Insolvency and Bankruptcy Code override other enactments: Supreme Court

Insolvency and Bankruptcy Code override other enactments: Supreme Court

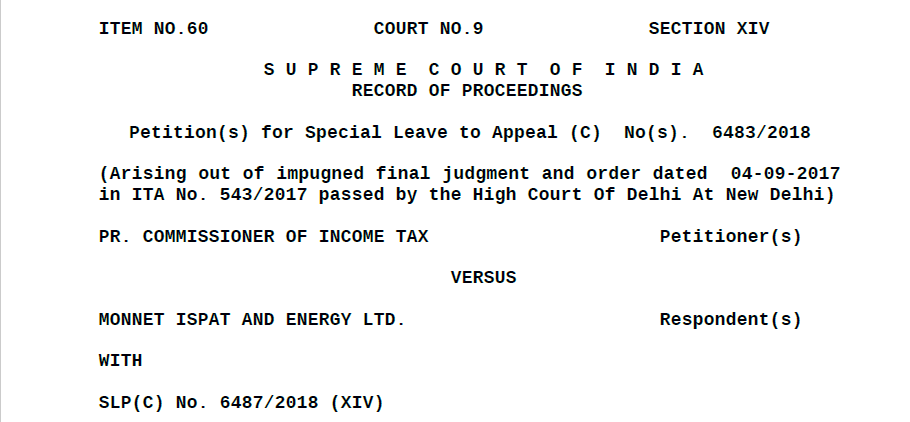

The Supreme Court of India has announced the order on 10 August 2018 regarding the Insolvency and Bankruptcy Code. In which the Supreme Court has ordered to IB Code override other enactments.

Download the order on Insolvency and Bankruptcy Code override other enactments by clicking the below image:

The text of the order:

Given Section 238 of the Insolvency and Bankruptcy Code, 2016, it is obvious that the Code will override anything inconsistent contained in any other enactment, including the Income-Tax Act.

We may also refer in this Connection to Dena Bank vs. Bhikhabhai Prabhudas Parekh and Co. & Ors. (2000) 5 SCC 694 and its progeny, making it clear that income-tax dues, being in the nature of Crown debts, do not take precedence even over secured creditors, who are private persons.

We are of the view that the High Court of Delhi, is, therefore, correct in law.

Accordingly, the Special Leave Petitions are dismissed.

Pending applications, if any, stand disposed of.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.