ITC for purchase from Non existent seller cant be recovered in case of a composition dealer

The author can be reached at shaifaly.ca@gmail.com

Table of Contents

Cases Covered:

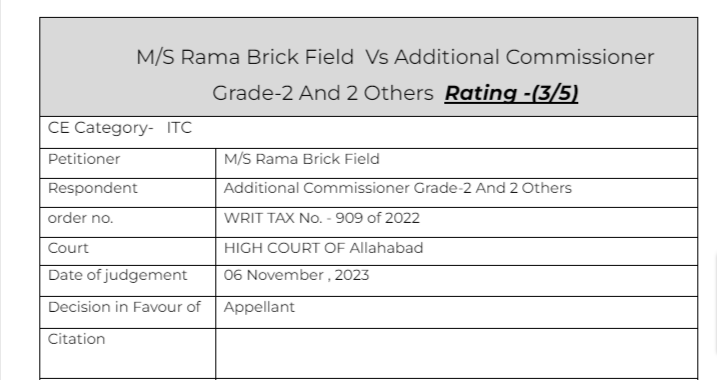

M/S Rama Brick Field Vs Additional Commissioner Grade-2 And 2 Others

Facts of the cases:

Purchase of coal was made from Rohit Coal Traders for which tax invoice was issued in which CGST and SGST was charged as well 2 as GST composition cess was also charged; on the said purchases even after payment of tax, no input tax credit was availed by the petitioner on the ground that the petitioner has opted for composition. But the proceedings under Section 74 was initiated and a notice was issued on 13.7.2020 on the ground that Rohit Coal Traders was not found to be in existence and thereafter the order was passed on 15.7.2020 imposition of tax and penalty of Rs. 200235/- and accordingly the demand was raised; against the said order a rectification application under Section 161 was filed but by order dated 20.7.2020 no relief was granted to the petitioner; against the said order, an appeal was preferred which was also rejected by the impugned order dated 26.10.2021.

Observation & Judgement of the Court:

Under the GST regime all details are available in the portal of GST department. The authorities could have very well verified as to whether after 4 filing of GSTR-1 and GSTR 3 B how much tax has been deposited by the selling dealer i.e. Rohit Coal Traders but the authorities have failed to do so. Thus looking to the said facts, the impugned orders cannot be sustained in the eyes of law. 10. In view of the facts as stated above, the writ petition succeeds and is allowed. The impugned orders are set aside. The matter is remanded to the first appellate authority, who shall pass a fresh order in accordance with law, expeditiously, preferably within a period of two months from the date of producing a certified copy of this order, without granting any unnecessary adjournment to the parties.

comment:

The dealer was registered as a composition dealer and made some purchases from a dealer which was found to be non existent. The dept initiated the proceedings under section 74 for recovery. The court quashed the demand and allowed the writ

Read & Download the Full M/S Rama Brick Field Vs Additional Commissioner Grade-2 And 2 Others

[pdf_attachment file=”1″ name=”optional file name”]

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.