Relaxation in electronic filing of Income Tax Forms 15CA / 15CB: CBDT

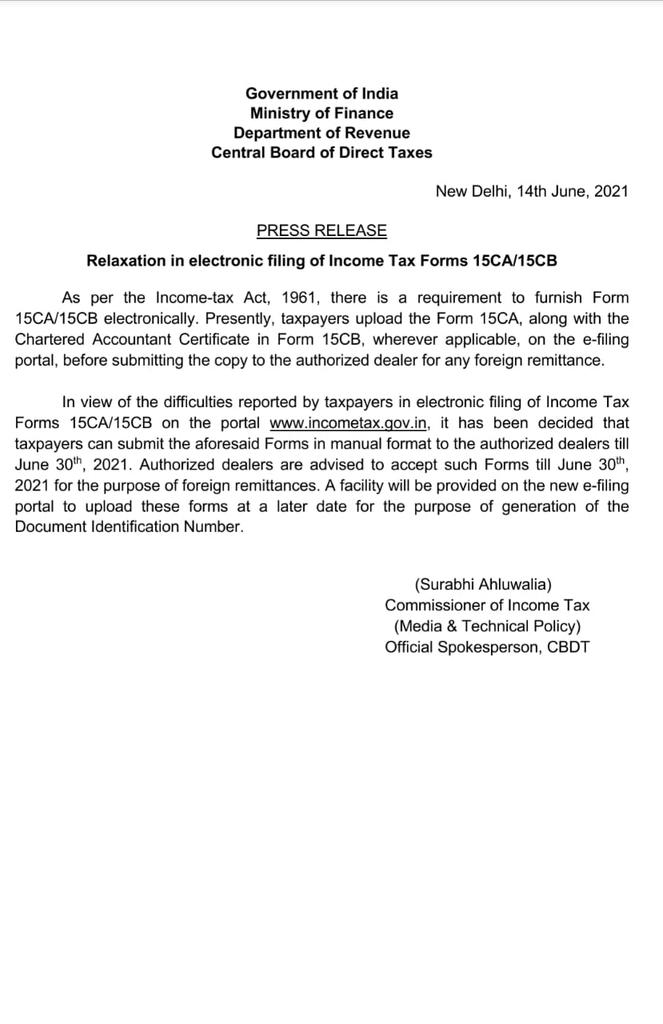

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, 14th June 2021

PRESS RELEASE

Relaxation in electronic filing of Income Tax Forms 15CA / 15CB

As per the Income-tax Act, 1961, there is a requirement to furnish Form 15CA / 15CB electronically. Presently, taxpayers upload the Form 15CA, along with the Chartered Accountant Certificate in Form 15CB, wherever applicable, on the e-filing portal, before submitting the copy to the authorized dealer for any foreign remittance.

Related Topic:

Best Salary Structure to Save Income Tax

In view of the difficulties reported by taxpayers in electronic filing of Income Tax Forms 15CA / 15CB on the portal of incometax, it has been decided that taxpayers can submit the aforesaid Forms in manual format to the authorized dealers till June 30th, 2021. Authorized dealers are advised to accept such Forms till June 30th, 2021 for the purpose of foreign remittances. A facility will be provided on the new e-filing portal to upload these forms at a later date for the purpose of generation of the Document Identification Number.

Related Topic:

New Regime of Income Tax Search and Seizure Assessments – Glaring Implications

(Surabhi Ahluwalia)

Commissioner of Income Tax

(Media & Technical Policy)

Official Spokesperson, CBDT

Related Topic:

15 Reasons Why We Should File an ITR

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.