Karnataka HC Order in the case of M/s Global International

Case Covered:

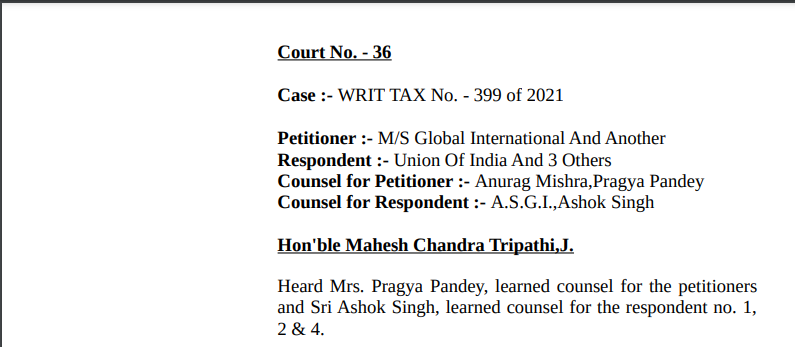

M/s Global International

Versus

Union Of India

Order of the Hon’ble Court:

Heard Mrs. Pragya Pandey, learned counsel for the petitioners, and Sri Ashok Singh learned counsel for the respondent no. 1, 2 & 4.

The present writ petition has been preferred by M/S Global International with a request commanding M/s Container Corporation of India Limited to immediately release the goods without charging any demurrage or rent charges.

Petitioner firm is engaged in the import business and as such is registered with the Import Export Code (IEC) No. 0317512889. The firm is also registered under the GST, Income Tax Department, and MSME. It appears the petitioner filed two self-assessed Bills of Entry dated 26.06.2018 for import of goods which were examined in the import shed on a first check basis. The quality and other import-related specifications were found to be in accordance with the declaration. The custom authorities found that the value of goods as declared by the petitioner is on the lower side and therefore, the value of both the bill of entries should be re-assessed. Rule 5(3) of the E-Waste Management Rule 2006 provides the import of electrical and electronic equipment shall only be allowed to those producers having Extended Producers Responsibility (EPR) Authorization. It appears the show cause notice was issued to the petitioners for redetermination of value and for the imposition of entry under section 112(a) of the Customs Act 1962. The said proceeding culminated to the appellate stage and finally, the Commissioner of Customs (Appeals) vide order dated 23.5.2019 has set aside the order of the Joint Commissioner and accepted the value declared by the petitioner. It was also held that there is no requirement for submission of EPR-Authorisation prior to the filing of the bill of entry. Consequently, the customs authorities issued the Detention Certificate dated 17.09.2019 for both the bill of entries and directed M/s Container Corporation of India Limited/respondent no. 3 not to take any rent for the period of 420 days for a bill of entry no. 6965733 and for 423 days for the bill of entry no. 6965298. The petitioner is aggrieved that despite deposit of duty and detention certificate for waiver of rent/demurrage charges, meanwhile, the respondent no. 3 has proceeded to auction the seized items.

Related Topic:

Karnataka HC in the case of Mr. Virendra Khanna Versus State of Karnataka

The matter requires consideration.

Issue notice to respondent no. 3, returnable with five weeks. Steps may be taken within a week.

All the respondent may file their counter-affidavits within four weeks. Rejoinder affidavit may be filed within one week thereafter. List thereafter.

As an interim measure, the third respondent is restrained to carry out an auction of the seized items meanwhile.

Related Topic:

References for Counter Affidavits to be filed for Writs

Read & Download the Order in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.