Income-tax (3rd Amendment) Rules, 2021: CBDT

Income-tax (3rd Amendment) Rules, 2021

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 11th March, 2021

G.S.R. 170(E). —In exercise of powers conferred by sections 200 and 203 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:—

1. Short title and commencement – (1) These rules may be called the Income-tax (3rd Amendment) Rules, 2021.

(2) They shall come into force on the 1st day of April 2021.

2. In the Income-tax Rules, 1962, in Appendix II,-

(i) For Form No. 12BA, the following shall be substituted, namely:–

“FORM NO. 12BA

[See rule 26A(2)(b)]

Statement showing particulars of perquisites, other fringe benefits or amenities, and profits in lieu of salary with value thereof

1. Name and address of employer :

2. TAN :

3. TDS Assessment Range of the employer :

4. Name, designation, and Permanent Account Number or Aadhaar Number of employee :

5. Is the employee a director or a person with a substantial interest in the company :

(where the employer is a company)

6. Income under the head “Salaries” of the employee (other than from perquisites) :

7. Financial year :

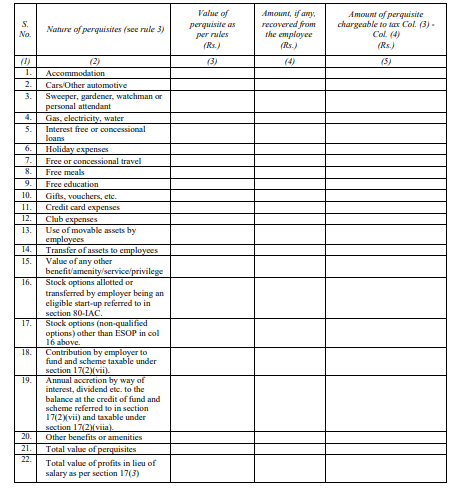

8. Valuation of Perquisites :

(9) Details of tax,—

(a) Tax deducted from the salary of the employee under section 192(1)

(b) Tax paid by the employer on behalf of the employee under section 192(1A)

(c) Total tax paid

(d) Date of payment into Government treasury

DECLARATION BY EMPLOYER

Related Topic:

New Regime of Income Tax Search and Seizure Assessments – Glaring Implications

I, _______, s/o _______________________ working as_________(designation) do hereby declare on behalf of ____________ (name of the employer) that the information given above is based on the books of account, documents and other relevant records or information available with us and the details of value of each such perquisite are in accordance with section 17 and rules framed thereunder and that such information is true and correct.

Place Full Name

Date Designation

Signature of the person responsible for deduction of tax.”;

Related Topic:

Read & Download the full Notification in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.