Manual Appeal by legal Heir was Dismissed

Manual Appeal by legal Heir was Dismissed

The assessee has deceased on 25.10.2011, so his son (legal heir) has filed the appeal. But the appeal was rejected/dismissed by the Appellate authority(Appeal) in the first hearing to the case. The Appellate authority(Appeal) has guided the legal heir to file the appeal electronically to proceed any further.

The text of the order was as follows:-

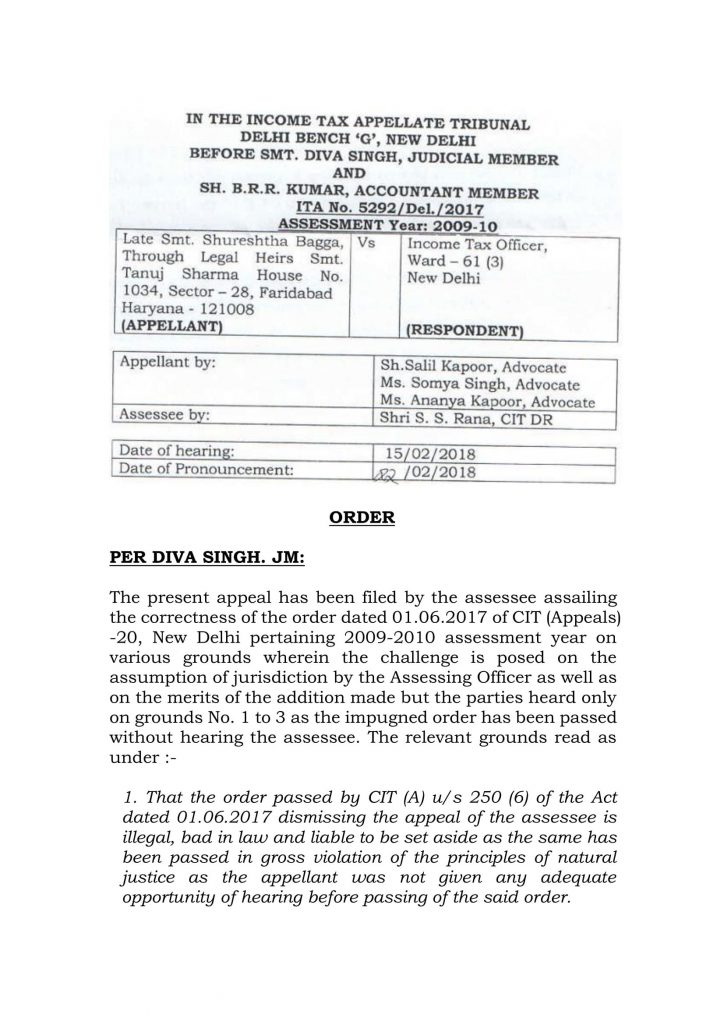

The present appeal has been filed by the assessee assailing the correctness of the order dated 01.06.2017 of CIT (Appeals) -20, New Delhi pertaining 2009-2010 assessment year on various grounds wherein the challenge is posed on the assumption of jurisdiction by the Assessing Officer as well as on the merits of the addition made but the parties heard only on grounds No. 1 to 3 as the impugned order has been passed without hearing the assessee. The relevant grounds read as under:-

1. That the order passed by CIT (A) u/s 250 (6) of the Act dated 01.06.2017 dismissing the appeal of the assessee is illegal, bad in law and liable to be set aside as the same has been passed in gross violation of the principles of natural justice as the appellant was not given any adequate opportunity of hearing before passing of the said order.

2. That the CIT (A) has erred in law by dismissing the appeal of the assessee merely because the was filed manually when the same had been accepted and allotted an appeal number, i.e. Appeal No. 247/2016-17 and therefore the same should have been decide on merits.

3. The CIT (A) has failed to appreciate that the appeal of the assessee, Late Smt. Shurestha Bagga was filed manually legal heir of the assessee could not register herself on Income Tax site.

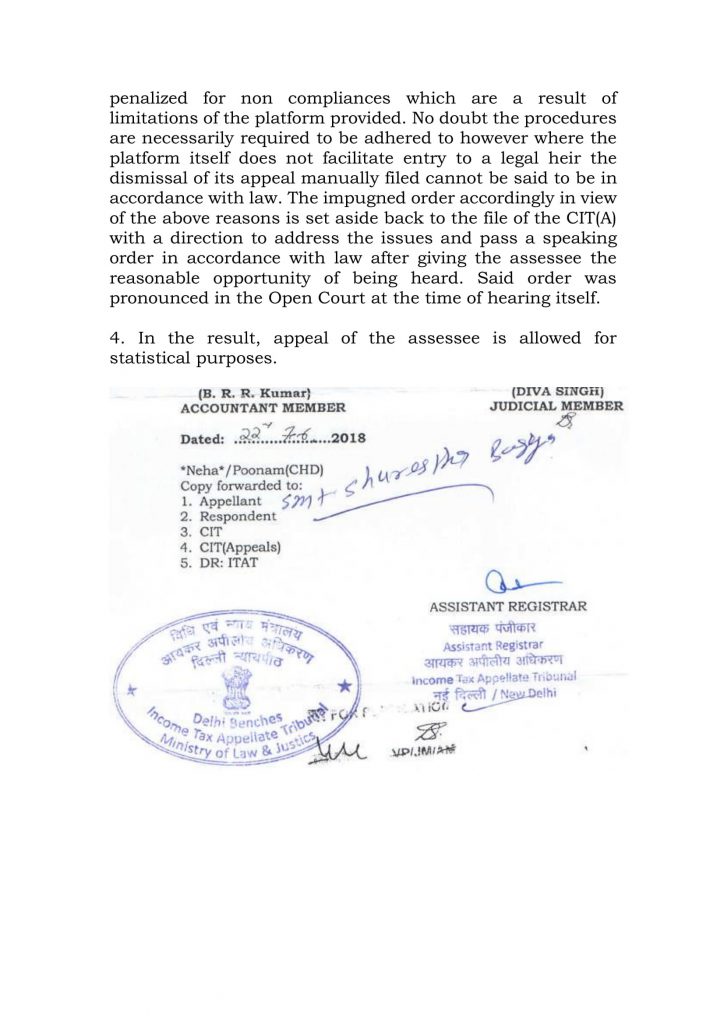

3. Both the parties were heard. The facts on record are that the assessee filed its return on 31.07.2009 which resulted in an order u/s 143 (3) dated 26.12.2011 wherein the returned income was accepted. Subsequently, the order dated 27.12.2016 u/s 147/143 (3) of the Income Tax Act was passed resulting in certain additions on account of rejection of assessees Claim Act u/s 54 F of the Income Tax Act 1961. A perusal of para 3.6 of the assessment order shows that the assessee had expired on 25.10.2011 and the Assessing Officer concluded the proceedings taking the legal heirs of the assessee on record. The legal heir aggrieved by the order filed an appeal before the CIT (Appeals). In the proceedings before the First Appellate Authority, the appeal was dismissed on the ground that the appeal filed manually had to be filed electronically which despite opportunity was held to have not been complied with or explained. The CIT(A) referring to Circular No. 20/26 dated 26.05.2016 dismissed the appeal as no explanation was offered on behalf of the assessee. The Ld. AR has stated that the facts have been incorrectly appreciated by the CIT-(Appeals) as the return was also manually filed thus in terms of the circular there was no requirement in these circumstances for the assessee to e-file the appeal. The Id. CIT-DR though placed reliance on the order was unable to address the same. It is noticed that since full facts are not readily available on record thus at this stage without getting into the debate about the correctness of the claims we deem it appropriate to set aside the impugned order back to the file of the CIT (Appeals). The CIT(A) is directed to first address the claim of the assessee namely that the online platform itself was not permitting the assessee to register as a legal heir in order to e-file the appeal, thus the assessee cannot be penalized for non-compliances which are a result of limitations of the platform provided. No doubt the procedures are necessarily required to be adhered to however where the platform itself does not facilitate entry to a legal heir the dismissal of its appeal manually filed cannot be said to be in accordance with law. The impugned order accordingly in view of the above reasons is set aside back to the file of the CIT(A) with a direction to address the issues and pass a speaking order in accordance with law after giving the assessee the reasonable opportunity of being heard. Said order was pronounced in the Open Court at the time of hearing itself.

4. In the result, the appeal of the assessee is allowed for statistical purposes.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.