Related Posts

Circular No. 15/2021: CBDT

Aug 04, 2021

Detailed Analysis of Sec. 194Q and 206C(1H)

Jul 19, 2021

Applicability Of Section 194Q

Jul 10, 2021

Latest TDS/TCS Related Amendments

Jul 07, 2021

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | |

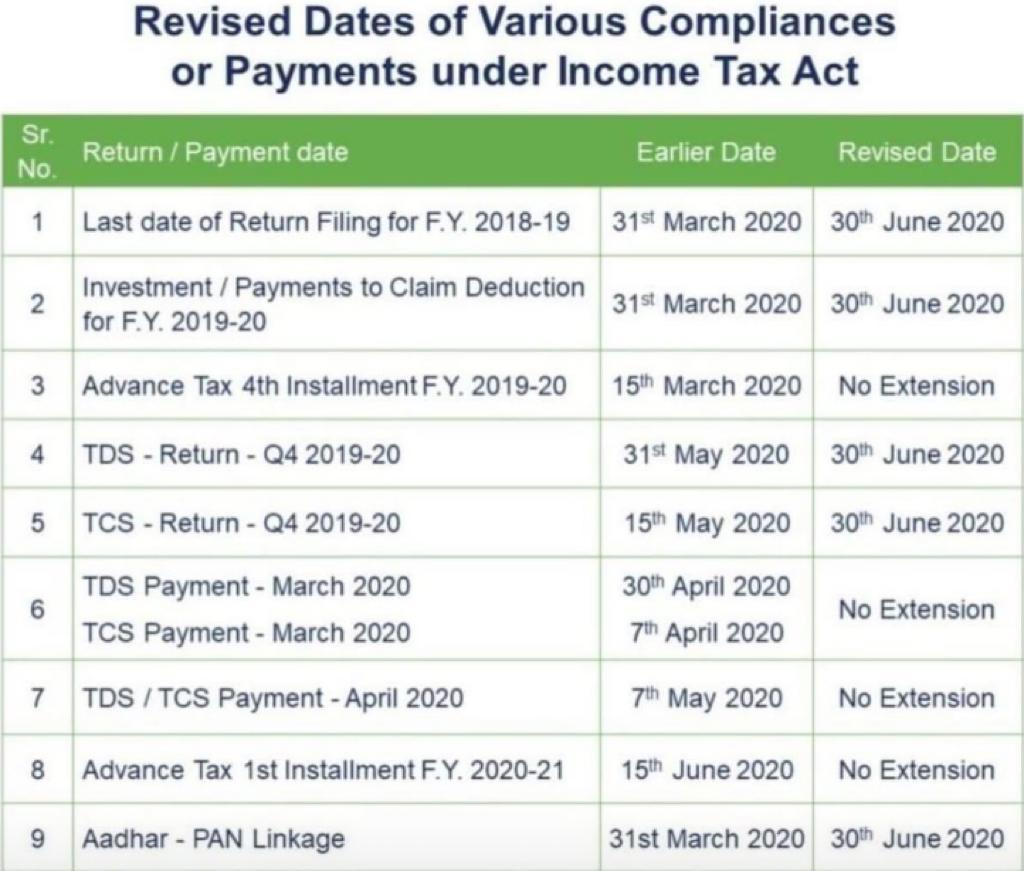

| Sr. No. | Return/ Payment date | Earlier Date | Revised Date |

| 1 | Last date of Return filing for FY 2018-19 | 31st March 2020 | 30th June 2020 |

| 2 | Investment/ Payments to claim Deduction for FY 2019-20 | 31st March 2020 | 30th June 2020 |

| 3 | Advance Tax 4th Installment FY 2019-20 | 15th March 2020 | No Extension |

| 4 | TDS – Return – Q4 2019-20 | 31st May 2020 | 30th June 2020 |

| 5 | TCS – Return – Q4 2019-20 | 15th May 2020 | 30th June 2020 |

| 6 |

TDS Payment – March 2020 TCS Payment – March 2020 |

30th April 2020 7th April 2020 |

No Extension

|

| 7 |

TDS/TCS Payment – April 2020 |

7th May 2020 |

No Extension |

| 8 |

Advance Tax 1st Installment FY 2020-21 |

15th June 2020 |

No Extension |

| 9 |

Adhaar – PAN Linkage |

31st March 2020 |

30th June 2020 |

Aug 04, 2021

Jul 19, 2021

Jul 10, 2021

Jul 07, 2021

Recieve the most important tips and updates

Absolutely Free! Unsubscribe anytime.

We adhere 100% to the no-spam policy.