PPT on All input tax credit forms in GST

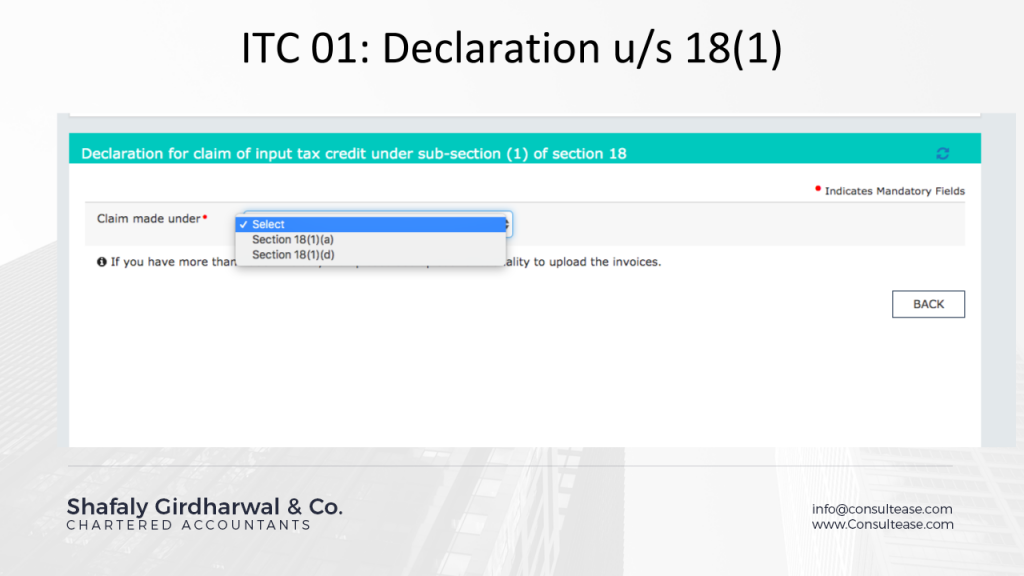

ITC 01

When to use?

- Section 18(a): Normal registration: In case of new registration is the taxpayer takes registration within 30 days from the date when he becomes liable. he will be eligible to take the input tax credit on inputs in stock, in semi-finished and finished goods as on the day immediately preceding the day when he becomes liable for registration.

e.g. XYZ LTD was formed on 31st January 2019. On 20th March 2019, their turnover crossed the threshold limit of Rs. 20 lac. They applied for registration on 30th March and duly granted the registration. They will be eligible to claim the ITC on the stock of inputs and inputs contained in stock of semi-finished and finished goods as on 19th March 2019. They will be able to avail this ITC by filing ITC 01 on the portal.

- Section 18(b) Voluntary registration: Taxpayers who have taken a voluntary registration u/s 25(2) are also eligible for same ITC on their opening stock of inputs. In this case, ITC of date immediately preceding the day when registration was granted will be considered.

- Section 18(c) shifting from composition to normal levy: In this case, the ITC on stock and capital goods will be available. The day immediately preceding the day when the transfer from composition to normal levy was made, will be relevant.

- Section 18(d) Exempt supply become taxable:: In this case where the exempt supply become taxable ITC of stock of inputs and capital goods shall be available. In this case, the day immediately preceding the date of becoming taxable will be the relevant date for stock.

How to use?

- Go to GST dashboard and select the forms from ITC forms. The select section which is relevant for filing. It will be any of section 18(1) a,b or d.

- Invoice details are required to be filled to claim ITC under this head. Following details will be filled.

- GSTIN of the supplier.

- Invoice number.

- Goods type

- UQC

- quantity

- Value

- amount of input tax credit

- The taxpayer is also required to inform whether the goods are contained in stock of goods or of semi-finished or finished goods.

- In the case of bigger data, an offline utility is also available.

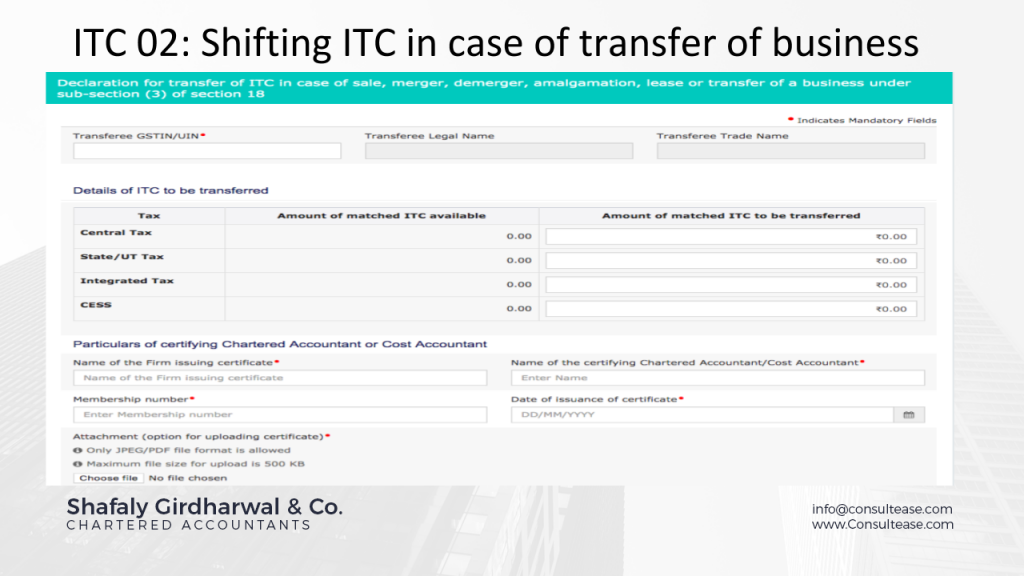

ITC 02

When to use?

- Section 18(3)

When there is a change in the constitution of a registered person on account of

- Sale

- merger

- demerger

- amalgamation

- lease or transfer

- with specific provision for transfer of liabilities.

The said person shall be allowed to take ITC, which remained unutilized in his electronic credit ledger. This ITC will be shifted to the transferee.

How to use?

- Go to GST dashboard and select the forms from ITC forms. The select section which is relevant for filing. It will be any of section 18(1) a,b or d.

- In this case, GSTIN of the transferee is required to be filled. ITC ledger will be there. The transferor can choose from the ITC ledger what amount they want to shift.

- In this case, a certificate from a chartered accountant or a cost accountant will also be required.

- This certificate will be uploaded on postal.

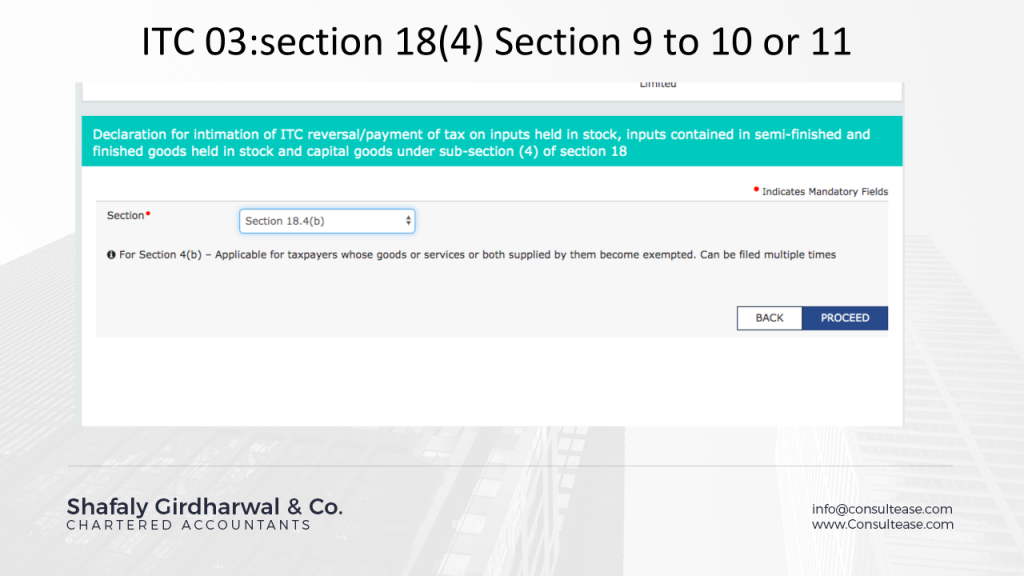

ITC 03

When to use?

- ITC 03 will be used for reversal of input tax credit in the following two cases:

- When a person paying tax under normal levy shift to composition levy.

- When a taxable supply becomes exempt.

- The taxable person will be liable to pay an amount

- equivalent to ITC of inputs and capital goods in stock on the immediately preceding day of shifting.

- ITC of capital goods will be reduced by 5% per quarter and then balancing figure will be reversed.

How to use?

Details of inputs and capital goods will be fed into this form.

- where the invoice is available

- where the invoice is not available

- inputs and capital goods of GST regime

- inputs and capital goods of pre-GST regime

All of the above details will be entered. The amount of relevant ITC will be reduced from the balance.

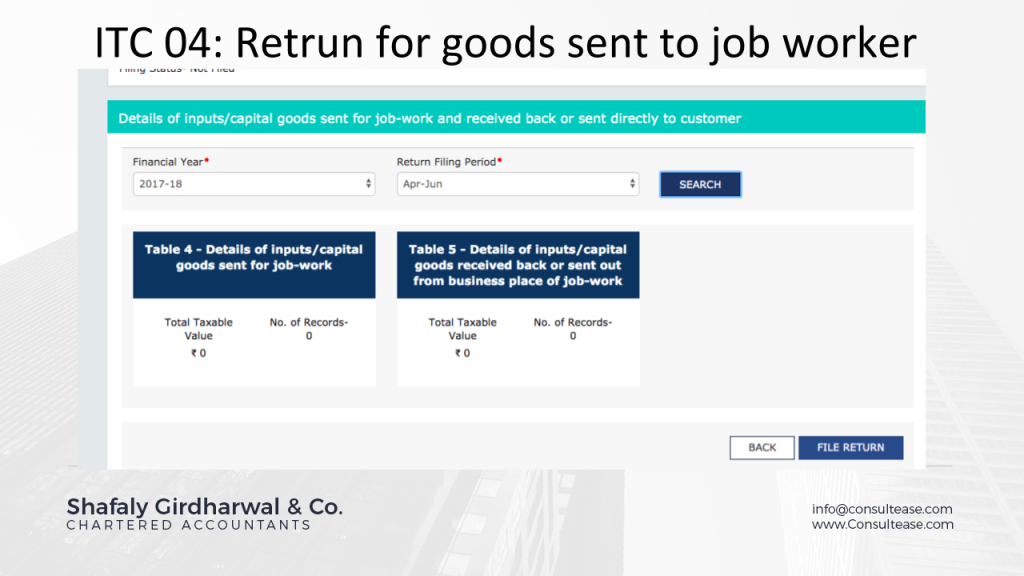

ITC 04

When to use?

- ITC 04 is a return required to be filed by a person sending goods to a job worker.

- This return contains the details of goods send or received from a job worker.

- A principal following the procedure of section 143 of the CGST Act is required to file it.

Download the full PPT on ITC forms in GST by clicking the image below

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.