How to make amendments in Annex 1 of new return

Table of Contents

Introduction to amendments in Annex 1 :

The best thing with the new return of GST is that it can be amended. You need to learn how to edit it and what data can be edited. Amendments in Annex 1 are possible using 1A. Some of the amendments will be direct in Annex 1. The new return of GST will have the following three parts.

- Annex 1: outward supply register. All the outward supply like local sales, the export will be part of it. Apart from this inward supplies liable for RCM are also included in it.

- Annex 2: Details of bills uploaded by our suppliers will be displayed here. Action can be taken in this annexure. Based on that action our ITC will be calculated.

- RET 01: Data from annex 1 and 2 will be compiled in RET 01.

Amendment in Annex 1:

Some of the data in annex one can be amended. The following tables of Annex 1 can be amended.

3B: B2B supply

3E: Export to SEZ with payment of Tax

3F: Export to SEZ without payment of Tax

3G: Deemed Export

You can enter the debit note and credit notes. Also, an amendment can be made with details of original document. It is important to note that if an invoice is accepted by the recipient. It is required to be unlocked first. It can be amended only if it is either not accepted or unlocked by the recipient.

Amendments in annex 1A

Amendments in Annex 1A of new return can be done in the following fields.

3A: B2B supply

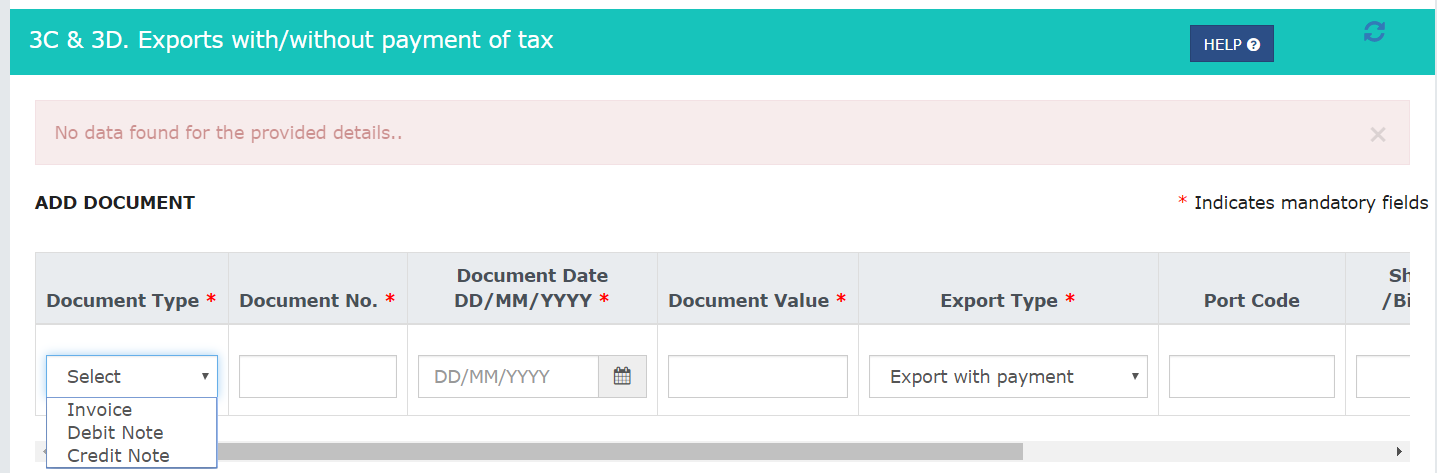

3C: Export with payment of Tax

3D: Export without payment of Tax

3H: Inward supplies attracting reverse charge

3I: Import of services

3J: Import of Goods

3K: Import from SEZ units and developers

These data can be amended using annex 1A. This data doesn’t need a trace to original document. As this data is to unregistered people. The cases need a direct connection to the original document, it will be done via annex 1 only.

Amendment in Annex 2:

Annex 2 cant be amended by the recipient. The supplier will change their invoice in annex 1. In annex 2 those changes can be accepted or rejected.

Thus you can change the new return of GST. But it is limited.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.