Late fees and interest for late filing of GST returns

GST returns are a mechanism of self-assessment. Government desire that taxpayer should file it on time. Many events are connected with the late filing of GST returns. Here we have incorporated all the important events related to GST returns. It may be late fees or interest or penalty or maybe a loss of business.

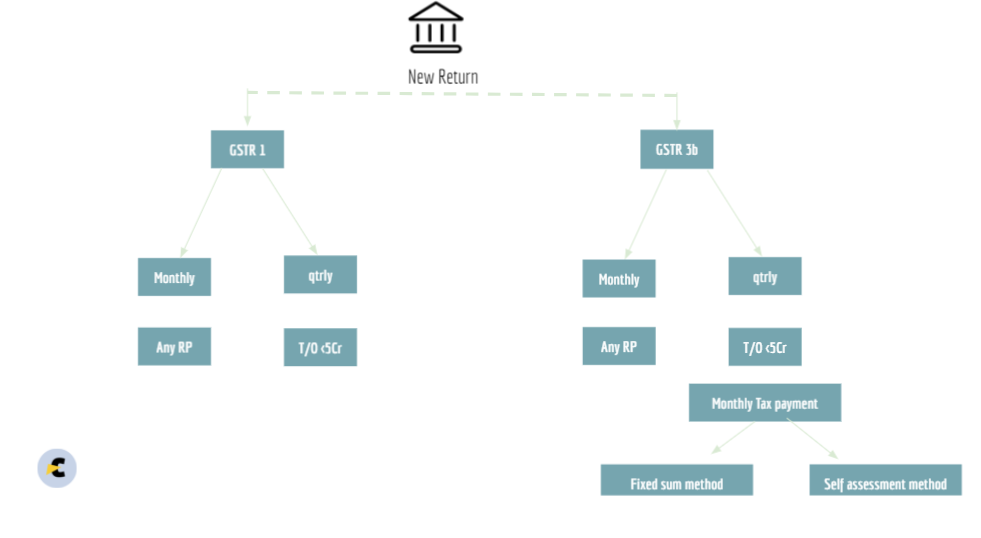

This is the normal scheme of return filing in GST.

Late fees on late filing of GST returns –

There are two main returns in GST. These are GSTR 1 and GSTR 3b. Apart from that, we file GSTR 9 annually. In the case of composition dealers, the return is CMP08 quarterly and GSTR 4A annually.

The late fees for GSTR 1 and 3b were rs. 200 per day up to a maximum of Rs.10,000. It is amended by CBIC. Both daily and maximum late fees are curtailed by CBIC. It is summarised in the following table.

| GSTR-3B(applicable from June 2021) | ||

| Return/Taxpayer | Late fee per day | Late fee Capped at |

| Nil return | Rs 20 per day [10 CGST + 10 SGST] | Rs 500 [250 CGST + 250 SGST] |

| Taxpayer having aggregate turnover upto 1.5 crores | Rs 50 per day [25 CGST + 25 SGST] | Rs 2000 [1000 CGST + 1000 SGST] |

| Taxpayer having aggregate turnover B/w 1.5 crores – 5 crores | Rs 50 per day [25 CGST + 25 SGST] | Rs 5000 [2500 CGST + 2500 SGST] |

| Taxpayer having aggregate turnover above 5 crores | Rs 50 per day [25 CGST + 25 SGST] | Rs 10000 [5000 CGST + 5000 SGST] |

GSTR-3B(Before June 2021)

| Return/Taxpayer | Late fee per day | Late fee Capped at |

| Nil return | Rs 20 per day [10 CGST + 10 SGST] | Rs 10,000 [5000 CGST + 5000 SGST] |

| Other than Nil Return | Rs. 50 per day[25 CGST + 25 SGST] | Rs. 10,000 [5000 CGST + 5000 SGST] |

GSTR-3B(Amnesty scheme)

| Return/Taxpayer | Return filing period | Late fee per day | Late fee Capped at |

| Nil return | 1-06-2021 – 31-08-2021 | Rs 20 per day [10 CGST + 10 SGST] | Rs 500 [250 CGST + 250 SGST] |

| Other than Nil Return | 1-06-2021 – 31-08-2021 | Rs. 50 per day[25 CGST + 25 SGST] | Rs. 1000 [500 CGST + 500 SGST] |

Interest liability on late filing of GST returns-

The interest liability is levied by section 50 of the CGST Act. This section is recently amended. You need to pay interest on the invoices missed the relevant return.

e.g. Let us say the turnover of a taxpayer was Rs. 20 lac in the month of March. He missed two invoices of Rs. 5 lac in March return. He entered those invoices in the return of May. Now he is liable to make the payment of interest on the tax component of that missed amount.

In our example, it is 18% of 18% if Rs. 5 lac for the days of delay.

Penalty on late filing of GST returns-

Late filing of returns may also attract penalties. Although it is not necessary. In some cases, the department may not go to the course of action of levying the penalty. But yes in case of consistent delays it may happen. The general penalty of GST can be levied on the late filing of GST returns.

Loss of business due to the delayed filing of GST returns

The delays in return filing may also result in loss of business. The buyer is eligible for the input tax credit only when the return is filed by the supplier. Delayed filing may cause your buyer to pay via cash ledger. This can harm his cash flow and eventually his business.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.