[watch video] Section 44AD – Presumptive Taxation for small businesses

Table of Contents

Section 44AD – Presumptive Taxation for small businesses

Section 44AD – Presumptive Taxation for small businesses.This is special scheme for small businesses. They can pay tax easily with simplified return. No need to calculate the profit. It is fixed on a percentage. Although they can declare higher or lesser profit also. In case of lesser profit they need to maintain the books of accounts and do audit when required.

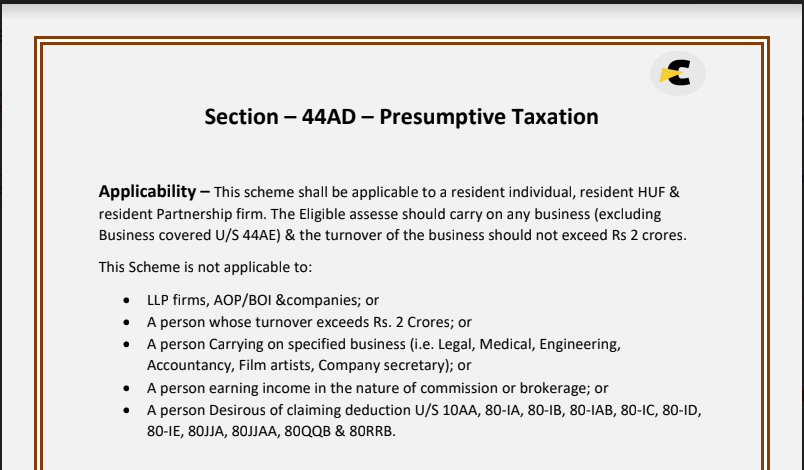

Applicability of Section 44AD – Presumptive Taxation

This scheme shall be applicable to a resident individual, resident HUF & resident Partnership firm. The Eligible assessee should carry on any business (excluding Business covered U/S 44AE) & the turnover of the business should not exceed Rs 2 crores.

This Scheme is not applicable to:

• LLP firms, AOP/BOI &companies; or

• A person whose turnover exceeds Rs. 2 Crores; or

• A person Carrying on specified business (i.e. Legal, Medical, Engineering, Accountancy, Film artists, Company secretary); or

• A person earning income in the nature of commission or brokerage; or

• A person Desirous of claiming deduction U/S 10AA, 80-IA, 80-IB, 80-IAB, 80-IC, 80-ID, 80-IE, 80JJA, 80JJAA, 80QQB & 80RRB.

Related Topic:

Calculation Under Section 44AE under Presumptive Taxation

Example – Mr. Varun Runs a Factory and has a turnover of Rs 1.4 crores in P.Y. 2018-19. He can adopt the scheme of presumptive taxation under Section 44AD to Avoid a lot of paperwork in filing income tax returns. Mr. Varun received all his turnover in cash now as per section 44AD his income will be 8% of 1.4 crores which is Rs. 11,20,000.

Related Topic:

Benefit in 44AD for sale through banking channel

Income Computation & Applicable Rates

Rates – PGBP Income shall be deemed to be 6% or 8% of the gross turnover, or any other higher sum as may be declared by the assessee.

• 6% for the portion of gross turnover which has been received by account payee cheque/draft or use of electronic clearance system through bank account till the last date of filing of return of income as specified u/s 139(1) (it would be deemed that all expenses allowable u/s 30 to 38 have already been allowed).

• 8% for the portion of gross turnover which has been received in any other mode.

Related Topic:

How to Compute 5% Cash Transactions Limit For Tax Audit U/s 44AB

Example – Mr. Varun Runs a Factory and has a turnover of Rs 1.4 crores in P.Y. 2018-19. He can adopt the scheme of presumptive taxation under Section 44AD to Avoid a lot of paperwork in filing income tax returns. Mr Varun received Rs 40 lakhs a part of his turnover in cash & Rs 1 crore through account payee cheque/draft and Electronic clearance system through a bank account. Now as per section 44AD his income will be 8% of Rs 40 Lakhs + 6% of Rs 1 crores i.e. 320000+600000 = Rs 920000

Deduction of other expenditure

• Any other Expense u/s 30 to 38 is Not Allowed to be deducted. Further, a partnership Firm Is Not allowed to claim Deduction of remuneration to partners as given U/s 40(b).

• Current year depreciation as well as brought forward unabsorbed depreciation are not allowed to be deducted.

• Brought forward losses are Allowed to be set off against presumptive Income.

• Deductions U/s 80C-80U are allowed to be deducted from presumptive income.

However, the deductions u/s 10AA, 80-IA, 80-IB, 80-IAB, 80-IC, 80-ID, 80-IE, 80JJA, 80JJAA, 80QQB & 80RRB are not allowed.

Section – 44AD(4)

Where an Eligible assessee declares profit for any year as per section 44AD, he is required to declare his profit for the next five years as per section 44AD.

If an Assessee declares profit for any year as per section 44AD and he doesn’t declare profit for any of the next five consecutive years in accordance with the provisions of section 44AD, such assessee cannot claim the benefit of section 44AD for the next five years.

Example – An eligible assessee claims the benefit of section 44AD for PY 2018-19 & declares income of Rs 8 Lakhs on turnover of Rs 1 crore. For PY 2019-20 & PY 2020-21, he again offers income in accordance with the provision of section 44AD. However, for PY 2021-22, he offers Income of Rs 6 lakhs on a turnover of Rs 1.5 crores( ie less than 8%). Now, he is not allowed to claim the benefit of section 44AD from PY 2022-23 to PY 2026-27

Liability to Pay Advance Tax

• In this scheme you don’t need to pay advance tax quarterly. You can pay it before 15th March for full year. Advance tax is payable only if the tax payable after TDS is more than Rs. 10000. In other cases it is quarterly. Interest is also applicable for any short payment or late payment.

• Interest u/s 234C shall be calculated only for the last instalment.

Rate 1% per month

Time period- 1 month

Amount- Advance tax liability (-) tax actually paid till 15th March)

• Interest u/s 234B & 234A shall be calculated in the normal manner.