Karnataka AAR in the case of M/s. Guitar Head Publishing LLP

Table of Contents

Case Covered:

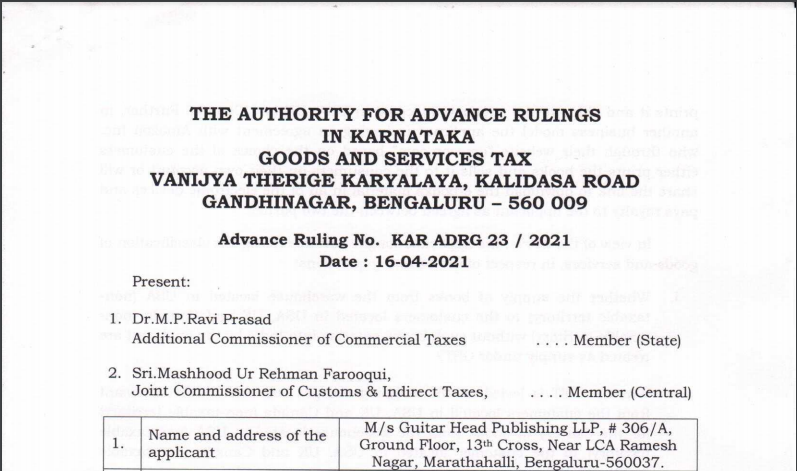

M/s. Guitar Head Publishing LLP

Facts of the Case:

M/s. Guitar Head Publishing LLP, # 306/A, Ground Floor, 13th Cross, Near LCA Ramesh Nagar, Marathahalli, Bengaluru-560037 having GSTIN 29AAVFG2223Q1ZN, have filed an application for Advance Ruling under Section 97 of the CGST Act, 2017, read with Rule 104 of CGST Rules 2017 and Section 97 of KGST Act, 2017 read with the KGST Rules 2017, in FORM GST ARA-01 discharging the fee of ₹ 5,000/- each under the CGST Act and the KGST Act.

The applicant is engaged in the business of selling guitar training books in the United States of America, the United Kingdom, and Canada through their website. The applicant sends a soft copy of the book to the printer located in the USA, who in turn prints it and ships it to the customers located in the USA, UK, and Canada. Further, in another business model, the applicant is having an agreement with Amazon Inc. who through their website “amazon” based on the choice of the customers either prints the books and sells it to the consumers on their own account or will share the link to download the e-books material in an of the electronic devices and pays a royalty to the applicant as agreed between the two parties.

Related Topic:

Karnataka AAR in the case of M/s. Page Industries Limited.

Observations:

We have considered the submissions made by the applicant in their application for advance ruling as well as the submissions made by Sri. Veeresh S Kandgol, Chartered Accountant and Duly Authorized Representative of the applicant during the personal hearing. We also considered the issues involved, on which advance rulings are sought by the applicant, relevant facts, and the applicant’s interpretation of the law.

The applicant sought advance ruling, with regard to business model ‘A’, in respect of the questions mentioned at para 2 supra. In this business model, customers in the USA, UK, and Canada place an order through the applicant’s website by making payment in Foreign Currency. The applicant places the bulk order with the printer, who prints and supplies to the warehouse. The books are stored in the warehouse for the quick delivery to the customer. The applicant shares the order details with the warehouse service provider, who in turn ships the books to the customer. The applicant pays printing charges, warehouse charges, and shipping charges to the respective service providers. The applicant collects the price of the book along with shipping charges.

It could easily be inferred from the aforesaid business model ‘A’ that the applicant is in receipt of the service of printing of the books where the content is supplied by the applicant and also moving the books so printed to the warehouse at the USA; shipping of the books by the person (agent of the applicant) located in the USA, on behalf of the applicant to the customer in USA/Canada/UK by the respective service providers.

Ruling:

i. The supply of books from the warehouse located in the USA (non-taxable territory) to the customers located in the USA, UK, and Canada (non-taxable territory) without such books entering into India by the applicant does not amount to supply under GST.

ii. The shipping charges collected by the applicant from the customers located in the USA, UK, and Canada (non-taxable territory) for the delivery of books from the warehouse located in the USA (non-taxable territory) to the customer located in the USA, UK, and Canada (non-taxable territory) are not exigible to GST.

iii. The printing charges, for the printing of books, charged by the printer located in the USA (non-taxable territory) are taxable under Reverse Charge Mechanism under GST, where only content is supplied by the applicant.

iv. The services received by the applicant from a foreign service provider such as the warehousing of printed books located in the USA (non-taxable territory) are not taxable under the Reverse Charge Mechanism under GST.

v. The input tax credit can’t be availed, to the extent of inputs and input service on the transaction covered in the first question as the said transaction does not amount to supply under GST.

Read & Download the full Ruling in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.