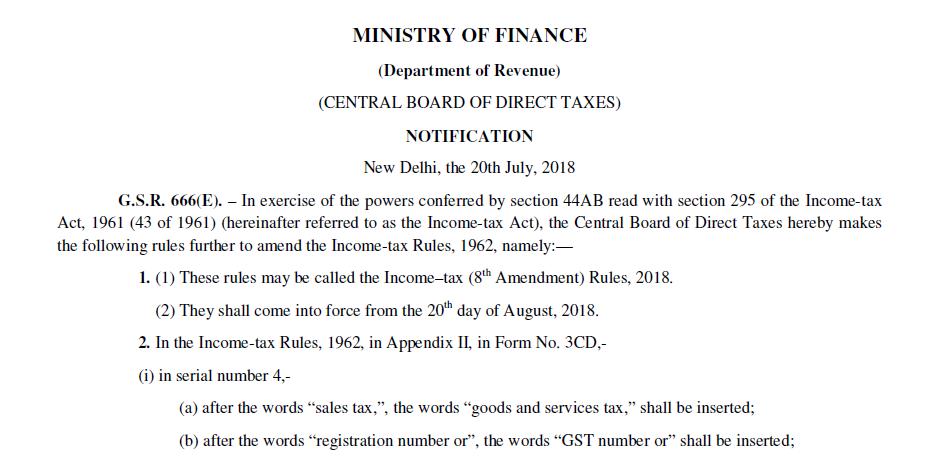

On the 20th July 2018, the Government of India has issued a Notification in which the new amendments are applied in the Income Tax rules. The said amendments have to be referred to as “Income Tax (8th Amendment) Rules, 2018”. Following is the text of the Notification:

G.S.R. 666(E). – In exercise of the powers conferred by section 44AB read with section 295 of the Income-tax Act, 1961 (43 of 1961) (hereinafter referred to as the Income-tax Act), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:—

1. (1) These rules may be called the Income Tax (8th Amendment) Rules, 2018.

(2) They shall come into force from the 20th day of August, 2018.

2. In the Income-tax Rules, 1962, in Appendix II, in Form No. 3CD,-

(i) in serial number 4,-

(a) after the words “sales tax,”, the words “goods and services tax,” shall be inserted;

(b) after the words “registration number or”, the words “GST number or” shall be inserted;

(ii) in serial number 19, in the table, after the row with the entry “32AC”, the row with the entry “32AD” shall be inserted;

(iii) in serial number 24, after the words “32AC or”, the words “32AD or” shall be inserted;

(iv) in serial number 26, for the words “or (f)”, the words “, (f) or (g)” shall be substituted;

(v) after serial number 29 and the entries relating thereto, the following shall be inserted, namely:-

“29A. (a) Whether any amount is to be included as income chargeable under the head ‘income from other sources’ as referred to in clause (ix) of sub-section (2) of section 56? (Yes/No)

(b) If yes, please furnish the following details:

- Nature of income:

- Amount thereof:

Download the Full Income Tax (8th Amendment) Rules, 2018 by clicking the below image:

29B. (a) Whether any amount is to be included as income chargeable under the head ‘income from other sources’ as referred to in clause (x) of sub-section (2) of section 56? (Yes/No)

(b) If yes, please furnish the following details:

(i) Nature of income:

(ii) Amount (in Rs.) thereof:”;

(vi) after serial number 30 and the entries relating thereto, the following shall be inserted, namely:-

“30A. (a) Whether primary adjustment to transfer price, as referred to in sub-section (1) of section 92CE, has

been made during the previous year? (Yes/No)

(b) If yes, please furnish the following details:-

(i) Under which clause of sub-section (1) of section 92CE primary adjustment is made?

(ii) Amount (in Rs.) of primary adjustment:

(iii) Whether the excess money available with the associated enterprise is required to be repatriated to India as per the provisions of sub-section (2) of section 92CE? (Yes/No)

(iv) If yes, whether the excess money has been repatriated within the prescribed time (Yes/No)

(v) If no, the amount (in Rs.) of imputed interest income on such excess money which has not been repatriated within the prescribed time:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.