Instructions for filing GST Audit Report

Instructions for filing GST Audit Report.

On 13th September 2018, the format for filing the GST Audit report is issued. The Notification No. 49/2018 also provide the instructions for filing GST Audit Report in Form GSTR-9C. All the taxpayer who filed the GST return should know that the minimum limit for the GST audit is 2 crore of the turnover. in the past few months, there is so many confusion related to the GST audit report. So many drafts and rumors regarding the GST Audit report is available to the people. Some of them were recommended and some are based on the personal opinions.

Finally, the long wait has ended now. The format of the GST Audit report is issued and added to the CGST Rules by the 10th amendment in the rules.

Download the Full Instructions for filing GST Audit Report by clicking the below image:

Instructions:

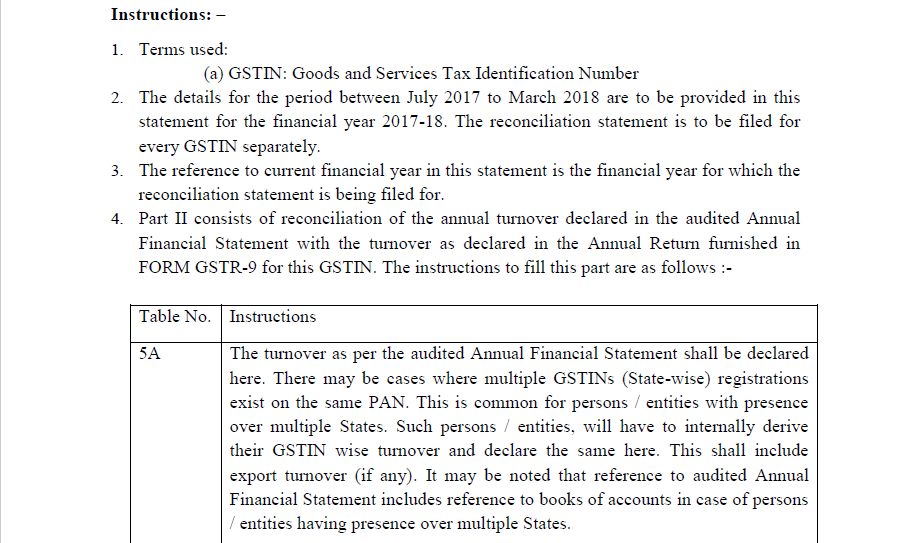

1. Terms used:

(a) GSTIN: Goods and Services Tax Identification Number

2. The details for the period between July 2017 to March 2018 are to be provided in this statement for the financial year 2017-18. The reconciliation statement is to be filed for every GSTIN separately.

3. The reference to the current financial year in this statement is the financial year for which the reconciliation statement is being filed for.

4. Part II consists of reconciliation of the annual turnover declared in the audited Annual Financial Statement with the turnover as declared in the Annual Return furnished in FORM GSTR-9 for this GSTIN. The instructions to fill this part are as follows:

| Table No. | Instructions |

| 5A | The turnover as per the audited Annual Financial Statement shall be declared here. There may be cases where multiple GSTINs (State-wise) registrations exist on the same PAN. This is common for persons/entities with a presence over multiple States. Such persons/entities, will have to internally derive their GSTIN wise turnover and declare the same here. This shall include export turnover (if any). It may be noted that reference to audited Annual Financial Statement includes reference to books of accounts in case of persons/entities having the presence over multiple States. |

| 5B |

Unbilled revenue which was recorded in the books of accounts on the basis of accrual system of accounting in the last financial year and was carried forward to the current financial year shall be declared here. In other words, when GST is payable during the financial year on such revenue (which was recognized earlier), the value of such revenue shall be declared here. (For example, if rupees Ten Crores of unbilled revenue existed for the financial year 2016-17, and during the current financial year, GST was paid on rupees Four Crores of such revenue, then the value of rupees Four Crores rupees shall be declared here) |

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.