New Revised Due dates under Income Tax Act 1961 AY 21-22

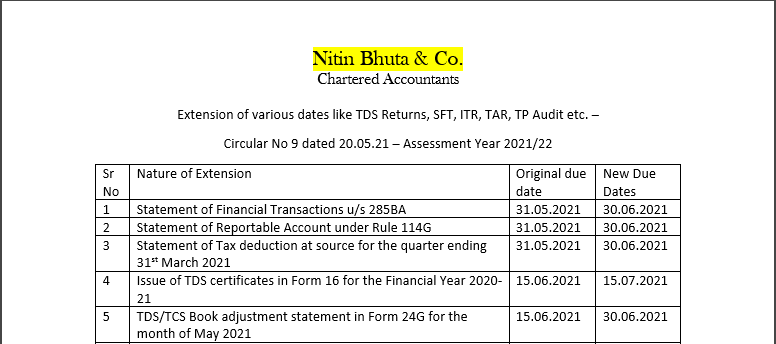

Extension of various dates like TDS Returns, SFT, ITR, TAR, TP Audit, etc. –

Circular No 9 dated 20.05.21 – The assessment Year 2021/22

| Sr No. | Nature of Extension | Original due date | New Due Dates |

| 1 | Statement of Financial Transactions u/s 285BA | 31.05.2021 | 30.06.2021 |

| 2 | Statement of Reportable Account under Rule 114G | 31.05.2021 | 30.06.2021 |

| 3 | Statement of Tax deduction at source for the quarter ending 31st March 2021 | 31.05.2021 | 30.06.2021 |

| 4 | Issue of TDS certificates in Form 16 for the Financial Year 2020- 21 | 15.06.2021 | 15.07.2021 |

| 5 | TDS/TCS Book adjustment statement in Form 24G for the month of May 2021 | 15.06.2021 | 30.06.2021 |

| 6 | Statement of Deduction of Tax in the case of a superannuation fund for FY 2021 | 31.05.2021 | 30.06.2021 |

| 7 | Statement of Income paid or credited by an investment fund to its unit’s holder in Form 64D for FY 2021 | 15.06.2021 | 30.06.2021 |

| 8 | Statement of Income paid or credited by an investment fund to its unit’s holder in Form 64C for FY 2021 | 30.06.2021 | 15.07.2021 |

| 9 | Income Tax Returns – Normal assessee without audits – FY 2021 | 31.07.2021 | 30.09.2021 |

| 10 | Filing of Audit Reports viz. Tax Audit Reports, Form 67 etc. – FY 2021 | 30.09.2021 | 31.10.2021 |

| 11 | Due date of Furnishing Report from Accountant in respect of International Transactions covered u/s 92E | 31.10.2021 | 30.11.2021 |

| 12 | Corporate assessee or Firm covered whose accounts required to be audited or Partner of Firm whose accounts are required to be audited or any assessee other than Corporate and Firm whose accounts are required to be audited | 31.10.2021 | 30.11.2021 |

| 13 | Assessee required to furnish return u/s 92E in respect of International Transactions | 30.11.2021 | 31.12.2021 |

| 14 | Belated Returns and Revised Returns | 31.12.2021 | 31.01.2022 |

Related Topic:

Professional Services Vs. Technical Services U/s 194J of Income Tax Act, 1961

Note: all the above extensions are planned in view of the New ITD portal to be launched from June 7, 2021.

According to me, such a new ITD portal is planned with the objective and purpose of generating pre-filled IT returns of all the Taxpayers or a certain class of taxpayers………………..to auto-populate the details of Dividends, Bank Interest, Banking Transactions, Banking account details, listed securities trading details in Shares, Mutual Funds and any other securities and any other relevant information that may flow in from SFT forms filing, etc.

Related Topic:

Condonation of delay under section 119(2)(b) of the Income-tax Act, 1961

All of us need to watch this space and development very closely as the new system will bring new challenges and opportunities for us and we need to plan our working systems accordingly. I am sure we are gradually taking baby steps by gearing up for faceless revenue assessment systems in times to come and I don’t see the above dates getting deferred further in the future under any circumstances considering precedents of dates announced for various tech initiatives.

Related Topic:

TCS under section 206C(1H) of income tax Act

Nitin Bhuta

Nitin Bhuta

Presently, he is actively involved with limited scale of doing Audits, Direct & Indirect Taxation, Management Advisory as well as handling of litigation matters, etc. of Corporate as Well as Non-Corporate persons. Presently, he is actively involved vetting out of drafted legal documents pertaining to business arrangements from the tax compliance perspective.