CBIC Issued Press Release on Interest on Delayed Payment of GST

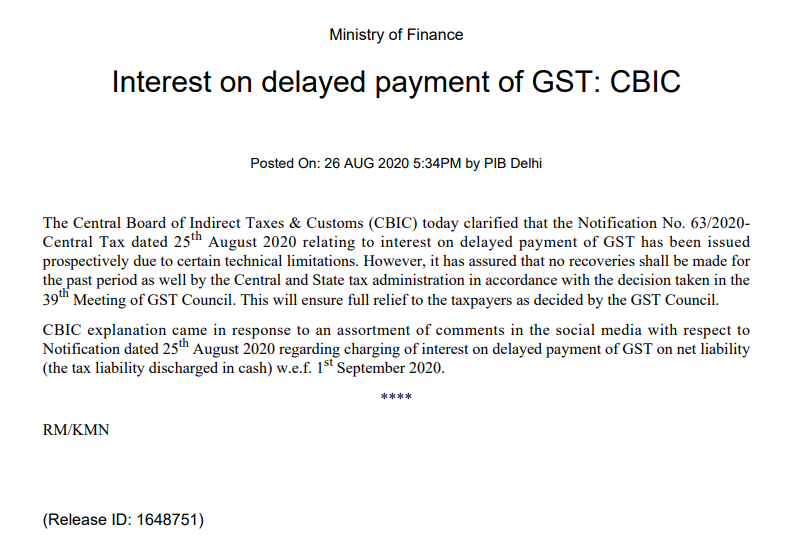

Interest on delayed payment of GST: CBIC

The Central Board of Indirect Taxes & Customs (CBIC) today clarified that the Notification No. 63/2020- Central Tax dated 25th August 2020 relating to interest on delayed payment of GST has been issued prospectively due to certain technical limitations. However, it has assured that no recoveries shall be made for the past period as well by the Central and State tax administration in accordance with the decision taken in the 39th Meeting of GST Council. This will ensure full relief to the taxpayers as decided by the GST Council.

CBIC explanation came in response to an assortment of comments in the social media with respect to Notification dated 25th August 2020 regarding charging of interest on delayed payment of GST on net liability (the tax liability discharged in cash) w.e.f. 1st September 2020.

Read the Copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.