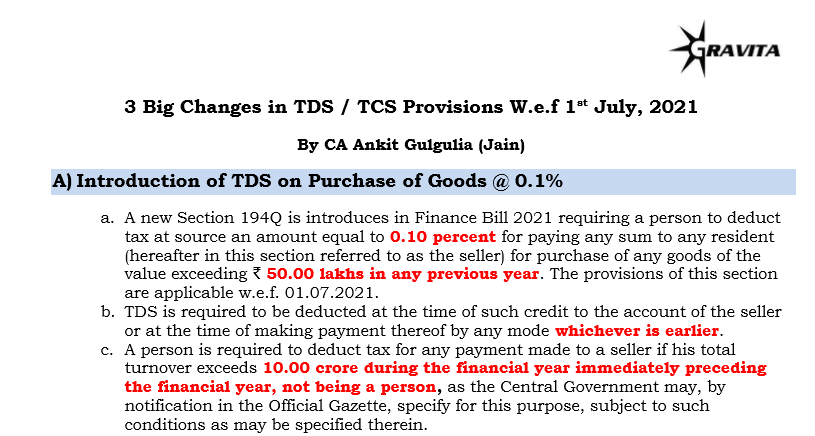

3 Big Changes in TDS / TCS Provisions w.e.f 1st July, 2021

Table of Contents

A) Introduction of TDS on Purchase of Goods @ 0.1%

a. A new Section 194Q is introduced in Finance Bill 2021 requiring a person to deduct tax at source an amount equal to 0.10 percent for paying any sum to any resident (hereafter in this section referred to as the seller) for purchase of any goods of the value exceeding ₹ 50.00 lakhs in any previous year. The provisions of this section are applicable w.e.f. 01.07.2021.

b. TDS is required to be deducted at the time of such credit to the account of the seller or at the time of making payment thereof by any mode whichever is earlier.

c. A person is required to deduct tax for any payment made to a seller if his total turnover exceeds 10.00 crore during the financial year immediately preceding the financial year, not being a person, as the Central Government may, by notification in the Official Gazette, specify for this purpose, subject to such conditions as may be specified therein.

Related Topic:

Applicability Of Section 194Q

d. The provisions of this section will not apply if tax is deductible under any other provisions of this Act or tax is collectible under the provisions of section 206C other than Section 206(1H) of the Act. {That is TDS not applicable on TCS on Scrap Sale say for example but it will supersede the TCS on Purchases introduced earlier via Section 206C(1H)}

e. Tax is deductible at the rate of 0.10 percent on a sum exceeding ₹ 50.00 lakhs if PAN is provided by the seller. If PAN is not provided by the seller, then the rate will be 5 percent of the amount.

f. If on any transaction TCS u.s. 206(1H) is required to be collected by the seller and TDS u.s. 194Q is required to be deducted, then on that transaction, provisions of section 194Q will apply and TCS won’t apply.

Related Topic:

TCS under section 206C(1H) of income tax Act

g. This section is similar to section 206(1H) which is applicable for collection of tax at source. However, section 206(1H) introduced by Finance Bill 2020 is already a part of the Income Tax Act and has been applicable w.e.f. 01.10.20. Section 206(1H) requires the seller to collect tax at the rate of 0.10 percent of the amount collected from the buyer exceeding ₹ 50.00 lakhs. Section 206(1H) specifically excludes a transaction on which tax is deductible under any other provisions of this Act including that of Section 194Q

h. However, Section 194Q does not exempt a transaction on which tax is required to be collected under section 206(1H). The primary and foremost obligation to deduct tax shall be of the buyer of goods. However, if the buyer makes a default, then the seller will be liable to collect tax from the buyer

Related Topic:

305th issue of Tax Connect

B) More Information Now Required in TDS / TCS Returns

a. Reason Code

i. New reason code inserted for mentioning Reason for non-collection/lower collection/or collection at a higher rate. in Form 26Q, 27Q, 27EQ to make form in-line with the new provisions under Amendment to Rule 31A U/N 71/2021 Dt 08-06-2021 {Income-tax (17th Amendment) Rules, 2021}

Related Topic:

TDS Provisions under Income Tax Act, 1961 for FY 2019-20

b. Effect of U/N 71/2021 Dt 08-06-2021 {Income-tax (17th Amendment) Rules, 2021}

i. Now, the assessee has furnish particulars of the amount paid or credited on which tax was not deducted or deducted at a lower rate under new sections introduced.

1. 194A(3)(x) – Exempted Interest on a threshold basis

2. Second Proviso to S. 194 (Clause D) – Exempted Dividend to Business Trust

3. Second Proviso to S. 194 (Clause E) – Exempted Dividend to Notified

4. 196D(2) – Exempted Capital Gains u/s 115AD payable to FII

5. Proviso to S.196D(1A) – clause (a) of sub-section (1) of section 115AD

6. 194Q (5) – Here it is important to note that TDS / TCS return require only disclosure when TDS u/s 194Q becomes inapplicable due to TDS becoming applicable under any other section or TCS other than 206C(1H) becomes applicable. Hence in our view, where TDS is not applicable u/s 194Q due to a threshold of 50 Lacs or 10 Crores then the same is still not required to be reported under New Rule 31A TDS Returns Norms.

Related Topic:

Latest TDS/TCS Related Amendments

C) Higher TDS/ TCS for Non-Filers of Income Tax Returns

a. New section 206AB has been inserted by THE FINANCE ACT, 2021 NO. 13 OF 2021 Dated 28th March 2021. The section is inserted w.e.f. 1st July 2021.

b. Section 206AB “Special provision for deduction of tax at source for non-filers of income-tax return”

i. Section is Applicable

1. If a person requires to deduct tax under any of the provisions of Chapter XVIIB Tax Deduction at Sources.

2. Transaction is done with a Specified person. (Specified person means a person who have not filed his return of Income immediately two preceding previous years, for which due date U/s 139(1) has expired.

a. For Eg. If tax is required to deduct for July 2021, the Previous year 2021-22, so for relevant immediately 2 preceding previous years for which ITR filing required to be checked are 2018-19 and 2019-20 (AY 2019-20 and 2020-21 respectively). As the time limit for Preceding Previous Year 2020-21 is not expired

3. The aggregate of tax deducted at source and tax collected at source in his case is rupees fifty thousand or more in each of these two previous years.

ii. Section Not Applicable

1. If the Specified Person is a Non-Resident who does not have a permanent establishment in India.

2. The section has an overriding effect on all provisions of Chapter XVIIB of the Income-tax Act, 1961 Except the Followings:

a. 192 – TDS on Salary

b. 192A – TDS on Premature withdrawal from EPF

c. 194B – TDS on Lottery

d. 194BB – TDS on Horse Riding

e. 194LBC – TDS on Income in respect of investment in securitization trust

f. 194N – TDS on cash withdrawal in excess of Rs. 1 crore

c. The tax shall be deducted at the Highest of the Following

i. at twice the rate specified in the relevant provision of the Act or

ii. at twice the rate or rates in force; or

iii. at the rate of five percent or

iv. Section 206AA Rate (If Applicable section applies)

Note:- Similar Provision for TCS u/s 206CCA has also been inserted and applied.

Related Topic:

PDF of Finance Act 2021 Passed by the Parliament

D) How to Check the Non Filer Status of Seller on Portal

It can be seen that the tax deductor or the tax collector is required to do due diligence of satisfying himself if the deductee or the collectee is a specified person. This can lead to an extra compliance burden on such tax deductor or a tax collector. To ease this compliance burden the Central Board of Direct Taxes is issuing a new functionality “Compliance Check for Sections 206AB & 206CCA”. This functionality is made available through reporting portal of the Income-tax Department. The tax deductor or the collector can feed the single PAN (PAN search) or multiple PANs (bulk search) of the deductee or collectee and can get a response from the functionality if such deductee or collectee is a specified person. For PAN Search, a response will be visible on the screen which can be downloaded in PDF format. For Bulk Search, the response would be in the form of a downloadable file that can be kept for record.

Related Topic:

TDS on Clearing & Forwarding Agents Payment

The deductor or the collector may check the PAN in the functionality at the beginning of the financial year and then he is not required to check the PAN of a non-specified person during that financial year.

Note:- Above is for Purely Client Circulation. Not for Solicitation Purpose. Stringent Copyrights.

CA Ankit Gulgulia

CA Ankit Gulgulia

Chartered Account and Financial Services Provider

New Delhi, India