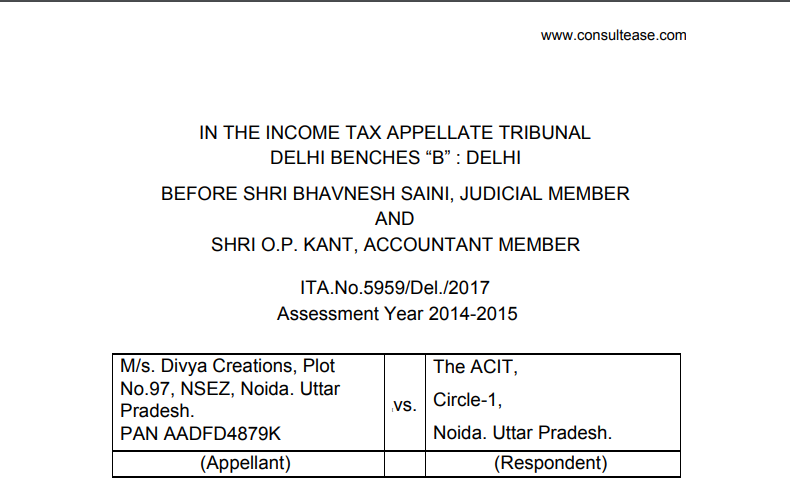

ITAT Delhi in the case of M/s. Divya Creations Versus The ACIT

Table of Contents

Case Covered:

M/s. Divya Creations

Versus

The ACIT

Facts of the case:

This appeal by the assessee has been directed against the Order of the Ld. CIT(A)-1, Noida, Dated 30.06.2017, for the A.Y. 2014-2015, challenging the addition of Rs.13,67,739/-.

The A.O. on perusal of Schedule-18 of Selling Expenses noticed that assessee had debited expenses in the name of the commission to non-resident other than a company or a foreign company amounting to Rs.13,67,739/-. The A.O. took-up the issue of TDS made on such payments to non-resident agents in the assessment year under appeal and examined the claim of the assessee. The A.O. also noted that similar disallowance was made under section 40(a)(i) of the I.T. Act and considering the fact that the expenses made in foreign agency commission are of the same nature as last year and no TDS has been deducted by the assessee, therefore, the amount in question was disallowed under section 40(a)(i) of the I.T. Act. The Ld. CIT(A) dismissed the appeal of the assessee.

Observations:

Learned Counsel for the Assessee submitted that facts are identical as have already been considered in an earlier year and this fact is also admitted by the A.O. in the assessment order and disallowances have been made as have been made in an earlier year. Therefore, the issue is covered in favour of the assessee and disallowance made may be deleted.

On the other hand, Ld. D.R. did not dispute that the issue is the same as having been considered in the earlier years and disallowance is also the same in respect of the same party. The Ld. D.R. however, relied upon the Orders of the authorities below and also relied upon Judgment of Hon’ble Supreme Court in the case of Transmission Corporation of A.P. Ltd., & Another vs., CIT [1999] 239 ITR 587 (SC).

Order:

We have considered the rival submissions. It is not in dispute that the issue is the same as having already been considered in the earlier years by the Tribunal. The parties are also the same. The Tribunal examined the issue in the light of agreement and material on record and found that the agent had their base situated in Abroad and moreover services were also rendered by them outside. Therefore, the assessee is not required to deduct tax at source while making payments in question. The A.O. in the assessment order has also made disallowance since in earlier years also of the same issue and no TDS have been deducted. Therefore, the facts being identical, no disallowance is required in the matter. We, therefore, following the Order of the Tribunal in the case of the assessee for the A.Y. 2010-2011, set aside the Orders of the authorities below and delete the addition.

As a result, the appeal of Assessee allowed. Order pronounced in the open Court.

Crux:

On payment of commission to agents based abroad by Indian exporter, no income tax (TDS) is required to be deducted & consequently there can be no disallowance or any other consequence on the exporter for not deducting TDS. Hearing through VC, the order issued in 1 day.

Read & Download Full order in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.