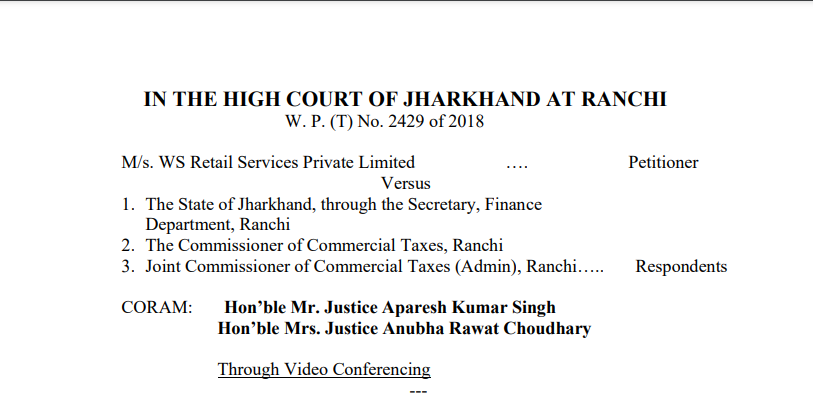

Jharkhand HC in the case of M/s. WS Retail Services Private Limited Versus The State of Jharkhand

Table of Contents

Case Covered:

M/s. WS Retail Services Private Limited

Versus

The State of Jharkhand

Facts of the Case:

The claim of refund of Rs. 61,74,899/- deposited between the period December 2014 to August 2015 by the petitioner before the RespondentCommercial Taxes Department, was declined by order dated 1st September 2016 (Annexure-4) passed by respondent no. 3 impugned herein on the ground that the application for refund was not maintainable. Learned Commercial Taxes Tribunal upheld the order of rejection by the impugned order dated 31st October 2017 (Annexure-8) holding that in absence of any statutory provision under the JVAT Act the learned JCCT had no jurisdiction to allow the refund application of the petitioner. Learned Tribunal at Para-6 observed that the receipt of the amount of Rs. 61,74,882/- by the Revenue Department from the petitioner between December 2014 to August 2015 is not in dispute.

Related Topic:

Jharkhand HC in the case of Shree Nanak Ferro Alloys Pvt. Ltd. Versus The Union of India

Observations:

We have considered the submission of learned counsel for the parties and taken note of the material pleadings on records as relied upon by them. We have also gone through the decisions cited by learned counsel for the petitioner.

It is the case of the petitioner, undisputed by the respondent that the petitioner is not a registered dealer under the JVAT Act, 2005 nor has been assessed to tax under the Act. No demand notices were raised against the petitioner as such to the effect that any tax is due against him. Petitioner claims to have made a deposit of Rs. 61,74, 899/- in order to ensure continuity of business and to avoid coercive action without any demand of tax since the goods transported by the petitioner were already excisable to Central Sales Tax to the tune of Rs. 58,05,157/- which were paid in the State of Origin. No sale took place in the State of Jharkhand within that period. The principles regarding maintainability of a writ petition seeking a refund in case the levy is unauthorized or without jurisdiction or is unconstitutional are well settled by the decisions of the Apex Court. In the case of HMM Ltd. (supra), the Apex Court has held that realization of tax or money without the authority of law is bad under Article 265 of the Constitution of India. It has further been held in the case of Arvind Lifestyle Brands Ltd. Vs. Under Secretary Technology Development Board & Ors., reported in 2019(368) ELT 387 (Kar.) relying upon the decision in the case of HMM Limited (Supra) that any amount paid by mistake or through ignorance of repeal Act deserves to be refunded as retention of such amount would be hit by Article 265 of the Constitution of India. In the case of the petitioner admittedly there has been no assessment of tax liability to date. The claim of refund has been denied on the plea that there is no provision under the JVAT Act since the petitioner is not a registered dealer and no assessment proceedings have been held. Under the Scheme of the JVAT Act, assessment proceedings can be held against dealers, who have failed to get themselves registered. However, no assessment can be made under Sections 37 or 38 after the expiry of 5 years from the end of the tax period, to which the assessment relates. On the face of the pleadings on record and the stand of the respondents brought through their counter affidavit, the rejection of the claim for refund only on the ground that there are no provisions under the JVAT Act, 2005 for entertaining such a claim is not sustainable in law. Whether the contention of the petitioner that the entire sale transaction originated in a different State after payment of central sales tax to the tune of Rs. 58,05,157/- and there was no sale transaction originating within the State of Jharkhand for the respondent to retain the amount so deposited is a matter of verification upon assessment.

However, as it appears the transaction relates to the period December 2014 to August 2015. Any assessment proceedings in respect of a transaction for the period December 2014 till 31st March 2015 would be impermissible in the light of Section 39 of the JVAT Act, 2005. However, it may be open for the respondent authorities to undertake such assessment for the period 1st April 2015 till August 2015 with the rider contained in Section 38 & 39 of the JVAT Act, 2005. We do not wish to observe any further in this regard. However, having regard to the facts and circumstances of the case and the discussions made hereinabove, the order of rejection of the claim of refund by respondent no. 3 dated 1 st September 2016 (Annexure-4) and the order of learned Commercial Taxes Tribunal dated 31st October 2017 (Annexure-8) upholding the same cannot be sustained in the eye of law Accordingly, they are set aside. The matter is remitted to respondent no. 3, Joint Commissioner of Commercial Taxes (Admin), Ranchi to consider the claim of refund of the petitioner in accordance with law within a period of six weeks from today. The petitioner should appear before respondent no. 3 on 15th February 2021 with the relevant records.

The Decision of the Court:

The writ petition is allowed in the manner and to the extent indicated hereinabove. However, we make it clear that any observations made hereinabove, shall not prejudice the case of the parties while considering the claim of refund.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.