Amended TDS chart for 14-5-2020 to 31-3-2021

Table of Contents

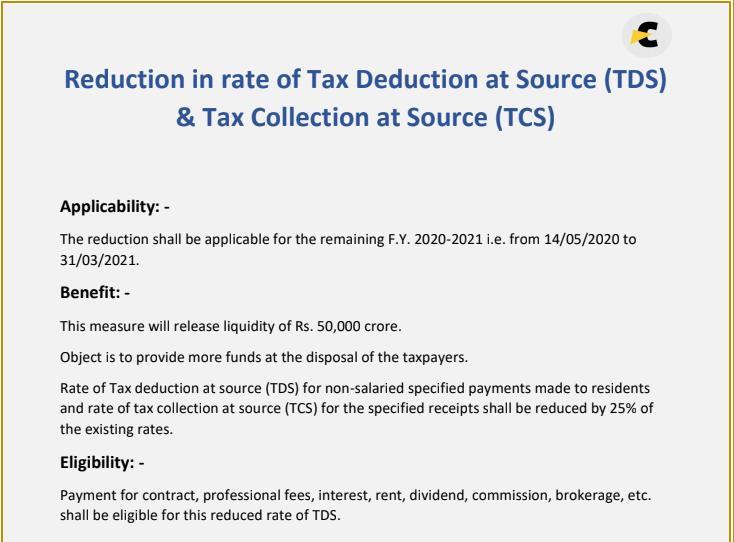

Reduction in rate of Tax Deduction at Source (TDS) & Tax Collection at Source (TCS)

Applicability: –

The reduction shall be applicable for the remaining F.Y. 2020-2021 i.e. from 14/05/2020 to 31/03/2021.

Benefit: –

This measure will release liquidity of Rs. 50,000 crore.

The object is to provide more funds at the disposal of the taxpayers.

Rate of Tax deduction at source (TDS) for non-salaried specified payments made to residents and rate of tax collection at source (TCS) for the specified receipts shall be reduced by 25% of the existing rates.

Related Topic:

Latest TDS/TCS Related Amendments

Eligibility: –

Payment for the contract, professional fees, interest, rent, dividend, commission, brokerage, etc. shall be eligible for this reduced rate of TDS.

1. In order to provide more funds at the disposal of the taxpayers for dealing with the economic situation arising out of COVID-19 pandemic, the rates of Tax Deduction at Source (TDS) for the following non-salaried specified payments made to residents has been reduced by 25% for the period from 14th May 2020 to 31st March 2021:-

TDS RATE CHART

| S. No | Section of the Income-tax Act |

Nature of Payment | Existing Rate of TDS | Reduced rate from 14/05/2020 to 31/03/2021 |

| 1 | 193 | Interest on Securities |

10% | 7.5% |

| 2 | 194 | Dividend | 10% | 7.5% |

| 3 | 194A | Interest other than interest on securities |

10% | 7.5% |

| 4 | 7.5% | Payment of Contractors and sub-contractors |

1% (individual/HUF) 2% (others) |

0.75% (individual/HUF) 1.5% (others) |

| 5 | 194D | Insurance Commission |

5% | 3.75% |

| 6 | 194DA | Payment in respect for life insurance policy |

5% | 3.75% |

| 7 | 194EE | Payments in respect for deposits under National Savings Scheme |

10% | 7.5% |

| 8 | 194F | Payments on

an account of re- Units by Mutual |

20% | 15% |

| 9 | 194G | Commission, prize etc., on sale of lottery tickets |

5% | 3.75% |

| 10 | 194H | Commission or brokerage |

5% | 3.75% |

| 11 | 194-I(a) | Rent for plant and machinery |

2% | 1.5% |

| 12 | 194-I(b) | Rent for immovable property |

10% | 7.5% |

| 13 | 194-IA | Payment for acquisition of immovable property |

1% | 0.75% |

| 14 | 194-IB | Payment of rent by individual or HUF |

5% | 3.75% |

| 15 | 194-IC | Payment for

Joint |

10% | 7.5% |

| 16 | 194J | Fee for Professional or Technical Services (FTS), Royalty, etc. |

2% (FTS, certain royalties, call centre) 10% (others) |

1.5% (FTS, certain royalties, call centre) 7.5% (others) |

| 17 | 194K | Payment of dividend by Mutual Funds |

10% | 7.5% |

| 18 | 194LA | Payment of Compensation on acquisition of immovable property |

10% | 7.5% |

| 19 | 194LBA(1) | Payment of income by Business trust |

10% | 7.5% |

| 20 | 194LBB(i) | Payment of income by Investment fund |

10% | 7.5% |

| 21 | 194LBC(1) | Income by securitisation trust |

25% (Individual/HUF) 30% (Others) |

18.75% (Individual/HUF) 22.5% (Others) |

| 22 | 194M | Payment to commission, brokerage etc. by Individual and HUF |

5% | 3.75% |

| 23 | 194-O | TDS one- commerce participants |

1% (w.e.f. 1.10.2020) |

0.75% |

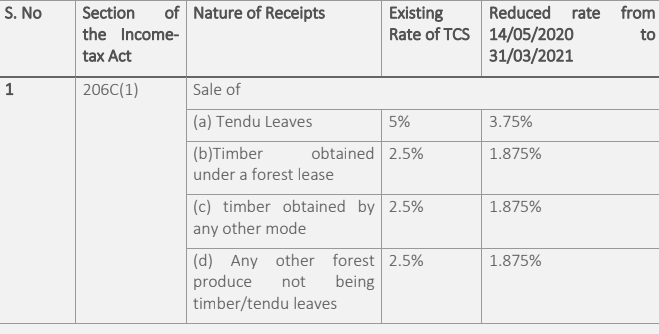

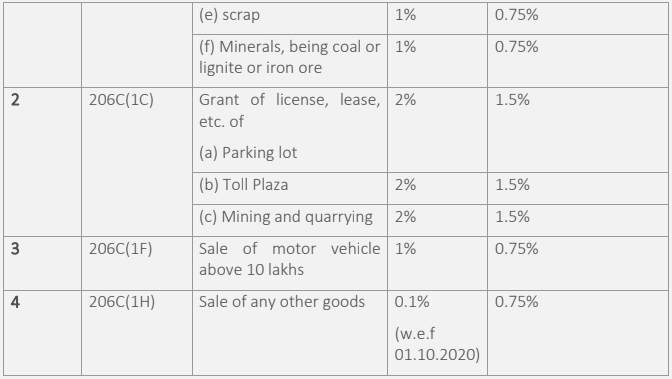

2. Further, the rate of Tax Collection at Source (TCS) for the following specified receipts has also

been reduced by 25% for the period from 14th May 2020 to 31st March 2021:

TCS RATE CHART

3. Therefore, TDS on the amount paid or credited during the period from 14th May 2020 to 31st March 2021 shall be deducted at the reduced rates specified in the table in para 1 above. Similarly, the tax on the amount received or debited during the period from 14th May 2020 to 31st March 2021 shall be collected at the reduced rates specified in the table in para 2 above.

4. It is further stated that there shall be no reduction in rates of TDS or TCS, where the tax is required to be deducted or collected at a higher rate due to non-furnishing of PAN/Aadhaar. For example, if the tax is required to be deducted at 20% under section 206AA of the Income-tax Act due to non-furnishing of PAN/Aadhaar, it shall be deducted at the rate of 20% and not at the rate of 15%.

5. Legislative amendments in this regard shall be proposed in due course.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.