Karnataka AAR in the case of Mr. Rajendran Santhosh

Table of Contents

Case Covered:

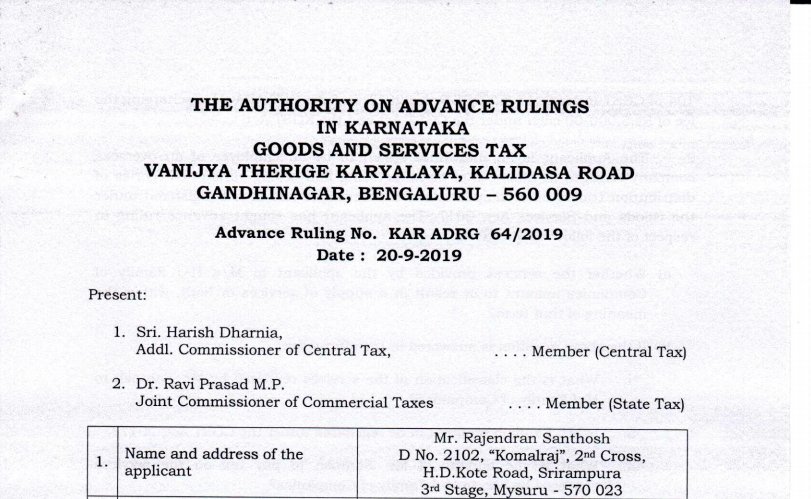

Mr. Rajendran Santhosh

Facts of the Case:

Sri Rajendran Santhosh, (called as the ‘Applicant’ hereinafter), residing at D No. 2102, “Komalraj”, 2nd Cross, H.D.Kote.Road, Srirampura 3rd Stage, Mysuru 570023, is employed as an “independent Regional Sales Manager for the Middle East and Indian Markets” by H-J Family of Companies, a company engaged in the business of manufacturing and selling various categories of distribution transformer components and accessories. He has filed an application for Advance Ruling under section 97 of the CGST Act, 2017, and KGST Act, 2017 read with Rule 104 of CGST Rules 2017 & KGST Rules 2017, in form GST ARA-01 discharging the fee of Rs. 5,000-00 each under the CGST Act and the KGST Act.

Observations:

We have considered the submissions made by the Applicant in their application for advance ruling as well as the submissions made by Ms. Rupashri Khatri, Advocate, and authorized representative of the applicant during the personal hearing. We have also considered the issues involved, on which advance ruling is sought by the applicant, and relevant facts.

Ruling:

- The service provided by the applicant to M/s H-J Family Companies would result in the supply of services within the meaning of that term.

- The service provided would be classifiable under HSN 9983.11 under the description “Other Professional, technical and business services”

- The applicant is required to be registered under the Central Goods and Services Tax Act, 2017.

- The rate of tax applicable to the service provided are

a. In the case of intra-State Supply

i. Under CGST at 9%

ii. Under KGST at 9%

b. In the case of inter-State supply at 18% under the IGST Act.

5. The time of such supply be determined as per the provisions of sub-section (2) of section 13 of the CGST Act, 2017, and the value of such supply would be the amount received by the applicant from the recipient of services and also includes amounts reimbursed to the applicant by the recipient of services for the expenses incurred.

Read & Download the full Ruling in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.