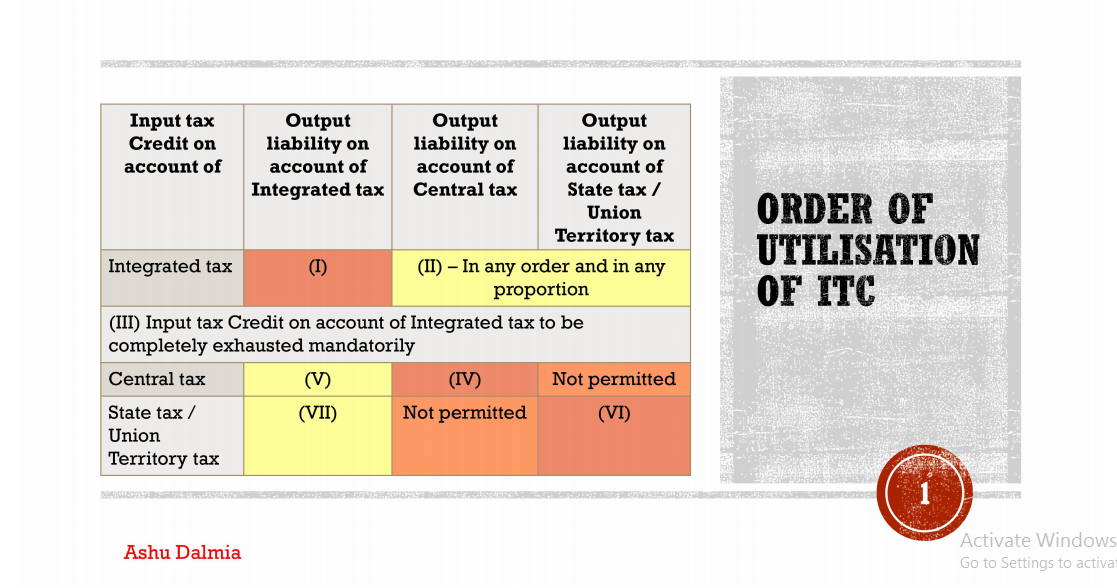

ITC Utilization Sequence

Order of Utilization of ITC

| Input Tax Credit on account of | Output liability on account of Integrated Tax | Output liability on account of Central Tax | Output liability on account of State Tax/ Union Territory Tax |

| Integrated Tax | (I) | (II)- In any order and in any proportion | |

| (III) Input Tax Credit on account of Integrated Tax to be completely exhausted mandatorily | |||

| Central Tax | (V) | (VI) | Not Permitted |

| State Tax/ Union Territory Tax | (VII) | Not Permitted | (VI) |

Read the copy:

Ashu Dalmia

Ashu Dalmia

New Delhi, India

Ashu Dalmia is Managing Partner of the firm AAP and Co., having office in Connaught Place Delhi. He is rank holder in CA Inter and also at graduation level from Lucknow university. He is has been working extensively in GST training, Consultancy and litigation in India and also handled VAT implementation projects for mid and large corporates in Saudi Arabia. He was special Invitee to Indirect Tax Committee of ICAI for year 2018-19. He is faculty in ICAI to train professionals for GST in India and VAT for UAE. He has authored books on GST: “GST A Practical Approach” published by Taxman, “Audit and Annual Return in GST” published by Wolters Kluwer-CCH GST Referencer and Manual published by LMP. He has taken more than 300 workshops and trainings on various forums: like ICAI, ASSOCHAM, CII, PHD Chamber of commerce, trade associations in India, UAE and KSA.