Legacy Dispute Resolution Scheme

In this e-book on Legacy Dispute Resolution Scheme, CA Pritam Mahure has discussed the various provisions regarding the legacy disputes. So following is the e-book on Legacy Dispute Resolution Scheme:

Table of Contents

1. Legacy Dispute Resolution Scheme

1.1 Why Legacy Dispute Resolution Scheme is needed?

Pending legacy indirect tax litigation is one of the biggest cause of concern not only for Government but also for taxpayers as most of it comprised of frivolous cases. In many cases, the taxpayers felt that the litigation was frivolous and this concern was vindicated by higher Courts as more than 85% of the cases were decided in favor of the taxpayers.

Also, legacy litigation has drawn a lot of attention, as more than INR 3.75 lacs crore in 1.50 lacs indirect tax cases are pending before Commissioner (Appeals), CESTAT, High Court and Apex Court. Even the H’ble FM mentioned in her Budget 2019 Speech as under:

“141. GST has just completed two years. An area that concerns me is that we have huge pending litigations from the pre-GST regime. More than 3.75 lakh crore is blocked in litigations in service tax and excise. There is a need to unload this baggage and allow the business to move on. I, therefore, propose a Legacy Dispute Resolution Scheme that will allow quick closure of these litigations. I would urge the trade and business to avail this opportunity and be free from legacy litigations.”

Further, Notes to Clause of Finance Bill, 2019 (page 107) States that “The Scheme is a one time measure for liquidation of past disputes of Central Excise and Service Tax as well as to ensure disclosure of unpaid taxes by a person eligible to make a declaration. The Scheme shall be enforced by the Central Government from a date to be notified. It provides that eligible persons shall declare the tax dues and pay the same in accordance with the provisions of the Scheme. It further provides for certain immunities including the penalty, interest or any other proceedings under the Central Excise Act, 1944 or Chapter V of the Finance Act, 1944 to those persons who pay the declared tax dues.”

Thus, to address the pending legacy litigation, the Finance Minister has introduced “Legacy Dispute Resolution Scheme” (LDRS) for Excise, Service Tax, and Cess.

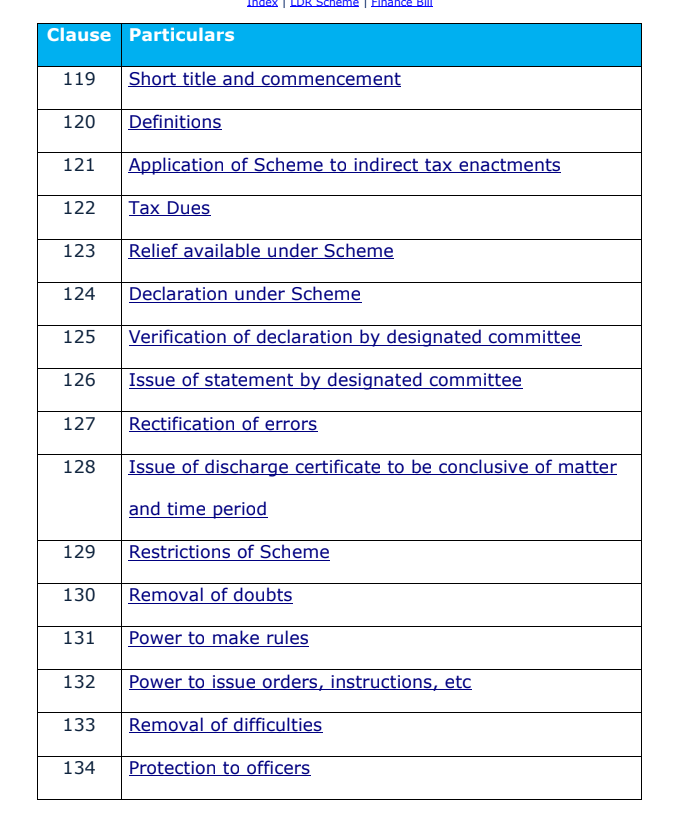

1.2 Which clause of the Finance Bill is relevant for LDRS?

Clauses 119 to 134 of the Bill provide for Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019 as discussed below:

1.3 When will the LDRS come into force?

The provisions of LDRS shall be applicable from a date to be notified later1.

1.4 Which are the enactments covered under LDRS?

LDRS is covered disputes/ liabilities relating to Excise and Service Taxenactments (i.e. Central Excise Act, 1944, Central Excise Tariff Act, 1985 and Finance Act, 1994). Additionally, it covers more than 26 other enactments such as Sugar Cess Act, Tobacco Cess Act, etc.

Thus, effectively disputes/ liabilities under 29 enactments are intended to get covered under the LDRS ambit.

1.5 Who can avail the benefit?

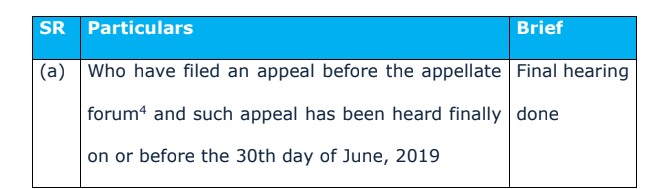

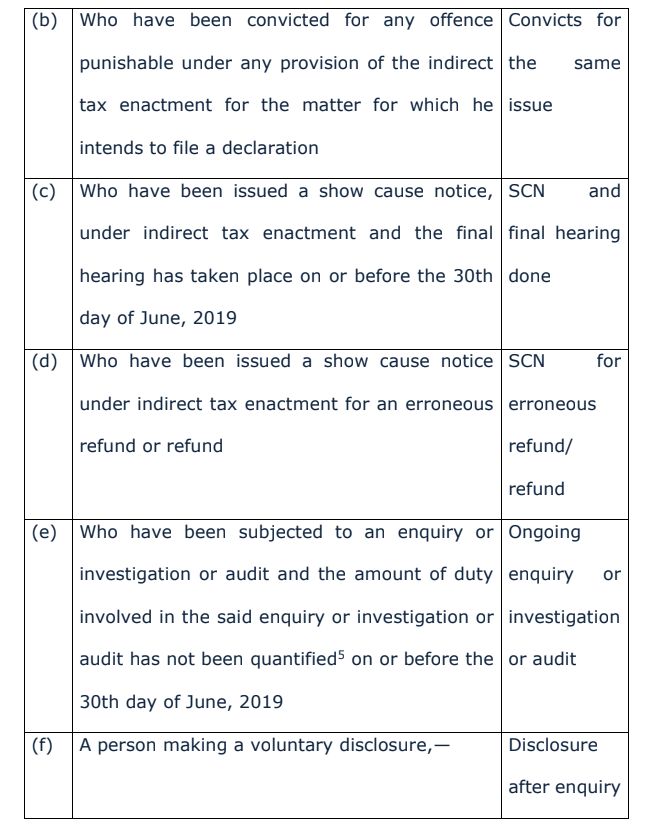

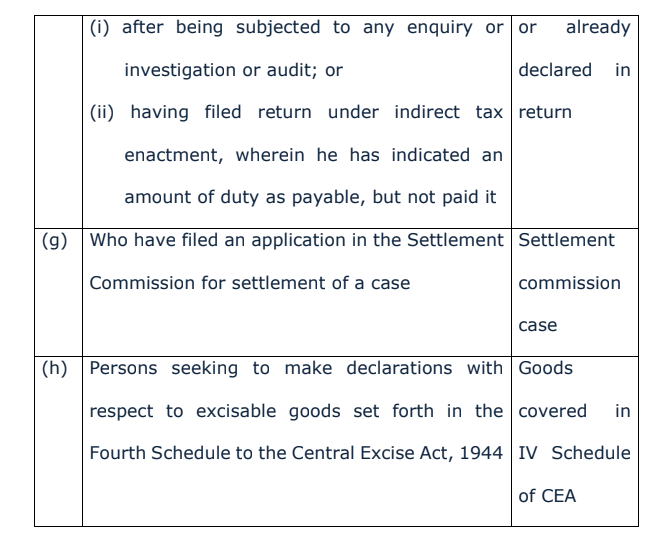

All persons shall be eligible except the following:

or the Customs, Excise and Service Tax Appellate Tribunal or the Commissioner (Appeals)”

5 Clause 120 (r) defines ‘‘quantified”, with its cognate expression, to mean “a written communication of the amount of duty payable under the indirect tax enactment”

1.6 How much benefit is available under LDRS?

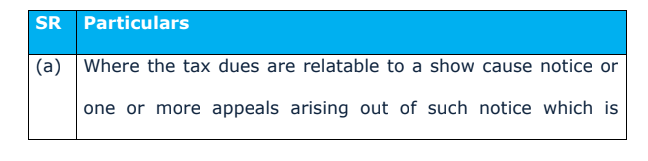

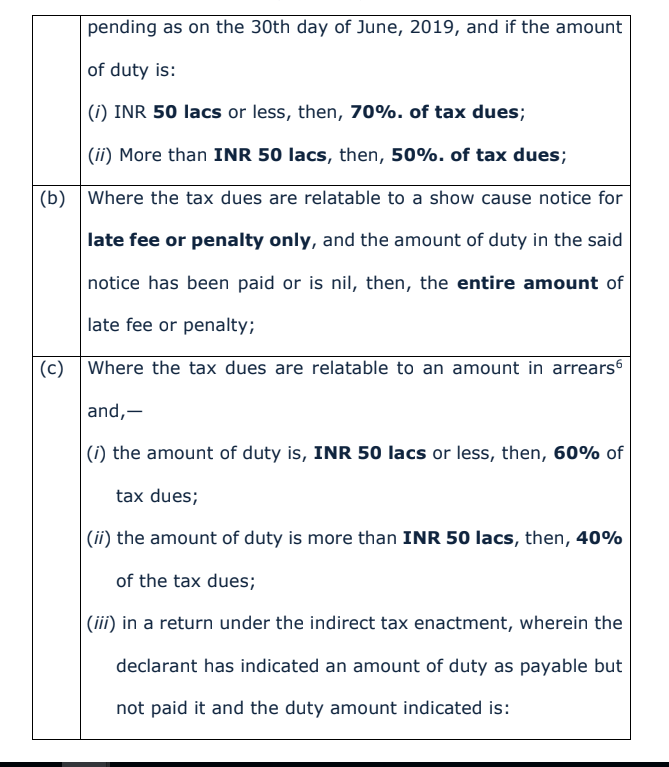

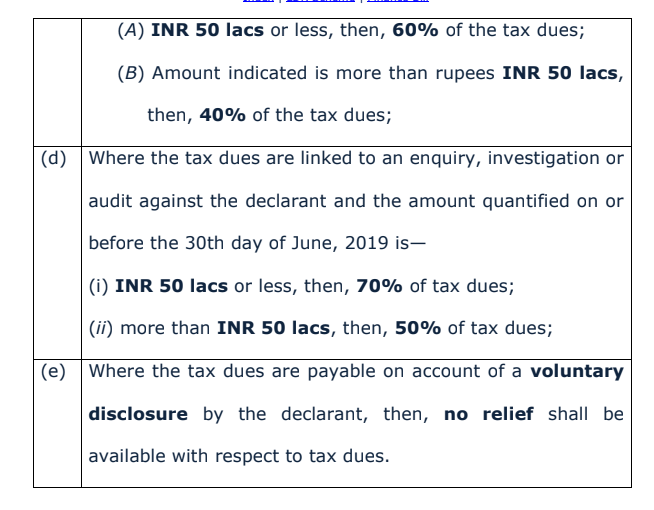

As per Clause 123 of Finance Bill, 2019 the benefit extended is in the range of 40% to 70% of tax dues whereas in case of penalty/ late fees, the entire amount can be waived as discussed below:

It can be observed that in case of voluntary disclosure, no relief shall be available with respect to tax dues, that means, only interest and penalty will be waived off.

It may be noted that the aforesaid relief calculated [under 123 (1) of the Finance Bill, 2019] shall be subject to the condition that any amount paid as pre-deposit at any stage of appellate proceedings under the indirect tax enactment or as a deposit during the inquiry, investigation or audit shall be deducted when issuing the statement\indicating the amount payable7 by the declarant.

It is also provided that if the amount of pre-deposit or deposit already paid by the declarant exceeds the amount payable by the declarant, as indicated in the statement issued by the designated committee, the declarant shall not be entitled to any refund.