Karnataka AAR in the case of M/s. Fraunhofer- Gessellschaft

Table of Contents

Case Covered:

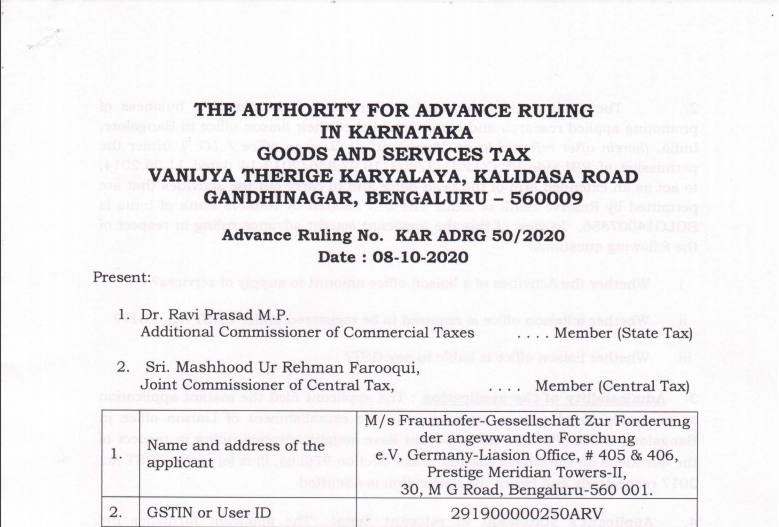

M/s. Fraunhofer- Gessellschaft Zur Forderung der angewwandten Forschung

Facts of the Case:

The applicant, incorporated in Germany, undertakes the business of promoting applied research and hence established their liaison office in Bangalore, India, (hereinafter referred to as “Applicant” or “liaison office/ LO”), under the permission of RBI vide FE.CO.FID/27803/10.97.856/2013-14 dated 11.06.2014, to act as an extended arm of the head office and to carry out the activities that are permitted by the Reserve Bank of India. The UIN allotted by the Reserve Bank of India is BGLO14007856. In view of this, the applicant sought a ruling in respect of the following questions:

i. Whether the Activities of liaison office amount to supply of services?

ii. Whether a liaison office is required to be registered under the CGST Act, 2017?

iii. Whether the liaison office is liable to pay GST?

Observations:

It is observed, on examination of the documents on record, that the Applicant’s HO is incorporated in Germany and is engaged in the business of promoting applied research. The HO has established their LO in Bangalore, India which is acting as an extended arm of the HO to carry out activities that are permitted by RBI. The RBI has stipulated certain conditions for the establishment of a liaison office in India, which includes among other things, that LO will not generate income in India and will not engage in any trade/ commercial activity, will represent in India the Present Company, will promote technical/ financial collaborations and act as a communication channel between the Parent Company and the Indian Company, the entire expenses of the office in India will be met exclusively out of the funds received from abroad through normal banking channels and it will not have any signing/commitment powers, except than those which are required for normal functioning of the office, on behalf of the HO/ Parent Company.

Ruling:

- The liaison activities being undertaken by the applicant (LO) in line with the conditions specified by RBI amount to supply under Section 7(1)(c) of the CGST Act, 2017.

- The applicant (LO) is required to be registered under the CGST Act, 2017.

- The applicant (LO) is liable to pay GST if the place of supply of services is in India.

Read & Download the full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.