[721 pages] Instructions for filing of Income-tax returns A.Y. 2020-21: CBDT

Table of Contents

- Instructions for filing of Income-tax returns for A.Y. 2020-21-General Instructions

- 1. Assessment Year for which this Return Form is applicable

- 2. Who is eligible to use this Return Form

- 3. Who is not eligible to use this Return Form

- 4. Annexure-less Return Form

- 5. Manner of filing and Verification of this Return Form

- 6. Filling out the ITR V- Income Tax Return Verification Form

- Read & Download the full copy in pdf:

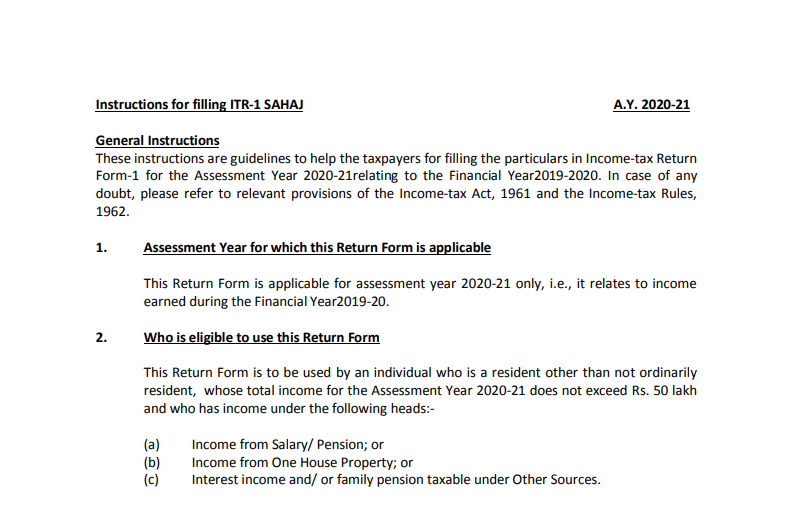

Instructions for filing of Income-tax returns for A.Y. 2020-21-General Instructions

These instructions are guidelines to help the taxpayers for filing the particulars in Income-tax Return Form-1 for the Assessment Year 2020-21 relating to the Financial Year2019-2020. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961, and the Income-tax Rules, 1962.

1. Assessment Year for which this Return Form is applicable

This Return Form is applicable for the assessment year 2020-21 only, i.e., it relates to income earned during the Financial Year2019-20.

2. Who is eligible to use this Return Form

This Return Form is to be used by an individual who is a resident other than not ordinarily resident, whose total income for the Assessment Year 2020-21 does not exceed Rs. 50 lakh and who has income under the following heads:-

(a) Income from Salary/ Pension; or

(b) Income from One House Property; or

(c) Interest income and/ or family pension taxable under Other Sources.

NOTE:

Further, in a case where the income of another person like spouse, minor child, etc. is to be clubbed with the income of the assessee, this Return Form can be used only if the income being clubbed falls into the above income categories.

3. Who is not eligible to use this Return Form

A. This Return Form should not be used by an individual who –

(a) is a Director in a company;

(b) has held any unlisted equity shares at any time during the previous year;

(c) has any asset (including financial interest in any entity) located outside India;

(d) has signing authority in any account located outside India; or

(e) has income from any source outside India.

B. This return form also cannot be used by an individual who has any income of the following nature during the previous year:-

(a) Profits and gains from business and professions;

(b) Capital gains;

(c) Income from more than one house property;

(d) Income under the head other sources which is of the following nature:-

(i) winnings from lottery;

(ii) the activity of owning and maintaining race horses;

(iii) income taxable at special rates under section 115BBDA or section 115BBE;

(e) Income to be apportioned in accordance with provisions of section 5A; or

(f) Agricultural income in excess of ₹5,000.

C. Further, this return form also cannot be used by an individual who has any claims of loss/deductions/relief/tax credit, etc. of the following nature:-

(a) any brought forward loss or loss to be carried forward under the head ‘Income from house property’;

(b) loss under the head ‘Income from other sources’;

(c) any claim of relief under section 90 and/or section 91;

(d) any claim of deduction under section 57, other than a deduction under clause (iia) thereof (relating to family pension); or

(e) any claim of credit of tax deducted at source in the hands of any other person.

4. Annexure-less Return Form

No document (including TDS certificate) should be attached to this Return Form. All such documents enclosed with this Return Form will be detached and returned to the person filing the return.

5. Manner of filing and Verification of this Return Form

This Return Form can be filed with the Income-tax Department in any of the following ways,:-

A. electronically on the e-filing web portal of Income-tax Department and verified in any one of the following manners –

(i) digitally signing the verification part, or

(ii) authenticating by way of electronic verification code (EVC), or

(iii) Aadhaar OTP, or

(iv) by sending duly signed paper Form ITR-V – Income Tax Return Verification Form by post to CPC at the following address –

“Centralized Processing Centre,

Income Tax Department,

Bengaluru— 560500,

Karnataka”.

The Form ITR-V – Income Tax Return Verification Form should reach within 120 days from the date of e-filing the return.

The confirmation of the receipt of ITR-V at Centralized Processing Centre will be sent to the assessee on e-mail ID registered in the e-filing account.

B. in paper form, at the designated offices of Income-tax Department, along with duly signed Form ITR-V. This mode of furnishing return is permissible only in case of super senior citizens (i.e. an individual of the age of 80 years or more at any time during the previous year).

6. Filling out the ITR V- Income Tax Return Verification Form

Where the Return Form is furnished in the manner mentioned at 5A(iv) above, the assessee should print out Form ITRV- Income Tax Return Verification Form. ITRV- Income Tax Return Verification Form, duly signed by the assessee then has to be sent by ordinary post or speed post only to Central, Processing Centre, Income Tax Department, Bengaluru- 560500 (Karnataka).

Read & Download the full copy in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.