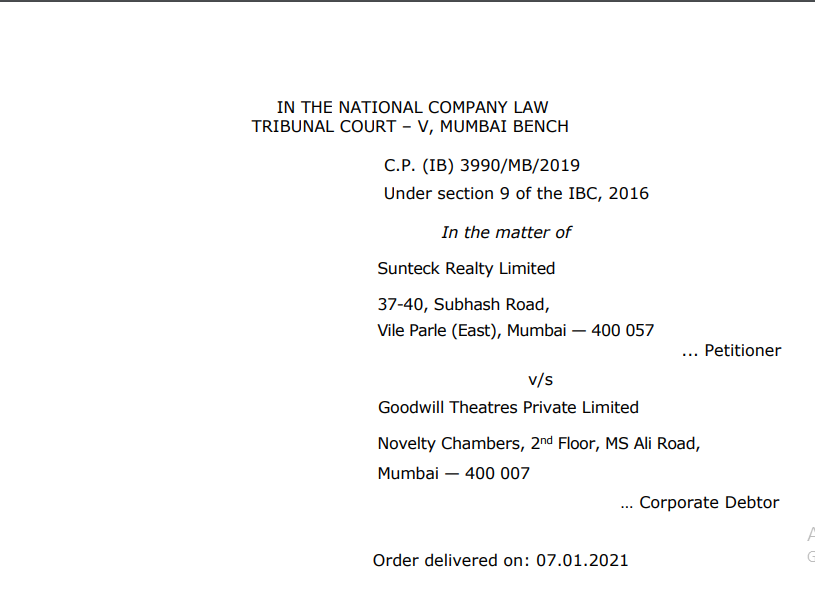

NCLT in the case of Sunteck Realty Limited Versus Goodwill Theatres Private Limited

Table of Contents

Case Covered:

Sunteck Realty Limited

Versus

Goodwill Theatres Private Limited

Facts of the Case:

This Petition is filed by the Petitioner, Sunteck Realty Limited, under Section 9 of Insolvency & Bankruptcy Code, 2016 (Code) against the Corporate Debtor, Goodwill Theatres Private Limited, alleging that the Corporate Debtor committed default in making payment to the extent of Rs. 3,12,39,529/- including interest @ 24% p.a. by invoking the provisions of Section 9 of Insolvency and Bankruptcy Code (hereinafter called “Code”) read with Rule 6 of Insolvency & Bankruptcy Rules, 2016.

The Corporate Debtor approached the Petitioner and requested the services of the Petitioner with regard to the redevelopment of the said property. Both the parties executed the Term Sheet dated 02.08.2018, thereby appointing and engaging the Petitioner as a Project Manager for performing services in relation to the said property in the manner set out therein. The terms and the conditions as entailed in the term sheet obligated the Petitioner to pay an amount of Rs. 2.51 crores as an advance towards aforesaid transactions. The exit option also clearly stipulated that in the event of failure to execute the Development Management Agreement between the parties, the said Term Sheet will stand automatically terminated subject to the Corporate Debtor repaying the advance amount along with the interest @ 15 % p.a. within 60 days of the termination of the Term Sheet and at the rate of 24 % p.a. after 60 days of termination of the Term Sheet. The Petitioner has enclosed a Bank Statement dated 03.08.2018 showing the transfer of money to the Corporate Debtor.

Related Topic:

Cyrus Investments Private Limited & Another v. Tata Sons Limited & Others: NCLT case

Observations:

The binding Term Sheet dated 2nd August 2018 is a mere understanding between the parties which captures the basic commercial terms and contend a specific clause that the parties would endeavor to execute the Development Management Agreement and that if the Development Management Agreement is not executed within the stipulated time, the binding Term Sheet would be automatically terminated. The binding Term Sheet thus demonstrates that the Petitioner had undertaken to provide the service to their Corporate Debtor and the same did not fructify and was thus terminated/cancelled. The execution of the Development Management Agreement would have qualified the Petitioner to claim the Development Management Agreement fees which is an Operational Debt but since the Development Management Agreement was not executed, the termination of the binding term sheet thus triggers the liability of refund of money as agreed under Clause 13 of the Term Sheet. The token amount was agreed was transferred by the Petitioner to the Corporate Debtor upon execution of the Term Sheet and therefore, as such upon the termination of the Term Sheet, the token amount is to be repaid as agreed under Clause 13 and can be construed as the part of the Operational Debt and part services rendered to the Corporate Debtor in accordance with mutual obligations set out in the Term Sheet.

Therefore, the binding Term Sheet dated 2nd August 2018 clearly stipulates the obligation of the Petitioner to pay the money to the Corporate Debtor at the time of execution of the Term Sheet, and hence, the liability of refund of such monies paid is well defined in the case of termination of the Term Sheet. Therefore, the Corporate Debtor is liable to refund the token amount to the Petitioner which is part of the services provided to the Corporate Debtor.

Related Topic:

Goodwill is IPR?

Order:

This Bench is of the consideration that this is the fit case of the admission in view of the above findings.

The Petition filed by the Operational Creditor is on proper Form 5, as prescribed under the Adjudicating Authority Rules, and is complete.

The Petition under sub-section (2) of Section 9 of I&B Code, 2016 filed by the Operational Creditor for initiation of CIRP in prescribed Form 5, as per the Insolvency and Bankruptcy (Application to Adjudicating Authority) Rules, 2016 is complete. The existing operational debt beyond the threshold limit against the Corporate Debtor and its default is also proved. Accordingly, the Petition filed under Section 9 of the Insolvency and Bankruptcy Code, 2016 for initiation of corporate insolvency resolution process against the Corporate Debtor deserves to be admitted.

This Petition is filed under Section 9 of I&B Code, 2016 by Sunteck Realty Limited against Goodwill Theatres Private Limited for initiating corporate insolvency resolution process is admitted. We further declare a moratorium under Section 14 of the I&B Code with consequential directions as below:

a) This Bench prohibits the institution of suits or continuation of pending suits or proceedings against the corporate debtor including execution of any judgment, decree, or order in any court of law, tribunal, arbitration panel or other authority; transferring, encumbering, alienating or disposing of by the corporate debtor any of its assets or any legal right or beneficial interest therein; any action to foreclose, recover or enforce any security interest created by the corporate debtor in respect of its property including any activity under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002; the recovery of any property by an owner or lessor where such property is occupied by or in possession of the corporate debtor;

b) The supply of essential goods or services to the corporate debtor, if continuing, shall not be terminated or suspended or interrupted during the moratorium period;

c) The provisions of sub-section (1) of Section 14 of I&B Code shall not apply to such transactions as may be notified by the Central Government in consultation with any financial sector regulator;

d) The order of moratorium shall have effect from the date of this order till the completion of the corporate insolvency resolution process or until this Bench approves the resolution plan under sub-section (1) of Section 31 of I&B Code or passes an order for the liquidation of the corporate debtor under Section 33 of I&B Code, as the case may be;

e) The public announcement of the corporate insolvency resolution process shall be made immediately as specified under section 13 of I&B Code;

f) This Bench at this moment appoints Mr. Ravi Prakash Ganti, a registered Insolvency Resolution Professional having Registration Number [IBBI/IPA-002/IP-N00102/2017- 18/10245], having email address: gantirp@gmail.com as Interim Resolution Professional to carry out the functions as mentioned under I&B Code. The fee payable to IRP/RP shall comply with the IBBI Regulations/Circulars/Directions issued in this regard.

g) Having admitted the Petition/Application, the provisions of Moratorium as prescribed under Section 14 of the Code shall be operative henceforth with effect from the date of appointment of IRP shall be applicable by prohibiting institution of any Suit before a Court of Law, transferring/encumbering any of the assets of the Debtor, etc. However, the supply of essential goods or services to the “Corporate Debtor” shall not be terminated during the Moratorium period. It shall be effective till completion of the Insolvency Resolution Process or until the approval of the Resolution Plan prescribed under Section 31 of the Code.

h) That as prescribed under Section 13 of the Code on the declaration of Moratorium, the next step of Public Announcement of the Initiation of Corporate Insolvency Resolution Process shall be carried out by the IRP immediately on the appointment, as per the provisions of the Code.

i) The appointed IRP shall also comply with the other provisions of the Code including Section 15 and Section 18 of the Code. Further, the IRP is hereby directed to inform the progress of the Resolution Plan to this Bench and submit a compliance report within 30 days of the appointment. Liberty is granted to intimate even at an early date if need be.

The Registry is hereby directed to communicate this order to both the parties and to the Interim Resolution Professional immediately.

Read & Download the full Order in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.