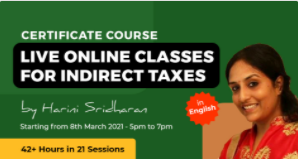

Course on Indirect Tax Course for CA Final Students and Professionals by CA Harini Sridharan.

Table of Contents

About the course:

Live online classes for Indirect taxes is a course covering all the provisions of the Goods and Services Tax legislation, Customs and Foreign Trade Policy Provisions, and is relevant for CA, CMA, and CS aspirants appearing for Final examinations. It is also beneficial for leaders in-charge of the Indirect tax department in a company and GST consultants.

The medium of learning and explaining the concepts is in English. The Classes are taken using a Virtual blackboard and a virtual pen using a lot of charts and diagrams. So in effect, the attendees will reap all the benefits of attending a physical session.

A summary of the discussions at the end of each class will appear on the dashboard so that the attendees can have a better memory of recalling the concepts and discussions.

A weekly MCQ test for testing the subject understanding of the attendees will be done to enhance the confidence level of the attendees.

Course Schedule:

- GST in India – 08th Mar 2021

- Supply under GST – 09th Mar 2021

- Charge of GST – 10th Mar 2021

- Exemptions from GST – 11th Mar 2021

- Time of Supply of Services – 12th Mar 2021

- Place of Supply – 13th Mar 2021

- Registration – 15th Mar 2021

- Documentation & Accounts and records – 16th Mar 2021

- Input tax credit – 17th & 18th Mar 2021

- Returns and Payment of tax – 19th Mar 2021

- Refunds, Assessment, and Audit, GST practitioner – 20th Mar 2021

- Audit, Inspection, search, seizure, and arrest – 21st Mar 2021

- Demands and Recovery – 22nd Mar 2021

- Liability to pay tax in certain cases; offenses and penalties – 23rd Mar 2021

- Appeals and Revision, Advance Ruling – 24th Mar 2021

- Constitutional Provisions under GST – 25th Mar 2021

- CUSTOMS ACT – 26th & 27th Mar 2021

- FOREIGN TRADE POLICY – 30th & 31st Mar 2021

Who should buy

CA Final aspirants, CMA Final aspirants, CS final aspirants, CEO, CFO, MD, decision-makers and tax heads, Legal and compliance team, Professionals aspiring to be GST consultants, GST practitioners.

Course Features:

- Intense learning of more than 42 hours in English

- Certificate by ConsultEase

- Facility to clarify doubts in everyday interaction with the faculty

- Concepts explained using Virtual blackboard and pen

- Use of flowcharts to explain the concepts.

- Summary of the discussions at the end of each class available in the dashboard for revision and better memory.

- A weekly MCQ test to test the knowledge level and confidence of attendees provided.

About the course creator:

Harini Sridharan is a qualified Chartered Accountant and a Company Secretary. She is an author of a book titled ‘Returns and Payment under GST’. She has rich experience in Indirect taxes and has handled matters of clients from diverse industries.

Register Here:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.