Karnataka AAAR in the case of M/s WeWork India Management Private Limited

Table of Contents

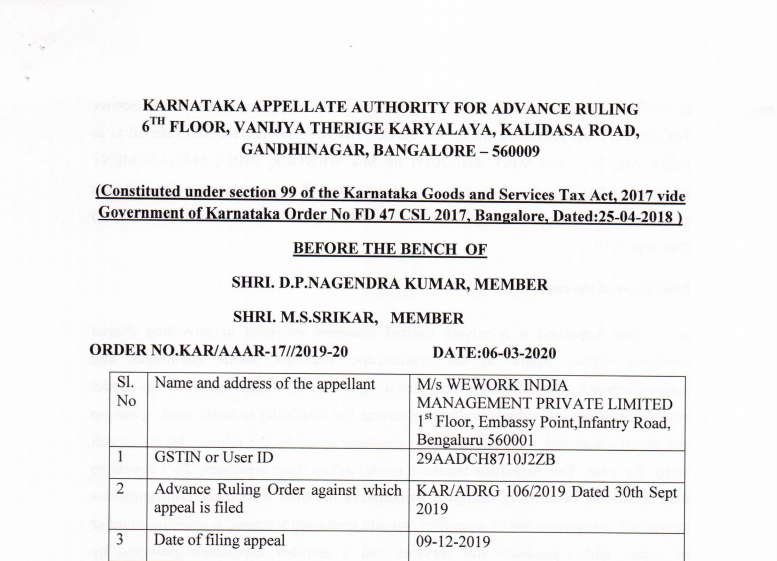

Case Covered:

M/s WeWork India Management Private Limited

Facts of the Case:

The Appellant is a private limited company engaged in providing shared workspace/ Office Space to the freelancers, start-ups, small businesses, and large enterprises. The Appellant provides a “space-as-a-service” membership model wherein it offers individuals and organizations the flexibility to scale workspace up and down as needed, with the ability to consume space by the minute, by the month or by the year. The Appellant business model offers its members 24/7 access to their locations, beautifully designed workspaces, flexible workspace configurations as needed, a common set of amenities, on-site community teams, a growing number of value-added products and services and a member experience powered by technology.

Observations:

We have gone through the records of the case and considered the submissions made by the Appellant in their grounds of appeal as well as at the time of the personal hearing.

We find that the Appellant has sought condonation of delay of 29 days in filing the present appeal. The impugned order of the lower Authority dated 20.09.2019 was received by the Appellant on 11.10.2019. In terms of Section 100(2) of the CGST Act, every appeal to this authority should be filed within a period of 30days from the date on which the Advance Ruling order is communicated to the aggrieved party. The proviso to Section 100(2) empowers this authority to condone the delay in filing the appeal by another period of 30 days. In this case, the due date for filing the appeal was 10.11.2019 but the Appellant has filed the appeal on the 9th December 2019 after a delay of 29 days from the due date for filing appeal. The Appellant has stated that the delay had occurred since deliberations with the parent company and the stakeholders on filing the appeal took time resulting in the delay. Considering the submissions made by the appellant, the delay in filing is hereby condoned in the exercise of the power vested in terms of the proviso to Section 100(2) of the CGST Act.

Order:

We set aside the portion of the Advance Ruling Order No. KAR ADRG 106/2019 dated 30th September 2019 which deals with the eligibility of input tax credit on detachable sliding and stackable glass partitions. We answer the question in the appeal as follows:

“Input tax credit can be availed by the Appellant on detachable sliding and stackable glass partitions which is movable in nature.”

Read & Download the full decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.