Who can file ITR-1 SAHAJ

Who can file ITR-1 SAHAJ

The time for filing the ITR is now too close and time is very little. Every year, many youngsters start their earning and are confused regarding the filing of the ITR. There are So many formats for filing the return, but not every person has to file the same return. So, let us know Who can file ITR-1 SAHAJ:

Return Form ITR – 1 (SAHAJ) can be used by an individual whose total income includes:

(1) Income from salary/pension; or

(2) Income from one house property (excluding cases where the loss is brought forward from previous years); or

(3) Income from other sources (excluding winnings from lottery and income from race horses, income tax under section 115BBDA or Income of nature referred to in section 115BBE).

Further, in a case where the income of another person like spouse, minor child, etc., is to be clubbed with the income of the taxpayer, this return form can be used only when such income falls in any of the above categories.

| ITR Type | Who can file ITR-1 SAHAJ |

| ITR-1 SAHAJ | For Individuals having Income from Salaries, one house property, other sources (Interest etc.) and having total income up to Rs.50 lakh |

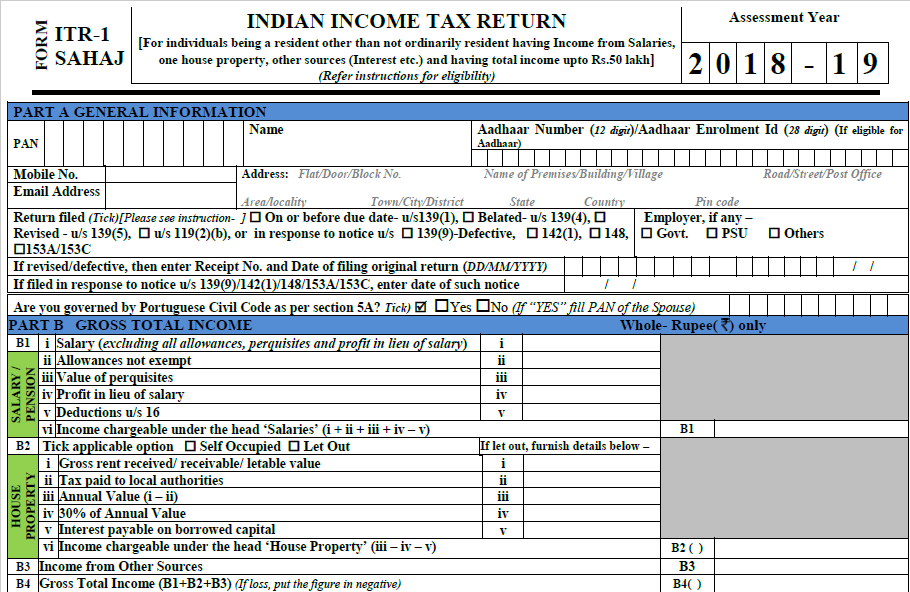

Download the Form ITR-1 SAHAJ by Clicking the below Image:

Who cannot file ITR-1 SAHAJ

Return Form ITR – 1 (SAHAJ) cannot be used by an individual:

- Whose total income for the Assessment year 2018-19 exceeds Rs. 50 lakh;

- Whose total income for the year includes income from more than one house property.

- Whose total income for the year includes income from winnings from lottery or income from race horses or income tax under section 115BBDA.

- Whose total income for the year includes income chargeable to tax under the head “Capital Gains”.

- Whose total income for the year includes income of nature referred to in section 115BBE.

- Whose total income for the year includes agricultural income of more than Rs. 5,000.

- Whose total income for the year includes income from business or profession.

- Whose total income for the year includes loss under the head “Income from other sources”.

- Who has claimed relief under section 90 and/or 91.

- Any Resident having any assets (including financial interest in any entity) located outside India or signing authority in any account located outside India.

- Any resident having income from any source outside India.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.