Indirect Tax Impact On Funds

Table of Contents

In Brief

This is with reference to a recent Hon’ble Bangalore CESTAT ruling rendered in the context of Venture Capital Funds, set up as Trusts, wherein the Tribunal has pronounced its view with respect to the concept of mutuality, taxability of carried interest, and other expenses incurred by the Trust. [ M/s. ICICI Econet Internet and Technology Fund Vs. Commissioner of Central Tax (CESTAT Bangalore) ]

Facts

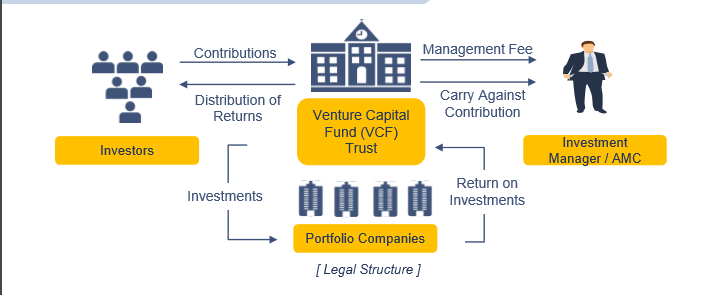

- The taxpayer is a Venture Capital Fund established as a trust under the Indian Trusts Act, 1882 and registered with the Securities and Exchange Board of India (“SEBI”) as a Venture Capital Fund (“VCF”);

- The VCF is represented and managed by a Trustee with the terms and conditions contained in the Indenture of Trust (“Trust Deed or “IOT; a Private Placement Memorandum (PPM).

- The VCF’s properties (i.e. money contributed by investors) are held in trust by the Trustee for the benefit of beneficiaries, who are contributors to the VCF (“Contributors/ Beneficiaries”);

- The Trustee appoints an Investment Manager or Asset Manager who is responsible for managing the assets/ investments of the VCF and receives remuneration in the form of management fees for the services rendered by it;

- Investment Manager or Asset Manager contributes to the fund in exchange for certain units.

Related Topic:

Indirect Tax Amendments by Finance Bill 2021

Issues

- Concept of Mutuality in case of trust.

- Whether the Trust provides “Asset Management Service” as per the definition of “banking and other financial services”.

- Applicability of service tax on the VCF (in the hands of Trust) on account of Expenses incurred by the Trust and claimed from VCF.

- Applicability of service tax on Disbursement of carry income or carried interest to certain specified unitholders.

- Applicability of service tax on Provision made for losses and impairment of investment which is debited to financials.

The Decision of Honourable CESTAT

- The Concept of Mutuality of Interest is challenged and held that the Trust is a separate legal entity registered under the special provision of SEBI Act, 1992 and its regulations.

- Not adhering to the principle of mutuality of interest and by carrying out commercial activities have failed a test laid down by Hon’ble Supreme Court in the case of Bangalore Club, CIT MANU/SC/0030/2013.

- The trusts have been formed with a profit motive, and the activities are akin to those of a Bank or Financial Institution i.e. using the monies of Contributors to make profits Thus, undoubtedly, they are a ‘commercial concern’ Thus Hon’ble Tribunal held that trust is a VCF and not Trust as such…

- Costs and expenses incurred by funds such as Management fee, Performance fee, and other expenses are met by retaining a portion of the proceeds before making over the balance of proceeds to the investors; such retention of the proceeds is the consideration for the services rendered by the Fund to the investors.

- The trust/fund does not qualify for a “pure agent” going by Rule 5 of the Valuation Rules.

- CI (Carrying Interest) which is paid out to the AMC and its affiliates, thus deducting the CI from the income of the Fund which is otherwise distributable to the common investors/unit holders is nothing but a performance-related payment or fee camouflaged as return on investment.

Impact

- The ruling has implications in classifying the Trust as a Separate Legal Entity, distinguishing Earlier decisions of courts wherein it is held that the Trust is not a separate legal entity

- The drafting of IOT, PPM for the VCF will undergo changes.

- The expenses of the VCF are considered to be in the nature of Management Fees, Performance Fees, which are met out of the proceeds of the investment and therefore shall be subject to levy of Service Tax / GST.