CBDT has extended the time limits of certain compliances to provide relief to taxpayers in view of the severe pandemic

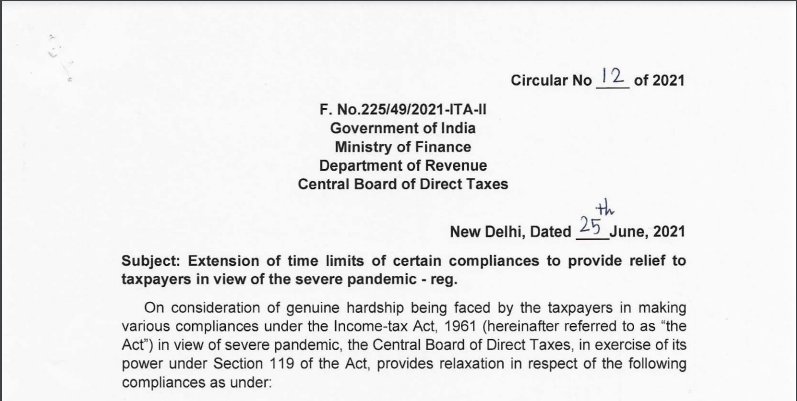

Circular No 12 of 2021

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, Dated 25 June 2021

Subject: Extension of time limits of certain compliances to provide relief to taxpayers in view of the severe pandemic· reg.

On consideration of genuine hardship being faced by the taxpayers in making various compliances under the Income-tax Act. 1961 (hereinafter referred to as “the Act”) in view of a severe pandemic, the Central Board of Direct Taxes, in the exercise of its power under Section 119 of the Act, provides relaxation in respect of the following compliances as under:

1) Objections to Dispute Resolution Panel (DRP) and Assessing Officer under section 144C of the Act, for which the last date of filing under that Section is 1st June 2021 or thereafter, may be filed within the time provided in that Section or by 31st August. 2021, whichever is later;

2) The Statement of Deduction of Tax for the last quarter of the Financial Year 2020-21, required to be furnished on or before 31st May 2021 under Rule 31A of the Income-tax Rules,1962 (hereinafter referred to as “the Rules”), as extended to 30th June 2021 vide Circular No. 9 of 2021, maybe furnished on or before 15th July 2021;

3) The Certificate of Tax Deducted at Source in Form No.16, required to be furnished to the employee by 15th June 2021 under Rule 31 of the Rules, as extended to 15th July 2021 vide Circular No. 9 of 2021, maybe furnished on or before 31st July 2021;

4) The Statement of Income paid or credited by an investment fund to its unit holder in Form No. 64D for the Previous Year 2020-21, required to be furnished on or before 15th June 2021 under Rule 12CB of the Rules, as extended to 30th June 2021 vide Circular No. 9 of 2021, maybe furnished on or before 15th July 2021;

5) The Statement of Income paid or credited by an investment fund to its unit holder in Form No. 64C for the Previous Year 2020-21, required to be furnished on or before 30th June 2021 under Rule 12CB of the Rules, as extended to 15th July 2021 vide Circular No. 9 of 2021, maybe furnished on or before 31st July 2021;

6) The application under Section 10(23C), 12AB, 35(1 )(ii)/(iia)/(iii) and 80G of the Act in Form No. 10A/ Form No.10AB. for registration/ provisional registration/ intimation/ approval/ provisional approval of Trusts/ Institutions/ Research Associations etc. required to be made on or before 30th June. 2021. maybe made on or before 31st August 2021;

Related Topic:

CBDT grants further relaxation in electronic filing of Income Tax Forms 15CA/15CB

7) The compliances to be made by the taxpayers such as investment, deposit, payment, acquisition, purchase, construction, or such other action, by whatever name called, for the purpose of claiming any exemption under the provisions contained in Section 54 to 54GB of the Act, for which the last date of such compliance falls between 1st April 2021 to 29th September 2021 (both days inclusive), may be completed on or before 30th September 2021;

8) The Quarterly Statement in Form No. 15CC to be furnished by an authorized dealer in respect of remittances made for the quarter ending on 30th June 2021, required to be furnished on or before 15th July 2021 under Rule 37 BB of the Rules, may be furnished on or before 31st July 2021;

9) The Equalization Levy Statement in Form No.1 for the Financial Year 2020- 21, which is required to be filed on or before 30th June 2021, maybe furnished on or before 31st July 2021;

Related Topic:

Order passed at the time when Income Tax Portal was dysfunctional, Assessment Order was set Aside

10) The Annual Statement required to be furnished under sub-section (5) of section 9A of the Act by the eligible investment fund in Form No. 3CEK for the Financial Year 2020-21, which is required to be filed on or before 29th June 2021, maybe furnished on or before 31st July 2021;

11) Uploading of the declarations received from recipients in Form No. 15G/15H during the quarter ending on 30lh June 2021, which is required to be uploaded on or before 15th July 2021, maybe uploaded by 31st August 2021;

12) Exercising of option under sub-section (1) of Section 245M of the Act in Form No. 34BB which is required to be exercised on or before 27th June 2021 may be exercised on or before 31st July 2021.

-sd –

(Prajna Paramita)

Director to the Government of India

Related Topic:

305th issue of Tax Connect

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.