IRFC Limited – Launch of Tax Free Bonds Public Issue – Tranche 2 (Opening on 10th March, 2016)

IRFC Limited has Launched Tax Free Bonds Public Issue – Tranche 2 (Opening on 10th March, 2016)

IRFC Limited has Launched Tax Free Bonds Public Issue – Tranche 2 (Opening on 10th March, 2016)

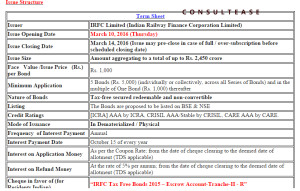

Issue Structure

| Term Sheet | |

| Issuer | IRFC Limited (Indian Railway Finance Corporation Limited) |

| Issue Opening Date | March 10, 2016 (Thursday) |

| Issue Closing Date | March 14, 2016 (Issue may pre-close in case of full / over-subscription before scheduled closing date) |

| Issue Size | Amount aggregating to a total of up to Rs. 2,450 crore |

| Face Value /Issue Price (Rs.) per Bond | Rs. 1,000 |

| Minimum Application | 5 Bonds (Rs. 5,000) (individually or collectively, across all Series of Bonds) and in the multiple of One Bond (Rs. 1,000) thereafter |

| Nature of Bonds | Tax-free secured redeemable and non-convertible |

| Listing | The Bonds are proposed to be listed on BSE & NSE |

| Credit Ratings | [ICRA] AAA by ICRA, CRISIL AAA/Stable by CRISIL, CARE AAA by CARE. |

| Mode of Issuance | In Dematerialized / Physical |

| Frequency of Interest Payment | Annual |

| Interest Payment Date | October 15 of every year |

| Interest on Application Money | As per the Coupon Rate; from the date of cheque clearing to the deemed date of allotment (TDS applicable) |

| Interest on Refund Money | At the rate of 5% per annum; from the date of cheque clearing to the deemed date of allotment (TDS applicable) |

| Cheque in favor of (for Residents Indian) | “IRFC Tax Free Bonds 2015 – Escrow Account-Tranche-II – R” |

| Cheque in favor of (for NRI on Repat Basis) | “IRFC Tax Free Bonds 2015 – Escrow Account-Tranche-II – NR Repat” |

| Cheque in favor of (for NRI on Non-Repat Basis) | “IRFC Tax Free Bonds 2015 – Escrow Account-Tranche-II – NR Non-Repat” |

Interest Rates:

| Options | Option 1 | Option 2 |

| Tenure / Maturity | 10 Years | 15 Years |

| Coupon rate for Category I, II, and III (HNI & Corporate) | ||

| Series of Bonds | Series 1A | Series 2A |

| Coupon / Interest Rate | 7.04% | 7.35% |

| Coupon rate for Category IV (Retail Individuals up to 10 Lacs) | ||

| Series of Bonds | Series 1B | Series 2B |

| Coupon / Interest Rate | 7.29% | 7.64% |

Category-wise Allocation:

| Category | Category Allocation (Rs) | Category Allocation (%) |

| I – QIB | 245 | 10% |

| II – Corporate | 367.5 | 15% |

| III- HNI | 367.5 | 15% |

| IV- Retail (RII) | 1470 | 60% |

| Total Issue | 2450 Crores | 100% |

Special Benefits of the Bonds:

- Interest from these Bonds will not be taxable as it do not form part of total income as per provisions of Section 10 (15) (iv) (h) of Income Tax Act, 1961 read along with Section 14A (1) of the IT Act.

- Since the interest income on the Bonds is exempt, no tax deduction at source (“TDS”) is required.

- However interest on application money would be liable for TDS as well as would be subject to tax as per present tax laws.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.