Exception to monetary limits for filing appeals: Circular No. 23 of 2019 (CBDT)

CBDT has issued a new circular regarding the Exception to monetary limits for filing appeals specified in any Circular issued under Section 268A of the Income-tax Act, 1961-reg. Following is the text of the circular:

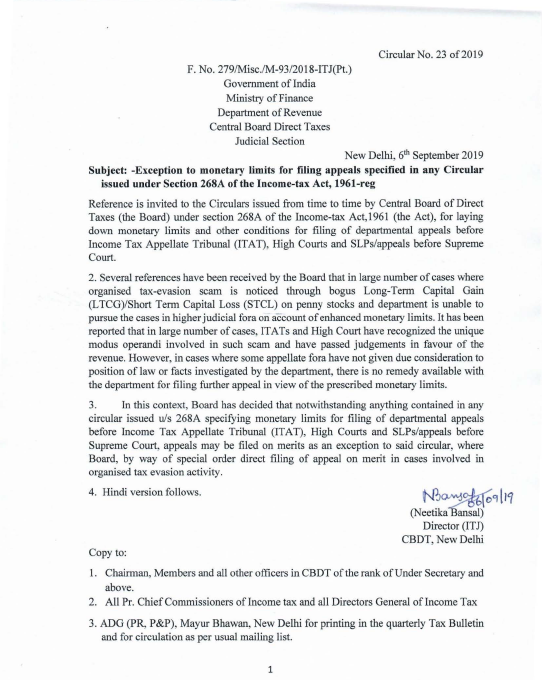

F. No. 279/Misc.lM-93/20l8-ITJ(Pt.)

Government of India

Ministry of Finance

Department of Revenue

Central Board Direct Taxes

Judicial Section

New Delhi, 6th September 2019

Subject: -Exception to monetary limits for filing appeals specified in any Circular issued under Section 268A of the Income-tax Act, 1961-reg

Reference is invited to the Circulars issued from time to time by Central Board of Direct Taxes (the Board) under section 268A of the Income-tax Act,1961 (the Act), for laying down monetary limits and other conditions for filing of departmental appeals before Income Tax Appellate Tribunal (ITA T), High Courts and SLPs/appeals before Supreme Court.

2. Several references have been received by the Board that in large number of cases where organised tax-evasion scam is noticed through bogus Long-Term Capital Gain (LTCG)/Short Term Capital Loss (STCL) on penny stocks and department is unable to pursue the cases in higher judicial fora on account of enhanced monetary limits. It has been reported that in large number of cases, ITA Ts and High Court have recognized the unique modus operandi involved in such scam and have passed judgements in favour of the revenue. However, in cases where some appellate fora have not given due consideration to position of law or facts investigated by the department, there is no remedy available with the department for filing further appeal in view of the prescribed monetary limits.

Related Topic:

Time Limit For Compliances And To Issue Show Cause Notice & Filing Appeals

3. In this context, Board has decided that notwithstanding anything contained in any circular issued U/S 268A specifying monetary limits for filing of departmental appeals before Income Tax Appellate Tribunal (IT AT), High Courts and SLPs/appeals before Supreme Court, appeals may be filed on merits as an exception to said circular, where Board, by way of special order direct filing of appeal on merit in cases involved in organised tax evasion activity.

Download the full Circular No. 23 of 2019 (CBDT) on Exception to monetary limits, below:

Source: CBDT

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.