Latest GST Updates During The Period of 01.06.2020 to 15.06.2020

Table of Contents

- 1. Filing GSTR-3B Through SMS

- 2. Tax Period To Transfer ITC For Person Registered In Union Territory

- 3. Time Period of Issuance of Refund Order

- 4. The validity of E-Way Bill

- 5. Clarifications on Refund of ITC Availed Not Reflected In GSTR 2A

- 6. Clarification On GST Applicability On Director’s Remuneration

- 7. Glimpses of 40th GST Council Meeting Dated 12.06.2020

- Read the copy:

1. Filing GSTR-3B Through SMS

(Notification 44/2020 dated 08.06.2020-Central Tax)

2. Tax Period To Transfer ITC For Person Registered In Union Territory

(Notification No. 45/2020-dated 09.06.2020-Central Tax w.e.f 31.05.2020)

– The transition procedure prescribed by CBIC to ascertain tax period, to transfer ITC and taxes for persons whose place of business was in the erstwhile Union Territory of Daman and Diu or in the Union Territory of Dadra and Nagar Haveli till the 26-1-2020 and is in the merged union territory of Daman and Diu and Dadra and Nagar Haveli from 27-2-2020 onwards, has now been extended till July 31, 2020 (instead of 31.05.2020 as per notification – 10/2020).

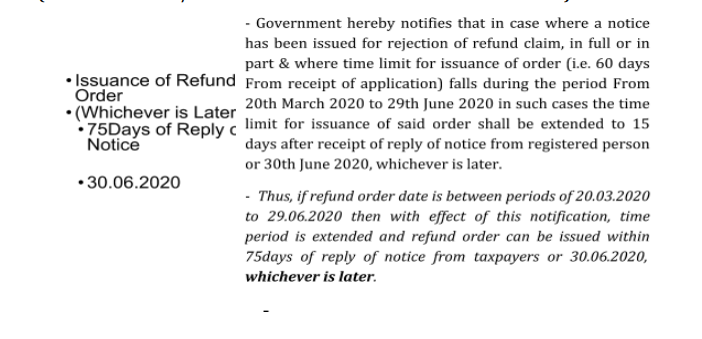

3. Time Period of Issuance of Refund Order

(Notification No. 46/2020 dated 09.06.2020-Central Tax w.e.f 20.03.2020):

4. The validity of E-Way Bill

(Notification No. 47/2020 date 09.06.2020- Central Tax, w.e.f 31.05.2020)

– The validity of an e-way bill generated on or before 24 March 2020 and whose validity has expired on or after 20 March 2020 shall be deemed to have been extended till the 30 June 2020.

5. Clarifications on Refund of ITC Availed Not Reflected In GSTR 2A

(Circular No. 139/09/2020 date 10.06.2020)

– CBIC with this circular clarifies issues pertaining to the refund of ITC availed on the invoices which are not reflecting in GSTR-2A.

– As per circular No. 125/44/2019 date 18.11.2019, the refund of ITC availed on such missing invoices was allowable on the basis of the presentation of copies of the said bills/invoices. But circular No. 135/05/2020 date 31.03.2020 put restrictions on refund of ITC availed.

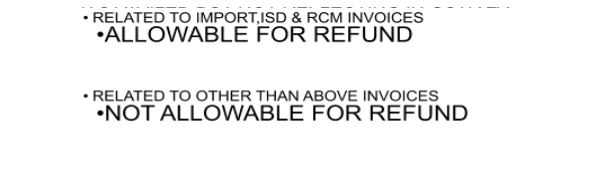

– Now, here is a question of reflection of ITC of RCM bills, ISD bills, and Imports/BOE. What refund sectioning authority doing, they are rejecting the amount of refund saying, it is not reflecting in GSTR 2A and as per circular No. 135/05/2020 date 31.03.2019 such missing invoices not to be considered. (If we think practically, Custom Department is not going to fill GSTR 1 so that ITC amount in BOE/import docs. will reflect in GSTR 2A and all the suppliers of specified goods/services are not registered. Hence it is obvious that such invoices will not be available in GSTR 2A.)

– Therefore, CBIC clarified with this circular that circular no. 135/05/2020 date 31.03.2019 does not impact the refund of ITC availed in respect of the above three cases. The treatment of refunds of ITC availed pertaining to these three invoices will continue to be the same as it was before circular no. 135/05/2020 i.e., as per 125/44/2019.

Related Topic:

Bill of Entry Late Filing Waiver Extended Till 3-6-2020- Tughlakabad ICD

– Further, ITC availed on missing invoices in GSTR -2A other than Imports, RCM, and ISD bills continues to be disallowable for the refund purpose.

There is no doubt that this is a disputable matter as the Input tax credit is vested rights for the taxpayer. They should not be suffered because of the mistakes of suppliers. Further, there is no clarification by CBIC that refunds admissible once such ITC of missing invoices gets reflected in GSTR 2A in next month or future period?

6. Clarification On GST Applicability On Director’s Remuneration

(Circular No. 140/10/2020 date 10.06.2020)

– Advance Rulings of AAR Rajasthan and AAR Karnataka had created confusion on the applicability of GST on the Director’s Remuneration. With this circular, CBIC clarifies and explains when GST under RCM will be applicable.

– CBIC clarifies that if any director is providing services to the company under a contract of services/ employments contract and TDS on salary paid to the director is deducted under section 192 of IT Act, then such transactions/services fall under Schedule III of CGST Act, 2017 i.e. “services by an employee to the employer in the course of or in relation to his employment”. No GST to be payable on such amount.

Let we refer below table for more understanding;

| Sr. No. | Particulars | GST Under RCM – Yes/No | Remarks |

| 1. | Payment to a Whole Time Director who is not an employee of the company i.e., no employment contract exits | Yes | Notification No. 13/2017, Entry No.6 |

| 2. | Payment to a Whole Time Director who is an employee of the company i.e., employment contract exists and TDS deducted u/s 192 of IT Act. | No | Schedule III of CGST Act,2017 |

| 3. | Payment to an Independent Director | Yes | If any person has not been director, proprietor, or partner in the last 3 years, then only he/she is eligible to be an Independent director. Such a director is not engaged in the regular operation of the company.

*Notification No.13/2017 entry no. 06 |

| 4. | Payment for “Professional ” or “Technical” services where TDS deducted u/s 194J | Yes | Notification No.13/2017 entry no. 06 |

– A question may arise that if a person is a director in more than two companies and drawing a salary from both companies, TDS deducted u/s 192 then GST under RCM will attract? The answer is NO. NO GST UNDER RCM IF THERE IS EMPLOYMENT CONTRACT.

7. Glimpses of 40th GST Council Meeting Dated 12.06.2020

(I) Reduction in Late Fee for past Returns: Late fee for filling of pending the GSTR-3B of the tax period of July 2017 to January 2020 has been waived off as below;

| Sr. No. | Any Tax Liability in a Month? | Late Fee per Return | Date of Filing of Returns |

| 1 | No | Nil | 01.07.2020 to 30.09.2020 |

| 2 | Yes | Rs.500 | 01.07.2020 to 30.09.2020 |

(II) Relief in Interest Rate for Small Taxpayers ( Aggr. Turnover up to Rs.5Cr):

– For The Tax Period of February, March, and April 2020: The Interest of late filing of returns for the said tax periods after specified dates (staggered up to 6th July 2020) is reduced @ 8% p.a. till 30.09.2020. No Interest till the notified dates (staggered up to 6th July 2020) which depends on the turnover of previous years.

– For The Tax Period of May, June, and July 2020: Interest rate and Late fee are waived off if filling of returns of these tax periods is furnished by September 2020. (Staggered due date will be notified by CBIC)

(III) One Time Extension for Revocation of Cancellation of Registration:

– To facilitate taxpayers who could not get their cancelled GST registrations restored in time, an opportunity is being provided for filing of the application for revocation of cancellation of registration up to 30.09.2020, in all cases where registrations have been cancelled till 12.06.2020.

(IV) Certain clauses of the Finance Act, 2020 amending CGST Act 2017 and IGST Act, 2017 to be brought into force from 30.06.2020.

Read the copy:

CMA Deepa N. Tanna

CMA Deepa N. Tanna

Assure to Provide Best Services

Kutch, India

CMA Deepa N. Tanna