Major turnaround in amended GSTR 9C

Table of Contents

- Introduction:

- Table 5: Reconciliation statement is optional in amended GSTR 9C

- Table 12

- TABLE 14

- Changes in Part B: No need to upload cash flow if not available

- Changes in part B: True and correct is corrected to “True and Fair”

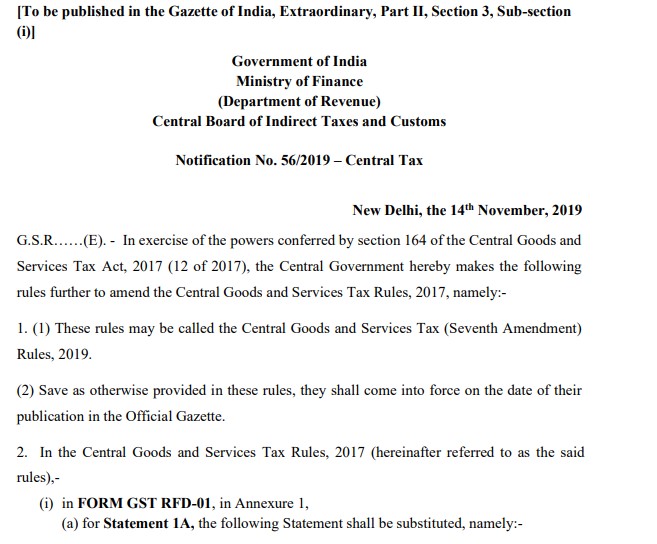

- Download the Notification No. 56/2019 for full reading

- Download the PPT on Changes in GSTR 9C, below:

Introduction:

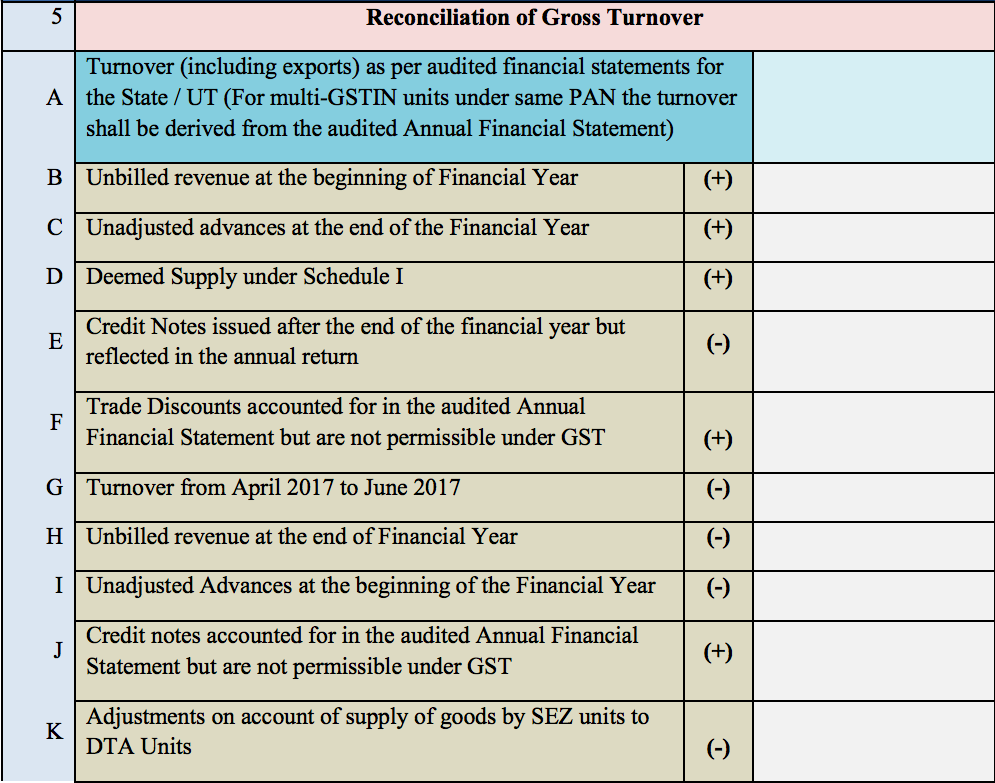

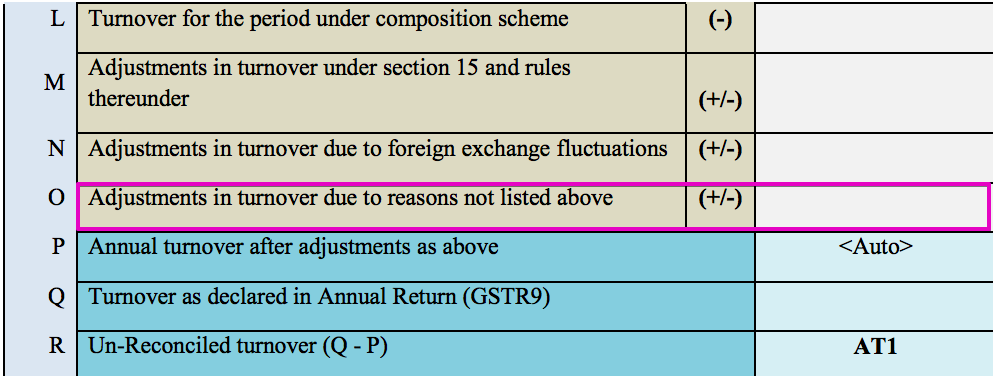

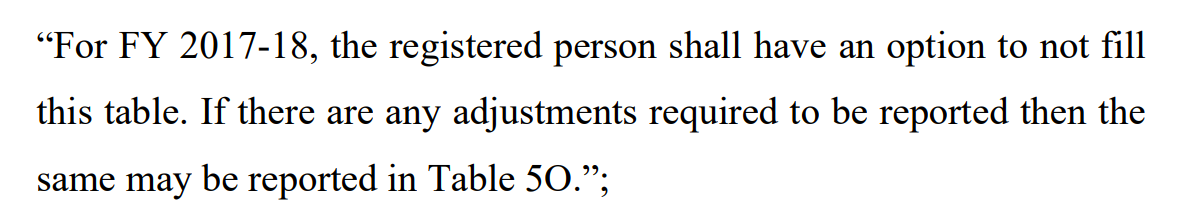

In a major turnaround notification no. 56/2019 has changed a lot of things in amended GSTR 9C. It is going to be a boon for taxpayers. They were finding it hard to fill these details. Now you can fill the figure of variance in 5O. So you can simply put the figure of financials and difference in GST and financials turnover in 5O.

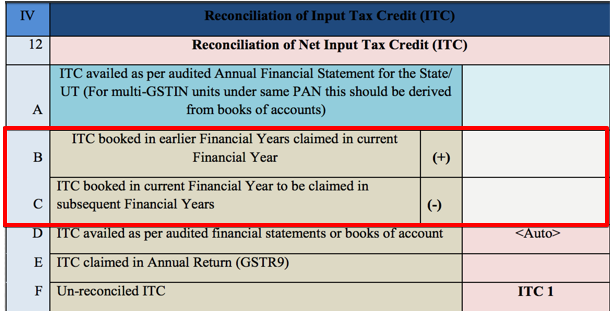

Table no. 12 and 14 are also simplified. You need to mention the total figure. No need to give the break up of data. Thus you can skip it.

Table no. 14 is also made optional. This table was covering the expanse wise details of ITC. It’s compilation was also very hard for the taxpayers.

Table 5: Reconciliation statement is optional in amended GSTR 9C

Now the entire reconciliation is made optional. Still, if you have compiled the data you can provide it to avoid future repercussions. Nonetheless, the department can ask you for this data. Also remember that this is only for initial years, later on, you still need to give this data.

As you can see in above heading you can simply put the gap figure in 5O only.

Table 12

TABLE 14

![PowerPoint Slide Show - [Changes in GSTR 9C] 2019-](https://www.consultease.com/wp-content/uploads/2019/11/PowerPoint-Slide-Show-Changes-in-GSTR-9C-2019-.png)

![PowerPoint Slide Show - [Changes in GSTR 9C] 2019- (2)](https://www.consultease.com/wp-content/uploads/2019/11/PowerPoint-Slide-Show-Changes-in-GSTR-9C-2019-2.png)

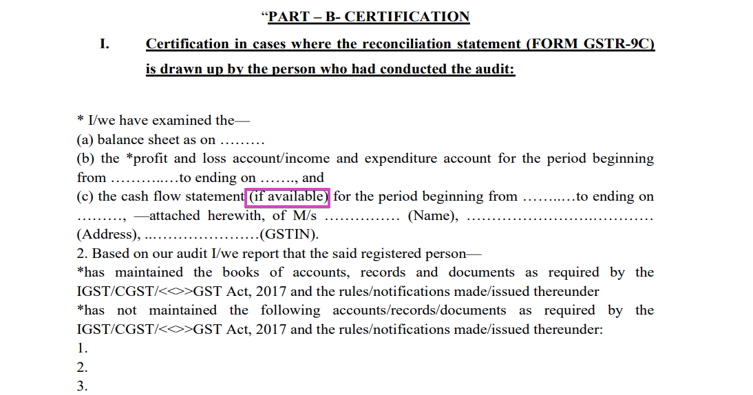

Changes in Part B: No need to upload cash flow if not available

In part B also the cash flow is required to be uploaded only if it is available. In case the cash flow statement is not available it can be skipped.

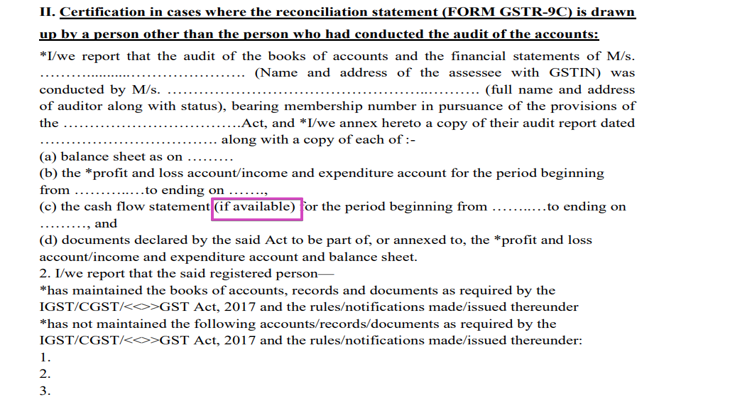

Changes in part B: True and correct is corrected to “True and Fair”

A change in language of 9C part 2 is made. The words true and correct are changed with the words true and fair. It is going to be a major relief. This will curtail the liability of auditors. It was a demand from ICAI as members were not fine with the use of words “true and correct” . Now it is changed. Professionals can file this return with mental peace.

Download the Notification No. 56/2019 for full reading

Download the PPT on Changes in GSTR 9C, below:

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.