Merchant Export vs Deemed Exports in GST

Introduction:

Exports always attract tax incentive since these increase forex reserves. Even under GST the benefits continued. Accountants sometimes get confused or interchangeably use the words Merchant exports and Deemed Exports. This article is an attempt to bring the clarity on both the concepts and avoid wrong reporting of value in the GST Returns.

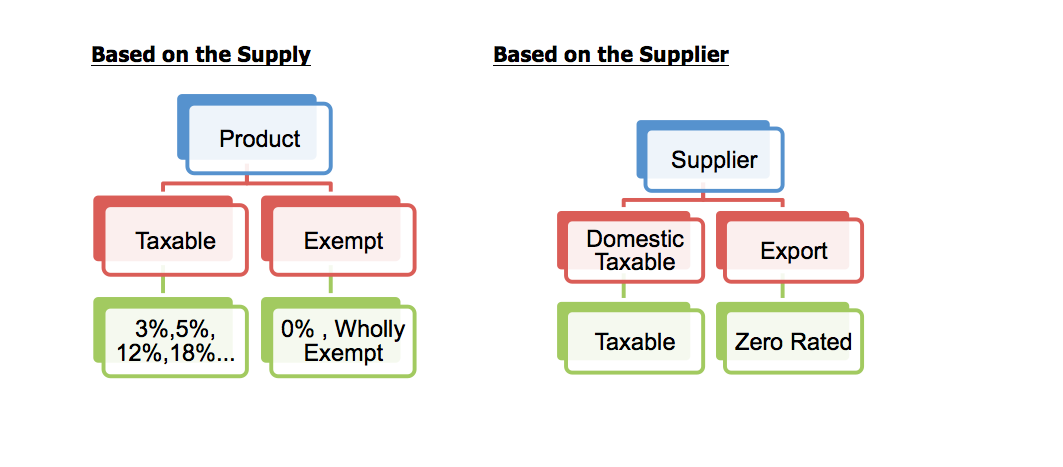

Firstly, one has to understand that the levy on supply and taxation is to be tested either based on the supplier or based on the nature of transaction. Exports levy is based on the supplier. A product which is taxed at 5% in domestic market, when exported would be called as Zero Rated and no tax impact to supplier. This is certainly distinct from a NIL rated. In case of a Nil rated rate of tax is Zero. But for a Zero-rated product, there exists a tax rate and the rate is made to Zero.

Explaining further, teaching services are taxable whereas when these teaching services are provided by education institution there are treated as exempted. In this example the supplier i.e. the educational institution determines the taxability of the transaction.

It is always necessary while determining the taxability or exemption for considering the following two limbs

- Nature of Supply

- Type of Supplier

Merchant Export

Merchant exporter is a person who is engaged in trading activity. The Goods bought for export or intending to export. He is not involved in any manufacturing activity. He intends to aggregate supplies from multiple registered suppliers and then export.

Prior to GST, Merchant exporters were exempted from paying:

- Excise duties by following procedures of Form CT-1 / ARE-1 formalities and

- CST was exempted against H-Form.

On implementation of GST, the facility of procurement of goods without payment of tax by the Merchant exporter for export has been dispensed with. Due to this Merchant exporters had working capital issue since they had to buy the goods with tax.

To ease the cash flow subject to certain condition government brought relief by way of Notification No. 40/2017-Central Tax (Rate) dated 23.10.2017 subject to fulfillment of the certain conditions.

Tax Rate on purchase

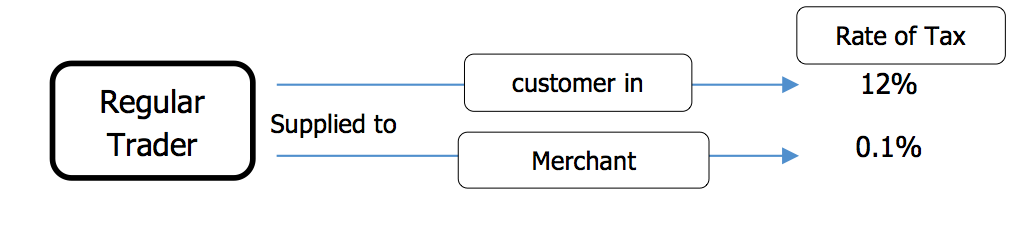

Exempts tax on supply of taxable goods by a registered supplier to a registered recipient for export from so much of the central tax leviable thereon under section 9 of the said Act, as is in excess of the amount calculated at the rate of 0.05 per cent. So, the tax rates would be CGST is 0.05% and SGST is 0.05% for intra-state supply and IGST would be @0.1% in case of inter-state supply

Conditions

- Registered supplier shall supply the goods to the registered recipient on a Tax invoice.

- Goods to be exported within 90 days from the date of issue of tax invoice.

- Merchant exporter shall mention GSTIN and Invoice Number of the supplier in Shipping bill.

- He shall be registered with an Export Promotion Council or a Commodity Board recognised by the Department of Commerce.

- He shall place PO for procuring goods at concessional rate of duty and send copy of same to the jurisdictional tax officer of the registered supplier.

- Goods shall be directly moved to port, ICD, Airport or Land customs station or warehouse of port, ICD or LCS from place of registered supplier

- If he intends to aggregate supplies from multiple registered suppliers, goods shall be aggregated at warehouse and then moved for export

- Tax invoice and Receipt of goods in registered warehouse to be issued

- Shipping Bill with GSTIN of supplier, Tax Invoice along with EGM to be given to supplier and jurisdictional tax officer of such supplier

Example: A product which is ordinarily sold at 12% rate of tax.

Deemed Export

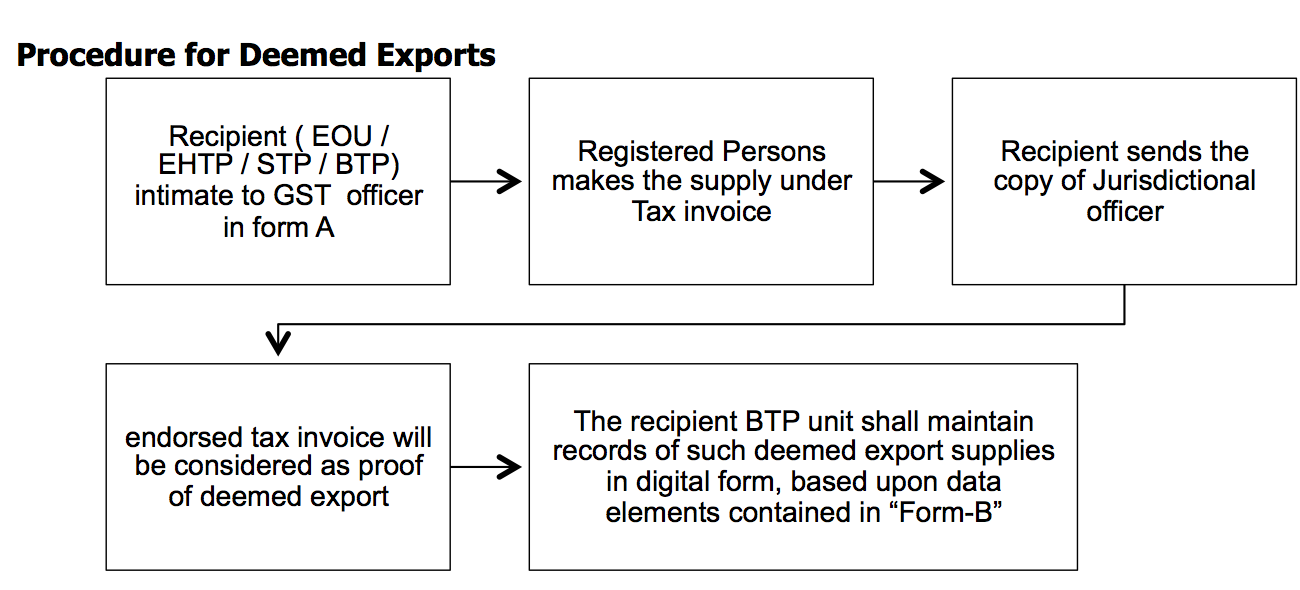

While merchant export facility is on procurement, Deemed Export benefit is on Supply. Export of Goods means taking goods out of India to a place outside India. In the transaction of Deemed exports the goods do not leave India though the goods are finally meant to be exported. The payment for such supplies is received in INR.

Benefit of Deemed exports are like Zero Rated supplies with payment of tax, where the Tax component paid would be refunded by the government. Overall there is no GST impact on this supply. Notification 47 /2017 and 48/2017 of Central Tax dated 18th Oct 2017 describes more on these supplies.

Applicability

Following are the DTA supplies to be categorized as deemed exports:

- Supply of goods by a registered person against Advance Authorisation

- Supplyof capital goods by a registered person against Export Promotion Capital Goods Authorisation

- Supply of goods by a registered person to Export Oriented Unit

- Supply ofgold by a bank or Public Sector Undertaking specified in the notification No. 50/2017-Customs, dated the 30th June, 2017 (as amended) against Advance Authorisation.

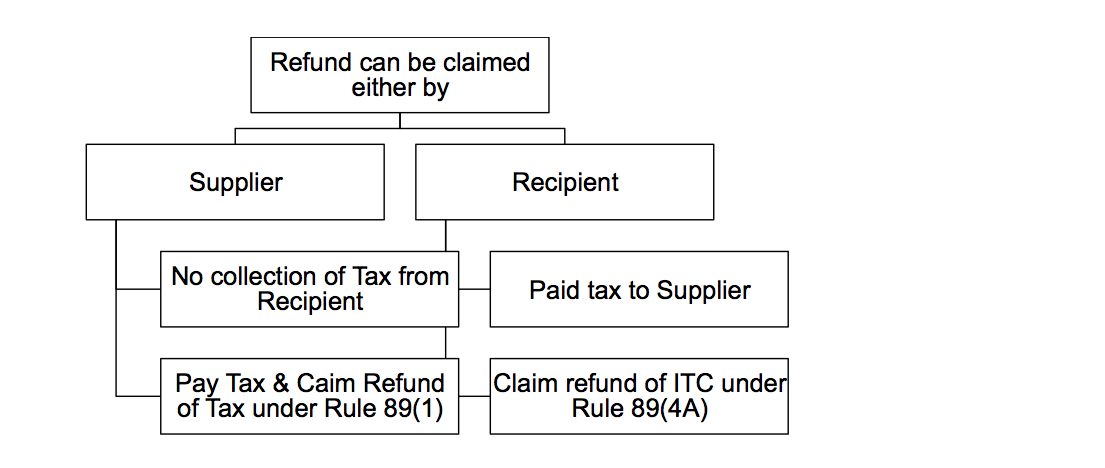

Refund of Taxes paid

Key points of distinction between Merchant Export & Deemed Export

|

Merchant Export |

Deemed Export |

|

· Benefit of lower tax procurement to an exporter |

· Extension of Zero-Rated Supply benefits to a Domestic Trader |

|

· Recipient shall be registered with an Export Promotion Council or a Commodity Board recognised by the Department of Commerce |

· Supply should be against Advance Authorisation or EPCG or to EOU |

|

· Concessional rate of duty (i.e .05%+0.05% or 0.1%) |

· Regular Rate of tax |

|

· Conditions to be satisfied to charge lower rate of tax |

· Conditions to be satisfied for claiming refund |

|

· These transactions can treated as partly exempted supplies and are not to be included as exempt supplies for the purpose of Rule 42. |

· Either the supplier or recipient can claim refund of the taxes paid. |

I hope this article was useful to you. You can post your queries in comment section.

CA Venu Gopal Gella

CA Venu Gopal Gella

Keep learning

Banglore, India

GST