How to file ITR without any software for Ay 20-21

Table of Contents

- Why should I file ITR?

- Which form of ITR is applicable in my case?

- How I can access the utility to fill return?

- Where to file an income tax return?

- Do I need to submit the documents or proof of investment with income tax return?

- Important data required for the income tax return of a salaried person

- Data for income tax return of a business entity

- Important data for the income tax return on a presumptive basis

- Consequences of non-filing or late filing of ITR

Why should I file ITR?

We should file ITR on time. It is a self-assessment form of tax. We inform the government about our income and pay tax on that income. We can file ITR even if there is no tax liability. It helps in easy disbursal of finance. You can file it yourself. But if you are liable for audit or Tax audit you will have to seek the help of a professional. ITR 1 and ITR 4 for this year are even notified. So the Income-tax department releases these forms every year. You need to fill the details in the relevant form.

Related Topic:

How To File ITR Using The New Filing Portal of Income Tax

Which form of ITR is applicable in my case?

If you are a salaried employee with house property and interest income:

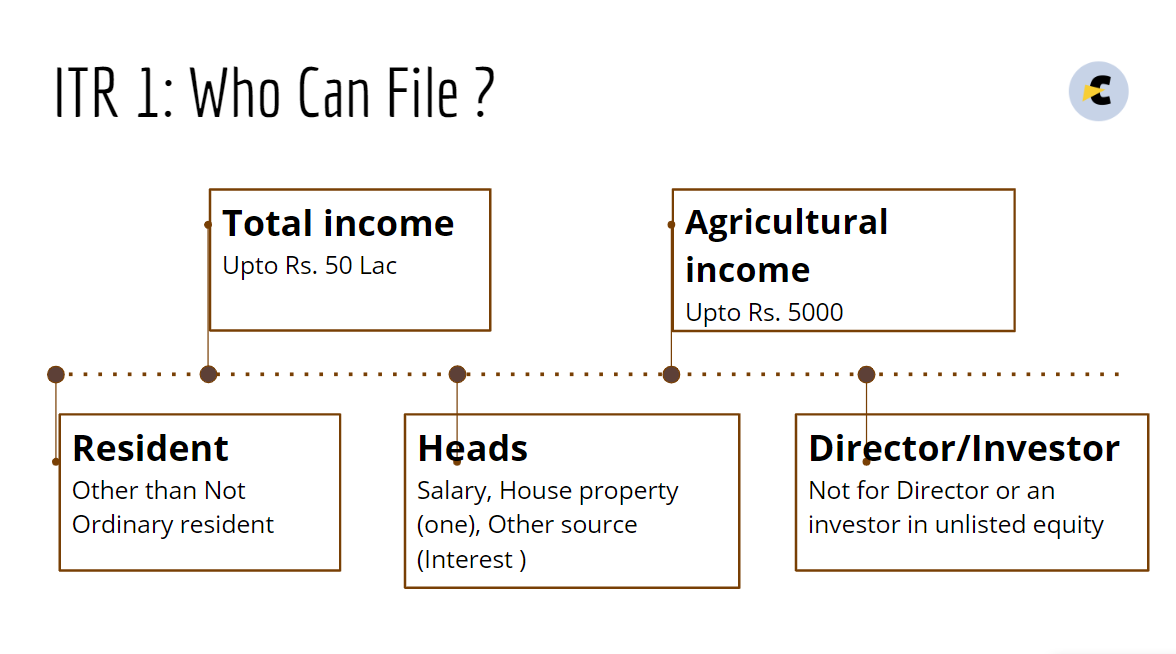

ITR 1 is suitable in this case. But see the following image to check whether you can file ITR 1 or not? If you are falling in any of the following exceptions. You are not eligible to file ITR 1. Although ITR 1 is most widespread. It is used by all salaried employees.

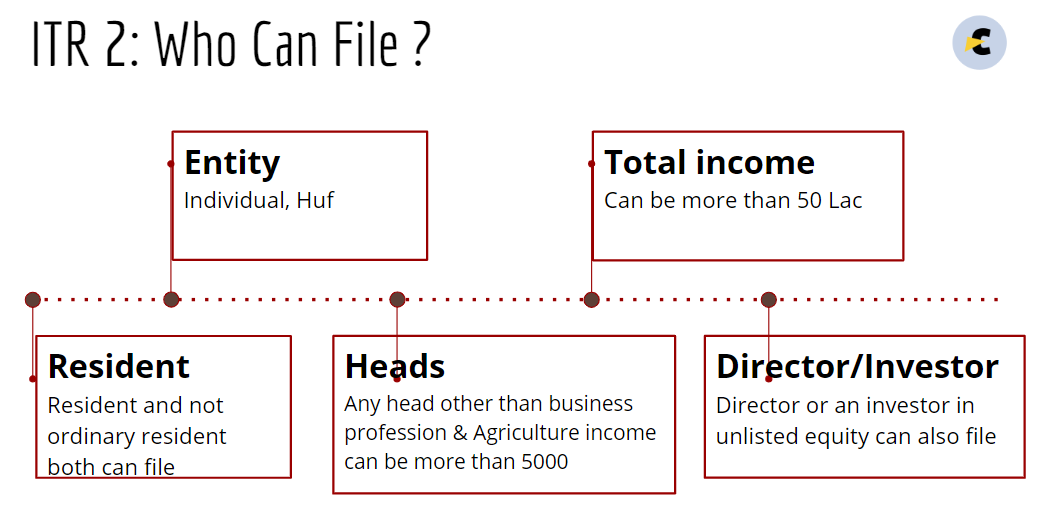

ITR 2:

This return can be filed by a person not eligible to file ITR 1. If you are out of ITR 1 , you can file ITR2. e.g . If you have capital gains income or house property income from more than two houses. You can file this return. There are some restrictions.

- Only Individual & HUF can file it

- Income from salary, pension, house property (even if more than one), Capital gains, and agriculture income more than Rs. 5000 can be covered. But income from business & profession cant be declared here.

- Even a Director can file it

- A not ordinary resident can also file it

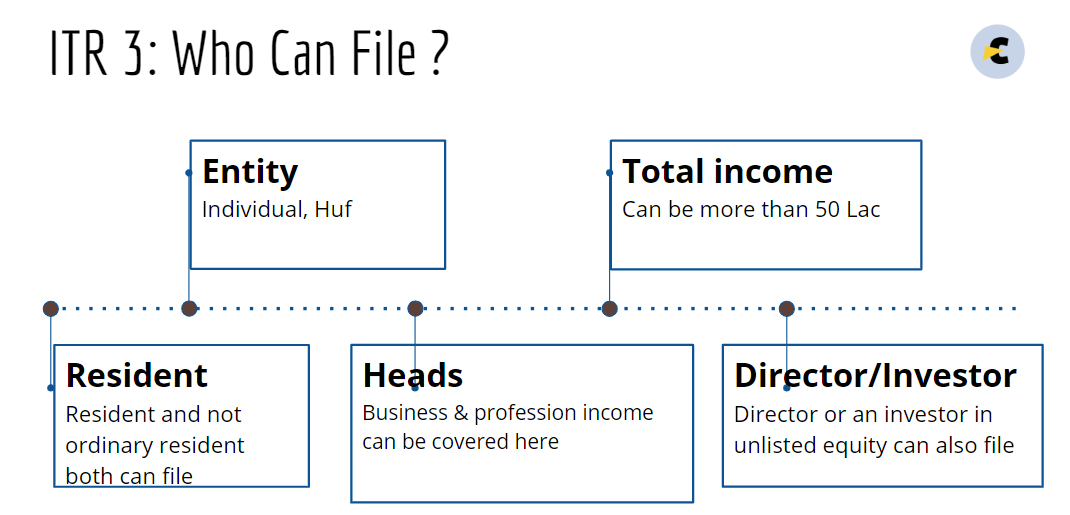

ITR 3:

Individual & HUF can file this return. When there is income from business & profession. ITR 3 can be filed.

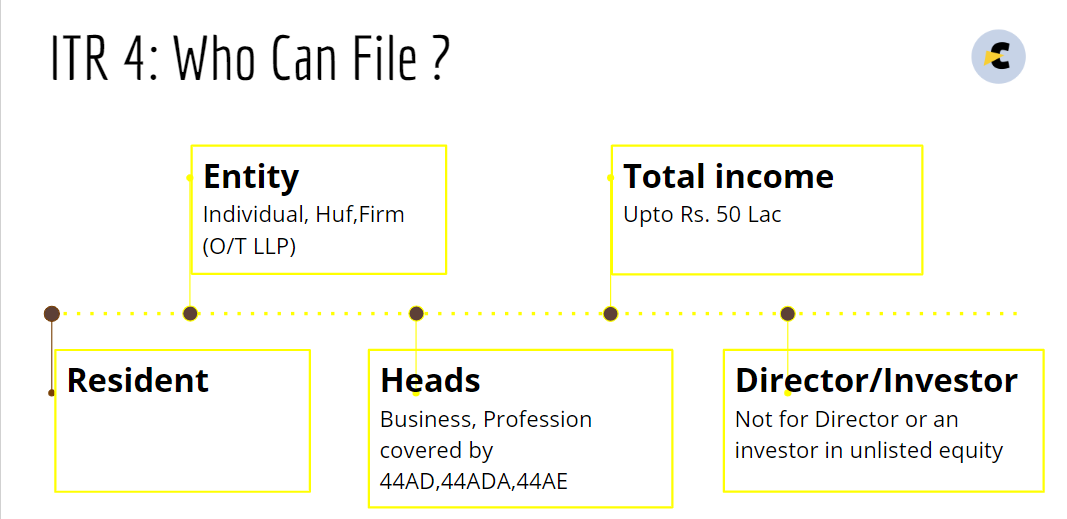

ITR 4:

This form is for business entities. But it can be filed only by Individual, HUF, Firm (Other than LLP). It is for presumptive income from business or profession. In some cases, the income is fixed at a % of gross receipts. This is called presumptive taxation. This form is for taxpayers opting for presumptive taxation.

How I can access the utility to fill return?

You can download the utility from the website of Income-tax India. Pre-filled XML is also available at your dashboard. You need to log in to the income tax website. Then information asked by the utility is required to be filled. Verify each sheet of utility. If there is any missing data, you will get a prompt. Once you validate all sheets you can generate Json file. This file can be uploaded at the income tax portal.

Where to file an income tax return?

You don’t need to go anywhere. Now the process of income tax returns filing is completely online. You can file it by login in at Income tax website Click on file return, and upload your Jason file.

Do I need to submit the documents or proof of investment with income tax return?

There is no need to submit any proof. No hard copy of a soft copy is required. The information for salary, investments, deduction etc is required. Income tax cross-verify it from that PAN. But assessee doesn’t need to upload any proof.

Important data required for the income tax return of a salaried person

List of information for ITR 1:

- Form 16 issued by the employer

- Form 26AS

- Bank statement

- Insurance document

- Investments in mutual funds (ELSS)

- Rent receipts (If applicable)

This year some additional information is required in ITR 1. Details of investment, foreign travel, and electricity bills is added in this year’s form.

Data for income tax return of a business entity

In this case, the profit and loss account is required. If the entity is also liable for a tax audit. All the information in form 3CD is needed. The return of the business entity is complex. Many factors need attention. A detailed study of PGBP head of income tax is required.

Important data for the income tax return on a presumptive basis

Only gross receipts are required. Income will be calculated at a % of gross receipts. Deductions of chapter are still available. But no other expenses are deductible.

Consequences of non-filing or late filing of ITR

Non-filing of ITR may result in interest and penalty. If you are looking forward to some finance then ITR is a must. In case of a belated return, you cant carry forward losses.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.