Income Tax Deductions – Individuals and HUF (FY 2019-20)

Table of Contents

- Income Tax Deductions – Individuals,HUF (FY 2019-20)

- Section 80C: Deduction in respect of life insurance premium, contribution to PF, children tuition fees, PPF etc.

- Section 80CCC: Income Tax Deduction for Contributions to Pension Funds

- Section 80CCD(1): An income tax deduction for contributions made by Individual to eligible NPS

- Section 80CCD(1B): Additional Income tax deduction for contributions made by Individual to eligible NPS

- Section 80CCD(2): An income tax deduction for contributions by the employer to eligible NPS

- Section 80D: Income Tax benefit for medical insurance premium

- Section 80DD: Income Tax Deduction for Medical Treatment of a Dependent with Disability

- Section 80DDB: Income Tax Deduction for Specified Diseases

- Section 80E: Income Tax Deduction for Interest paid on Higher Education Loan

- Section 80EE: Income Tax Deduction for Home Loan

- Section 80EEA: Income Tax Deduction for first time home buyers

- Section 80EEB: Income Tax Deduction for repayment of Electronic Vehicle Loan

- Section 80G: Deduction in respect of donations made to specified funds and charitable institutions etc

- Section 80GG: Income Tax Deduction for House Rent Paid

- Section 80GGA: Income Tax Deduction for Donation to Scientific Research & Rural Development

- Section 80GGC: Income Tax Deduction in respect of contributions given by any person to Political Parties

- Section 80IBA: Income Tax Deduction for Profits from Housing Projects

- Section 80RRB: Income Tax Deduction for Royalty on Patents

- Section 80TTA: Deduction in respect of interest on deposits in Savings Account

- Section 80TTB: Deduction in respect of interest from deposits held by Senior Citizens

- Section 80U: Income Tax Deduction for Disabled Individuals

Income Tax Deductions – Individuals,HUF (FY 2019-20)

Income Tax Deductions – Individuals,HUF. Income Tax Deduction is an investment/expenditure that helps in reducing the tax payable. The income tax deduction reduces gross total income (means the income on which tax has to be paid). Thereby, reducing the tax on total income.

Income tax deduction needs to be claimed at the time of filing Income Tax Return. The number of deductions should be reduced from the gross income to reach the taxable amount.

For Instance,

| Particulars | Income Tax Deduction of Rs. 1,50,000 | No Income Tax Deduction |

|---|---|---|

| Gross Income before deductions | Rs. 15,00,000 | Rs. 15,00,000 |

| Income Tax Deductions | Rs. 1,50,000 | NIL |

| Net taxable Income | Rs. 13,50,000 | Rs. 15,00,000 |

| Tax Liability before Rebate and Cess | Rs. 2,17,500 | Rs. 2,62,500 |

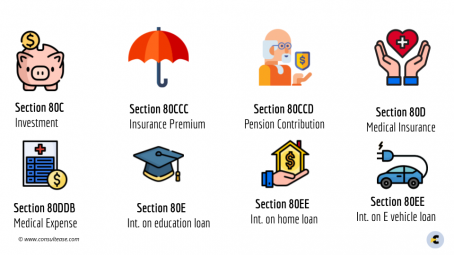

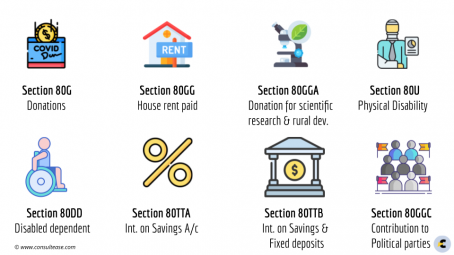

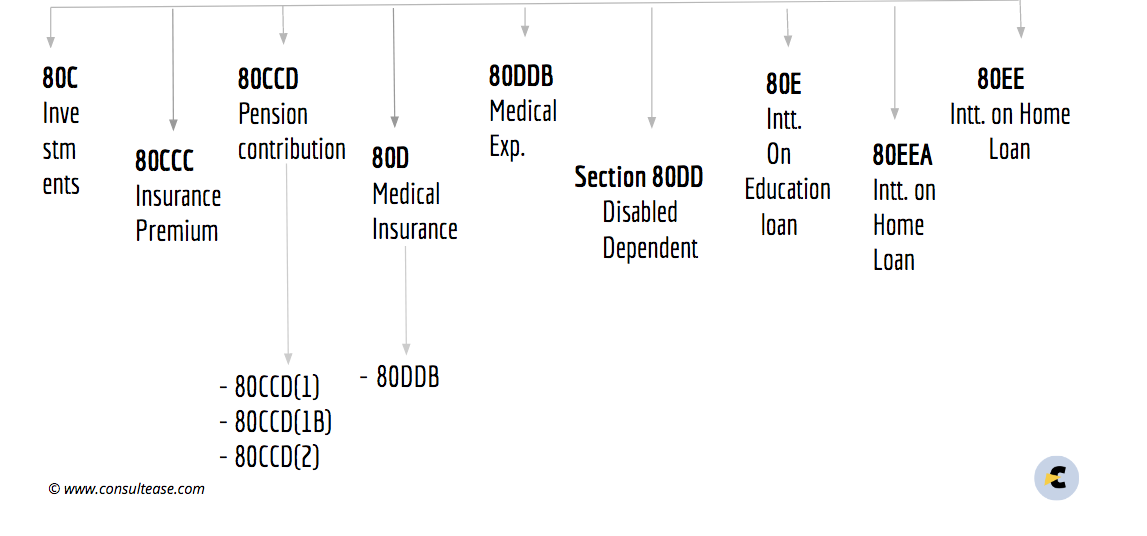

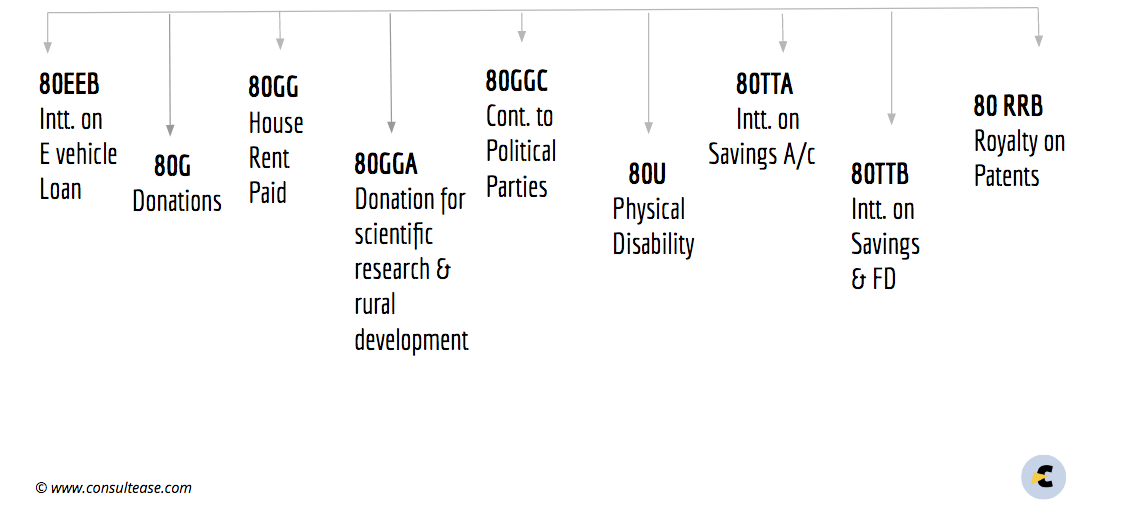

Many deductions have been prescribed under the income tax act. Refer the chart and table below:

| SEC | INCOME TAX DEDUCTION – FY 19-20(AY 20-21) | WHO CAN

INVEST? |

LIMIT |

| 80C | Investing in LIC, PPF,

NSC, MF, FD etc. |

Individual or

HUF |

Upto Rs 1,50,000 |

| 80CCC | Investment in pension

fund |

Individual | |

| 80CCD(1) | Atal pension yojna and

National pension scheme contribution |

Individual | |

| 80CCD(1B) | Atal pension yojna and

National pension scheme contribution |

Individual | Upto Rs 50,000 |

| 80CCD(2) | NPS contribution by

employer |

Individual | Amt. Contributed

or 14% of Basic Salary + Dearness Allowance (in case the employer is CG) 10% of Basic Salary + Dearness Allowance (in case of any other employer) – Whichever is lower |

| 80D | Medical insurance

premium and medical expenditure |

Individual or

HUF |

Upto Rs 1,00,000 |

| 80DD | Medical treatment of a

dependent with disability |

Individual or

HUF |

Normal disability:

Rs 75,000 Severe disability: Rs 1,25,000 |

| 80DDB | Specified diseases | Individual or

HUF |

Senior citizen:

upto Rs 1,00,000 Others: Rs 40,000 |

| 80E | Interest on loan taken

for higher education |

Individual | Full interest paid

upto 8 AY |

| 80EE | Interest paid on

housing loan |

Individual | Upto Rs 50,000

subject to restrictions |

| 80EEA | Interest paid on

housing loan |

Individual | Upto Rs 1,50,000

subject to restrictions |

| 80EEB | Interest paid on

E vehicle loan |

Individual | Upto Rs 1,50,000

subject to restrictions |

| 80G | Donation to

charitable institution |

All Assessee

(Individual, HUF, Company etc) |

100% or 50%

of the Donated amount or Qualifying limit (Donation in cash upto Rs.2000 allowed) |

| 80GG | House rent paid | Individual | Rs 60,000 or

25% of total income or Rent paid- 10% of total income -whichever is lower. |

| 80GGA | Donation to

scientific research & rural development |

All assessee

except person of business and/or profession |

100%

donation allowed except donation in cash upto Rs 10,000 |

| 80GGC | Individual on contribution

to political parties |

Individual

HUF AOP BOI Firm |

Full amount.

No deduction for cash contribution |

| 80IBA | Profits from

housing projects |

-Individual

-HUF -AOP -BOI -Company -Firm -Any other person engage in the business of Housing Projects as specified |

Full profit |

| 80RRB | Royalty on patents | Individuals

(Indian citizen/foreign citizen being resident in India) |

Rs 3,00,000 or

Specified income -lower |

| 80TTA | Interest on only

savings account |

Individual

HUF (except senior citizen) |

Upto Rs 10,000 |

| 80TTB | Interest on both savings & FD | individual

(60yrs or above) |

Upto Rs 50,000 |

| 80U | Disabled individuals | Individuals | Normal disability:

Rs 75,000 Severe disability: Rs 1,25,000 |

Section 80C: Deduction in respect of life insurance premium, contribution to PF, children tuition fees, PPF etc.

The maximum amount of deduction that can be claimed under this section is Rs 1,50,000. Various options for investment :

- Life insurance premium payment

- Annuity plan of LIC or any other notified insurer

- Unit Linked Insurance Plan (ULIP) of UTI or ULIP of LIC mutual fund u/s 10(23D) contribution

- PPF (Public Provident Fund) contribution

- Deferred annuity plan payment

- Amount deducted from government employee salary for the purpose of securing him of a deferred annuity

- SRF/RPF contribution

- Tuition fees payment

- Repayment of housing loan

- Superannuation Fund contribution

- Senior Citizen Scheme investment

- PPF investment

- 5 year FD investment

- Sukanya Samridhi Yojna investment

- Mutual Funds (Equity Linked Saving Scheme) investment

- Any deposit scheme/pension fund of National Housing Bank (NHB)

- Bonds issued by National Bank for Agriculture and Rural Development (NABARD)

- Notified deposit scheme of Public Sector Housing Finance Company and Housing Development Authority of cities, towns and villages

- Subscription to equity shares or debentures of Public Company or any Public financial institution forming part of an eligible issue of capital approved by Board where proceeds are utilized for infrastructure company.

- Stamp duty, registration fee incurred for the purpose of transfer of such house property to the assesse.

Related Topic:

Documents required for Registration under GST of HUF

Section 80CCC: Income Tax Deduction for Contributions to Pension Funds

Contributions made in specified pension plans can be claimed under this deduction. This can be availed by an individual whether resident or non-resident. This deduction gets clubbed with section 80C meaning thereby overall deduction under both sections can be claimed up to Rs 1,50,000.

Section 80CCD(1): An income tax deduction for contributions made by Individual to eligible NPS

Here deduction can be claimed by both self-employed as well as salaried individuals on contributions made towards National Pension Scheme or Atal Pension Yojna. A self-employed individual can claim deduction up to 10% of Basic+DA whereas a self-employed can claim up to 20% of gross total income. However, total deductions u/s 80C, 80CCC and 80CCD(1) cannot exceed Rs 1,50,000.

Section 80CCD(1B): Additional Income tax deduction for contributions made by Individual to eligible NPS

It is an additional tax saving benefit up to Rs 50,000 for contributions to the NPS account. It is over and above the limits of section 80C and this is the reason section 80CCD has gained so much attention.

Section 80CCD(2): An income tax deduction for contributions by the employer to eligible NPS

This Section is applicable for salaried employees where their employer is also contributing to the NPS. The employer can make contributions towards the NPS besides contribution to EPF. The limit of deduction allowed would be lower of the contributions made by the employer or 14% of the salary (in case the employer is CG)/10% of Salary (in case of other employers). This deduction is available over and above the deduction under Section 80 CCD (1).

Section 80D: Income Tax benefit for medical insurance premium

Under this tax benefit is admissible for

- Medical Insurance Premiums

- Expenditure on Preventive Health Check-up

- Other Medical Expenditure

The benefit under this section can be taken in aggregate for self and family to a maximum of Rs 1,00,000

Section 80DD: Income Tax Deduction for Medical Treatment of a Dependent with Disability

This benefit can be availed for incurring medical expenses for disabled dependent relatives. Income tax benefit to the extent of Rs 75,000 for normal and Rs 1,25,000 for severe disability can be claimed.

Section 80DDB: Income Tax Deduction for Specified Diseases

The amount of deduction depends upon two factors – age of patients and actual expenditure.

Capping-

- The actual amount being paid for the treatment or

- the sum of Rs. 40,000 /– (in case the patient is Normal citizen)

whichever amount is less.

In the case that the respective patient is a senior citizen then the maximum amount of deduction is Rs.1 lakh.

Section 80E: Income Tax Deduction for Interest paid on Higher Education Loan

Interest paid on higher education loan taken for self, spouse or child is eligible for income tax deduction under section 80E. The tax benefit is available for the next 8 Assessment Years, without any maximum limits.

Section 80EE: Income Tax Deduction for Home Loan

Tax Benefit on Interest on Home Loan to first-time buyers in the following events:-

- This deduction is provided only if the cost of the property acquired is not more than Rs. 50 Lakhs and the amount of the loan taken is upto Rs. 35 Lakhs.

- The loan should be sanctioned between 1st April 2016 and 31st March 2017.

- The advantage of this deduction would be possible till the time the payment of the loan continues.

- This deduction would be accessible from the financial year 2016-17 and onwards.

The above sections connecting to tax benefits on home loans have been abridged as under:

| Particulars | Quantum of Deduction (Rs.) | |

| Self-Occupied

Property |

Non-Self Occupied

Property |

|

| Section 24

(interest) |

2,00,000 | No Limit |

| Section 80C

(principal) |

1,50,000 | 1,50,000 |

| Section 80EE

(interest) |

50,000 | 50,000 |

Section 80EEA: Income Tax Deduction for first time home buyers

A new section has been proposed to be inserted in Chapter VI A deductions under Section 80. This section is Section 80EEA which allows an additional deduction to taxpayers for paying interest on a home loan availed by them. While Section 24 allowed for interest exemption on home loans up to INR 2 lakhs, this section allows an additional exemption of Rs 1.5 lakhs to home buyers who avail a home loan and pay interest on the loan.

Section 80EEB: Income Tax Deduction for repayment of Electronic Vehicle Loan

Deduction of interest payment on loan taken to purchase Electric Vehicle shall be available whether for personal or business purposes. The deduction under this section would be available till the repayment of loan.

Deduction u/s 80EEB is available for 4 wheeled vehicles and also for 2 wheeled vehicles

Amount of deduction:

The actual interest paid or

Rs 1,50,000

Whichever is Lower.

Section 80G: Deduction in respect of donations made to specified funds and charitable institutions etc

The deduction amount is based on the category in which the fund falls i.e. with or without any qualifying limit.

Where the funds are subject to qualifying limit the formula for calculation of deduction = Gross Qualifying Amount – Net Qualifying Amount

Cash donations exceeding Rs 10,000 are not allowed. Donations in kind are not eligible for deduction under this section.

Section 80GG: Income Tax Deduction for House Rent Paid

Conditions to claim deduction under this section:

- If you are salaried, you must not receive any HRA or RFA benefits and you are not even entitled to receive so, to avail the benefit of section 80GG.

- If the taxpayer gets any kind of similar deduction in that assessment year, then he or she cannot get deduction under this 80GG section.

- You or your spouse or your minor child or HUF of which you are a member – do not own any residential accommodation at the place where you currently reside, perform duties of the office, or employment or carry on business or profession.

- In case you have any self-occupied house property no benefit under section 80GG will be allowed.

Section 80GGA: Income Tax Deduction for Donation to Scientific Research & Rural Development

Donation for Scientific Research or Rural Development can avail the deduction. Under this section, the whole amount is allowed as deduction without any upper limit. Cash donations exceeding Rs. 10,000 are not allowed.

Section 80GGC: Income Tax Deduction in respect of contributions given by any person to Political Parties

Transparency and corruption-free are the main objectives in electoral funding. The tax deductions are made only to specified assessments. Cash donations are not allowed.

Section 80IBA: Income Tax Deduction for Profits from Housing Projects

100 percent of profits earned is allowed as under this section. It is available to Individual, HUF, AOP, BOI, Company, Firm or any other person engaged in the business of Housing projects as may be specified.

Section 80RRB: Income Tax Deduction for Royalty on Patents

A resident of India and a patentee (true and first inventor of the invention including co-patentee), can claim a deduction under section 80RRB being the lower of:

100% of Royalty Income from patent or

Rs 3,00,000

For claiming the benefit under this section patent must be registered.

Section 80TTA: Deduction in respect of interest on deposits in Savings Account

Deduction in respect of interest income on deposits in Savings Bank Accounts of Banks, Co-Operatives Banks or Post Office. The quantum of deduction allowed under this section is Rs. 10,000 or the actual interest earned, whichever is lower.

Section 80TTB: Deduction in respect of interest from deposits held by Senior Citizens

Deduction upto Rs 50,000/- in respect of interest income from deposits (savings and fixed) held by resident senior citizens (age 60 years or more). Section 80TTA and 80TTB are mutually exclusive.

Section 80U: Income Tax Deduction for Disabled Individuals

An individual with a certified disability by medical authority or government doctor can claim a deduction of Rs 75,000 in this section. The limit shall substitute with Rs 1,25,000 where there is a severe disability. It is a fixed deduction and not based on actual expenses.

To Summarize,