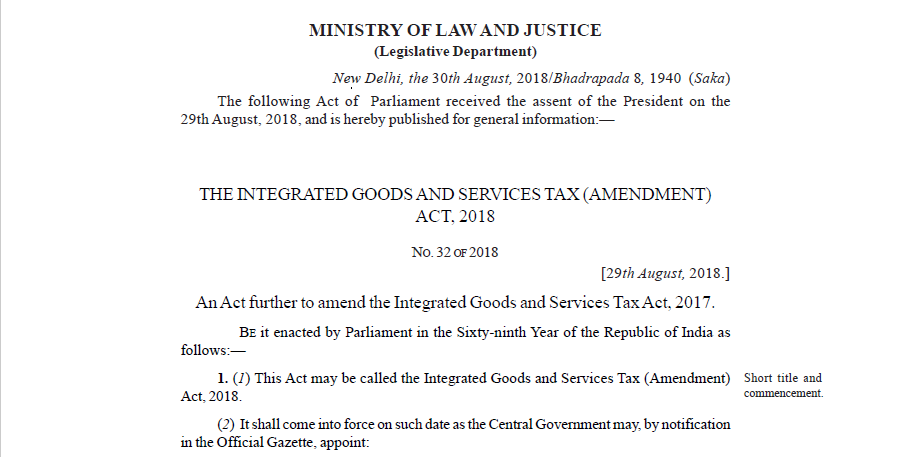

Integrated Goods and Services Tax (Amendment) Act, 2018

The Integrated Goods and Services Tax (Amendment) Act, 2018

Integrated Goods and Services Tax (Amendment) Act, 2018 was pus published in The Gazette of India. The Integrated Goods and Services Tax (Amendment) Act, 2018 of Parliament received the assent of the President on the 29th August 2018. After the assent, the act was published for the public.

The text of the Act:

1. (1) This Act may be called the Integrated Goods and Services Tax (Amendment) Act, 2018.

(2) It shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint:

Provided that different dates may be appointed for different provisions of this Act and any reference in any such provision to the commencement of this Act shall be construed as a reference to the coming into force of that provision.

2. In section 2 of the Integrated Goods and Services Tax Act, 2017 (hereinafter referred to as the principal Act),––

(i) in clause (6), in sub-clause (iv), after the words “foreign exchange”, the words “or in Indian rupees wherever permitted by the Reserve Bank of India” shall be inserted;

(ii) in clause (16), in the Explanation, in the long line, after the words “function entrusted”, the words, figures and letter “to a Panchayat under article 243G or” shall be inserted.

Download the full IGST(Amendment) Act, 2018 by clicking the below Image:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.