Madras HC in the case of Tirunelveli District Central Cooperative Bank Limited

Table of Contents

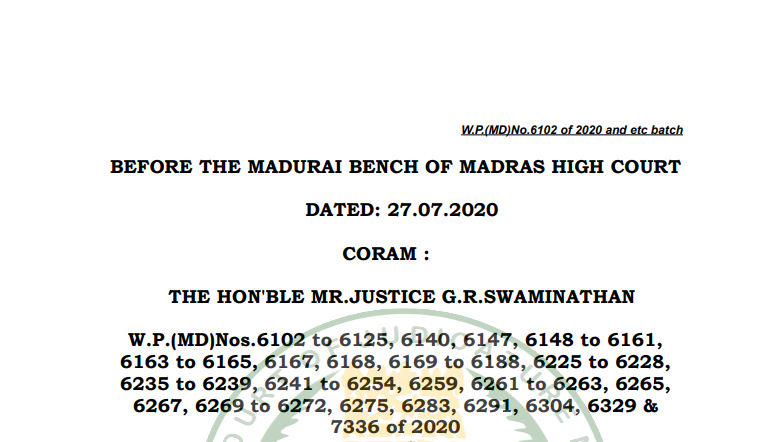

Case Covered:

Tirunelveli District Central Cooperative Bank Limited

Versus

The Joint Commissioner of Income Tax(TDS)

Facts of the Case:

The writ petitioners are Societies registered under the Tamil Nadu Co-operative Societies Act, 1983. They have been licensed by the Reserve Bank of India to carry on the banking business. The main account holders with the writ petitioners are the various Primary Co-operative Societies, who provide loans and advances to the end recipients. In the affidavits filed in support of the Writ Petitions, the nature of activities carried on by the writ petitioners has been spelled out. The writ petitioners grant loans to the member-Societies by crediting the same in the loan accounts standing in their names. The member-Societies in-turn transfers the funds to the farmers through banking channels, if they also having accounts. But financial inclusion is still a far cry. Most of the farmers do not have bank accounts. Therefore, the member-Societies withdraw cash from their accounts for making cash disbursements.

Observations of the Court:

Since the Assessing Officers have not taken into account the entire scheme of the Act and had proceeded at breakneck speed, I am constrained to interfere with the impugned proceedings and they are accordingly quashed. The matters are remitted to the file of the respective jurisdictional Assessing Officers. The Assessing Officers will issue fresh hearing notices to the writ petitioners. The writ petitioners are at liberty to bring on record the returns filed by the member societies who had withdrawn cash beyond the ceiling limit of Rupees One Crore. The Assessing Officers will exclude Pongal cash gift distributed by the petitioner-Banks at the instance of the Government of Tamil Nadu from the entire computation. This is because as already held the member-Societies have merely acted as business correspondents of the writ petitioners herein. As regards the remaining amounts, it is open to the writ petitioners to establish before the Assessing Officers that the sums withdrawn by the member-Societies do not represent income at their hands. As evidence, the annual income tax returns filed by the member-Societies can be produced. If the second respondent is satisfied that the amounts withdrawn by the member-Societies did not in fact represent income at their hands, the jurisdictional Assessing Officers will drop further action. If they are not so satisfied, of course, it is open to the Assessing Officers to pass further orders in accordance with the law.

The Decision of the Court:

With this liberty, the Writ Petitions stand allowed. No costs. Consequently, the connected miscellaneous petitions are closed.

Read & Download the Full Decision in pdf:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.