Latest features on GST Portal

Latest features ion GST portal:

GST portal is changing day by day. There are some latest features in GST portal. Although the changes are not in the desired frequency but still speed is very slow. Many functionalities are on hold. In recent past some of the functionalities are activated for the users. Here we will discuss those new utilities.

PMT07:

This utility is started to address grievances related to payment. You can access it via this path on GST portal. Service——user service—–Grievance/ complaint. Following information is required to be filled in this form.

- Grievance Type

- State

- Grievance Related to

- Details of Taxpayer(Person) who is reporting the grievance

- Registered Taxpayer/Unregistered Person

- GSTIN/UIN/Temporary ID

- Name and Address of Business

- Name of Complainant

- Email Address

- Mobile Number

- Description of Grievance(4000 characters)

- Upload Supporting Document

- Discrepancy In Payments

- CPIN

- Submit with DSC

- Submit with EVC

Advance Ruling:

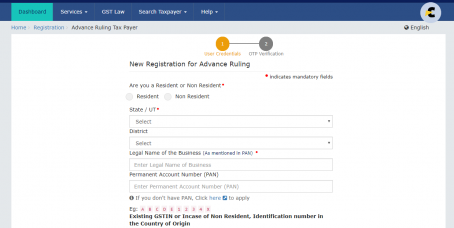

Advance ruling facility is also started on GST portal. Now you can generate the online request for advance ruling.Path for this utility is Services—user services—–Generate user ID for advance ruling. Section 95(a) defines the term advance ruling as

“advance ruling” means a decision provided by the Authority or the Appellate Authority to an applicant on matters or on questions specified in sub-section (2) of section 97 or sub-section (1) of section 100, in relation to the supply of goods or services or both being undertaken or proposed to be undertaken by the applicant”

Following are the details required to be filled in this application.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.