Notification for Deduction of TDS at Lower Rate

A lot of professional’s social media accounts got flooded with messages

and notifications due to the recently issued notification of #ICAI allowing

#CAs to form Multi-Disciplinary Partnership Firms. ICAI has allowed other

professionals like #CS and #CMA to be partners in the same firm and

render their services.

It is mere permission granted by ICAI and not by other institutes There is

no Code of Conduct for such firms. A specific code of conduct would be

required for the functioning of these firms as Multi-Disciplinary firms.

There is no such notification by the Other Bodies i.e., ICSI and ICMAI for

granting such permission to their members.

There are no common set of rules for the functioning and governing of

these Firms as they involve different professionals governed and regulated

by different institutes.

It is just a start; there is a long way to go.

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 3rd July 2020

INCOME-TAX

G.S.R. 429(E).— In exercise of the powers conferred by sections 194A, 194J, 194K, 194LBA, 194N, 194-O, 197A and 200 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes, hereby, makes the following rules further to amend the Income-tax Rules, 1962, namely:-

1. Short title and commencement.–– (1) These rules may be called the Income-tax (16th Amendment) Rules, 2020.

(2) Save as otherwise provided in these rules, they shall come into force from the date of their publication in the Official Gazette.

2. In the Income-tax Rules, 1962 (hereinafter referred to as the principal rules), in rule 31A, in sub-rule (4), —

(a) in clause (viii), after the words “not deducted”, the words “or deducted at a lower rate” shall be inserted;

(b) for clause (ix) the following shall be substituted from the 1st day of July 2020, namely:-

“(ix) furnish particulars of the amount paid or credited on which tax was not deducted or deducted at a lower rate in view of the notification issued under the second proviso to section 194N or in view of the exemption provided in the third proviso to section 194N or in view of the notification issued under the fourth proviso to section 194N”;

(c) after clause (ix), the following clauses shall be inserted, namely:–

“(x) furnish particulars of the amount paid or credited on which tax was not deducted or deducted at a lower rate in view of the notification issued under sub-section (5) of section 194A.

Related Topic:

All about Section 194 O of Income Tax Act 1961

(xi) furnish particulars of the amount paid or credited on which tax was not deducted under sub-section (2A) of section 194LBA.

(xii) furnish particulars of the amount paid or credited on which tax was not deducted in view of clause (a) or clause (b) of sub-section (1D) of section 197A.

(xiii) furnish particulars of the amount paid or credited on which tax was not deducted in view of the exemption provided to persons referred to in Board Circular No. 3 of 2002 dated 28th June 2002 or Board Circular No. 11 of 2002 dated 22nd November 2002 or Board Circular No. 18 of 2017 dated 29th May 2017.”

Related Topic:

ICAI announces various capacity building initiatives taken for Chartered Accountant in Practice

3. In the principal rules, in Appendix II,

(I) in form 26Q –

(a) for the brackets, words, figures, and letters

“[See sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194LA, 194LBA, 194LBB, 194LBC, 194N and rule 31A]” the following brackets, words, figures and letters

“[See sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194N, 194-O, 197A and rule 31A]” shall be substituted;

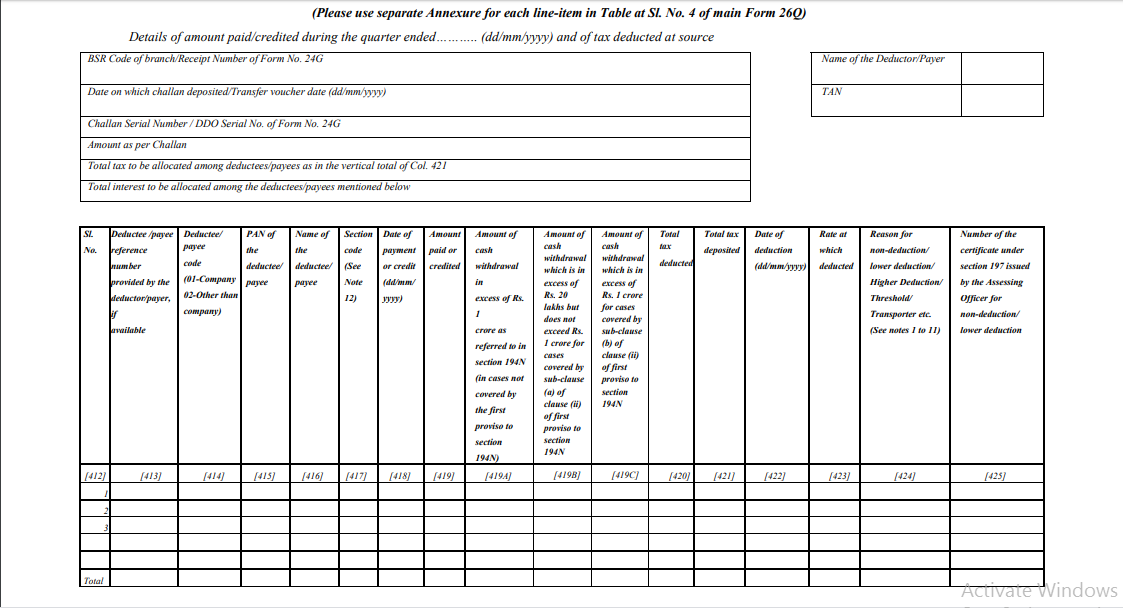

(b) for the “Annexure”, the following “Annexure” shall be substituted, namely:-

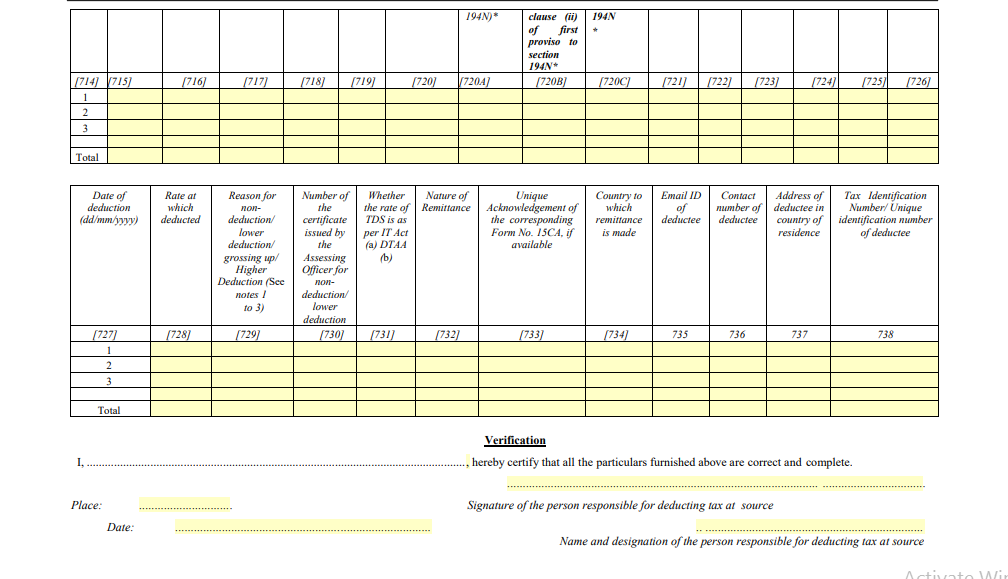

“[ANNEXURE: DEDUCTEE/PAYEE WISE BREAK UP OF TDS

(Please use separate Annexure for each line-item in Table at Sl. No. 4 of main Form 26Q)

(II) in form 27Q —

(a) for the brackets, words, figures, and letters

“[See sections 194E, 194LB, [194LBA, 194LBB, 194LBC], 194LC, 195, 196A, 196B, 196C, 196D, and rule 31A]”

the brackets, words, figures, and letters

“[See section 194E, 194LB, [194LBA, 194LBB, 194LBC], 194LC, 194N, 195, 196A, 196B, 196C, 196D, 197A and rule 31A]” shall be substituted;

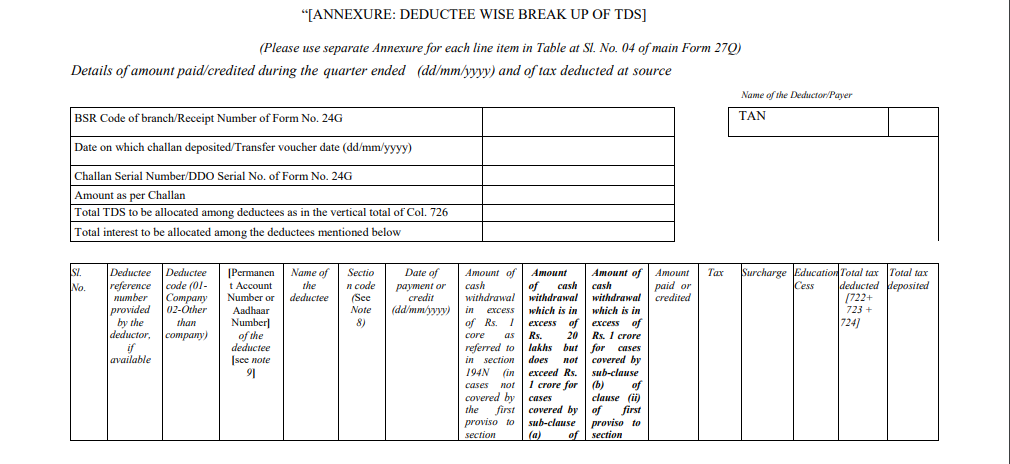

(b) for the “Annexure” the following “Annexure” shall be substituted, namely:–

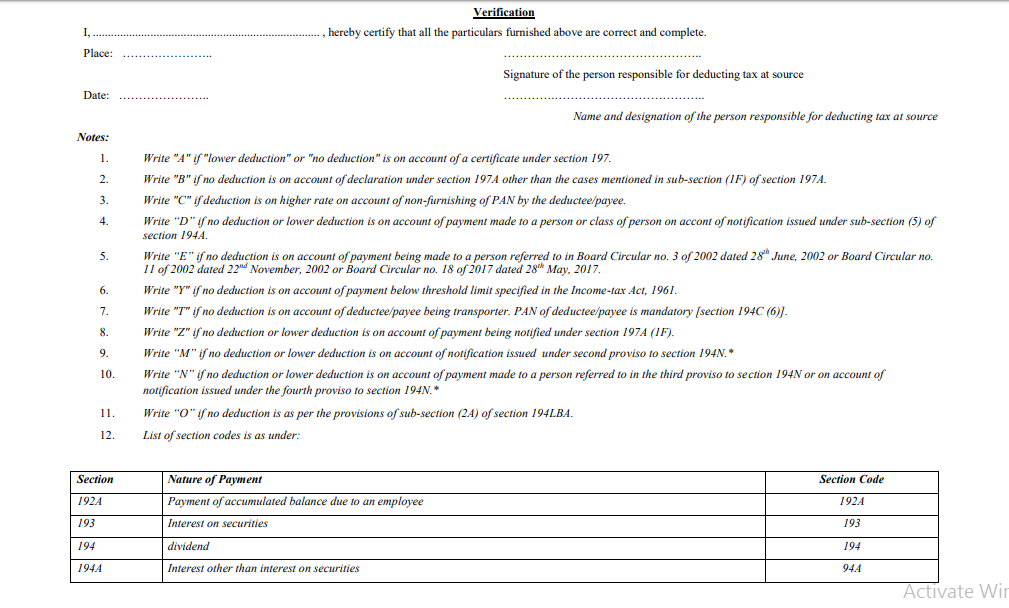

Notes:

1. Write “A” if “lower deduction” or “no deduction” is on account of a certificate under section 197.

2. Write “C” if grossing up has been done.

3. Write “D” if the deduction is on a higher rate on account of non-furnishing of [Permanent Account Number or Aadhaar Number] by the deductee.

4. Write “O” if no deduction is in view of sub-section (2A) of section 194LBA.

5. Write “M” if no deduction or lower deduction is on account of notification issued under the second proviso to section 194N.*

6. Write “N” if no deduction or lower deduction is on account of payment made to a person referred to in the third proviso to section 194N or on account of notification issued under the fourth proviso to section 194N.*

7. Write “G” if no deduction is in view of clause (a) or clause (b) of sub-section (1D) of section 197A.

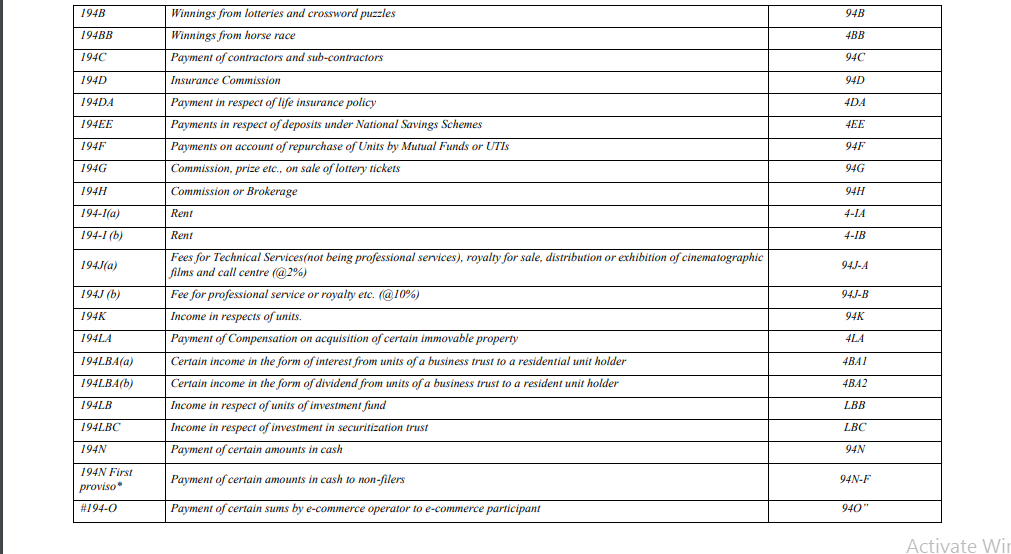

8. List of section codes is as under:

| Section | Nature of Payment | Section Code |

| 192A | Payment of accumulated balance due to an employee | 192A |

| 194E | Payments to non-resident Sportsmen/Sport Associations | 94E |

| 194LB | Income by way of interest from infrastructure debt fund | 4LB |

| 194LBA(a) | Income referred to in section 10(23FC)(a) from units of a business trust | LBA1 |

| 194LBA (b) | Income referred to in section 10(23FC)(b) from units of a business trust | LBA2 |

| 194LBA(c) | Income referred to in section 10(23FCA) from units of a business trust | LBA3 |

| 194LBB | Income in respect of units of investment fund | LBB |

| 194LBC | Income in respect of investment in securitization trust | LBC] |

| 194LC | Income by way of interest from an Indian company | 4LC |

| 194LD | Income by way of interest on certain bonds and Government securities | 4LD |

| 194N | Payment of certain amounts in cash | 94N |

| 194N First Proviso* | Payment of a certain amount in cash to non-filers | 94N-F |

| 195 | Other sums payable to a non-resident | 195 |

| 196A | Income in respect of units of Non-Residents | 96A |

| 196B | Payments in respect of Units to an Offshore Fund | 96B |

| 196C | Income from Foreign Currency Bonds or shares of Indian Company payable to Non-Resident | 96C |

| 196D | The income of foreign institutional investors from securities | 96D |

9. In case of deductees covered under rule 37BC, Permanent Account Number, or Aadhaar Number NOT AVAILABLE” should be mentioned.”

*in relation to section 194N, the changes shall come into effect from 1st July 2020.

#in relation to section 194-O, the changes shall come into effect from 1st October 2020.

[Notification No. 43/2020/F. No. 370142/11/2020-TPL]

ANKIT JAIN, Under Secy. (Tax Policy and Legislation Division)

Note: The principal rules were published in the Gazette of India, Extraordinary, Part-II, Section 3, Sub-section (ii) vide number S.O. 969 (E), dated the 26th March 1962 and were last amended vide notification number G.S.R. 423 (E), dated 30.06.2020.

Read the Notification:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.