Department is asking to pay interest on gross ignoring Refex order

Deptt asking to pay interest on gross in spite of Refex industries order.

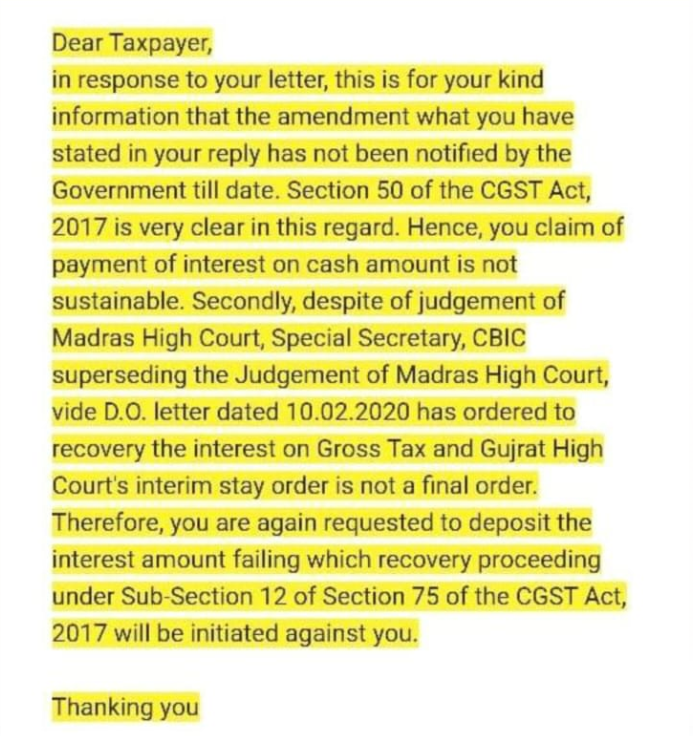

Litigation in favor of taxpayers is not helping much. Department is asking to pay interest on the gross amount. The provisions of section 50 of the CGST Act levying interest were amended. But the amendment was not notified. Earlier in the case of Megha engineering, Telangana High court ruled that interest levy id on gross. But later on, stay on interest was provided by many high courts.

In the case of Refex industries, it is clarified that interest shall be on the net. The court observed that an amendment of curative nature shall be applied retrospectively. After this judgment, many taxpayers withhold the payment of interest. There were bulk notices for the payment of interest. In every case where GSTR 3b was filed late was considered for notice of interest.

Special secretory, CBIC supersedes the order of Madras High Court: Will this amount to contempt of court?

Taxpayers replied on those notices quoting the Refex industries. Now reply from the department says that special secretory has ordered to collect interest on gross. Very interesting to see, the special secretary can override the order of a High Court. Is this not a contempt of court?

Pic Credit: Tweet of Puneet Nanda ji tagging Jatin Harjai Ji.

I hope these issues will be resolved soon. But the department is almost forcing taxpayers to pay interest on gross. This is not fair. Not everyone can have access to the high court. Why even they should file a writ for every small issue. When the court has clarified the issue, why it is not accepted by the deptt. yesterday our FM asked for what we want. We need a fair assessment. Punish the guilty but it shouldn’t harrassed the innocent taxpayers.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.