Most Controversial Rulings in Last 33 Months

ADVANCE RULING

CENTRAL GOODS AND SERVICES TAX ACT, 2017

The provisions for Advance Rulings have been provided through Sections 95 to 106 of Chapter 17 of the Central Goods and Services Tax Act, 2017 (‘CGST Act, 2017’). This concept has been borrowed from Service Tax (Sections 96A to 96I), Excise Duty (Sections 23A to 23G), Customs (28E to 28M), and Income Tax Act, 1961 (Section 245N to 245V).

Over 1000 rulings have been pronounced by the Authority for Advance Ruling (‘AAR’) and Appellate Authority for Advance Ruling (‘AAAR’) in the last 33 months of GST.

An advance ruling helps the applicant in tackling matters of questions as envisaged U/s. 97(2) of the CGST Act, which is liable for the payment of GST. Its intention is to help in avoiding long drawn and expensive litigation at a later date. Seeking an advance ruling is inexpensive and the procedure is simple, however, a lot of controversies have brewed in Advance Rulings under GST. In this paper, I discuss the reasons for all the hue and cry in trade regarding these rulings and certain very controversial case laws.

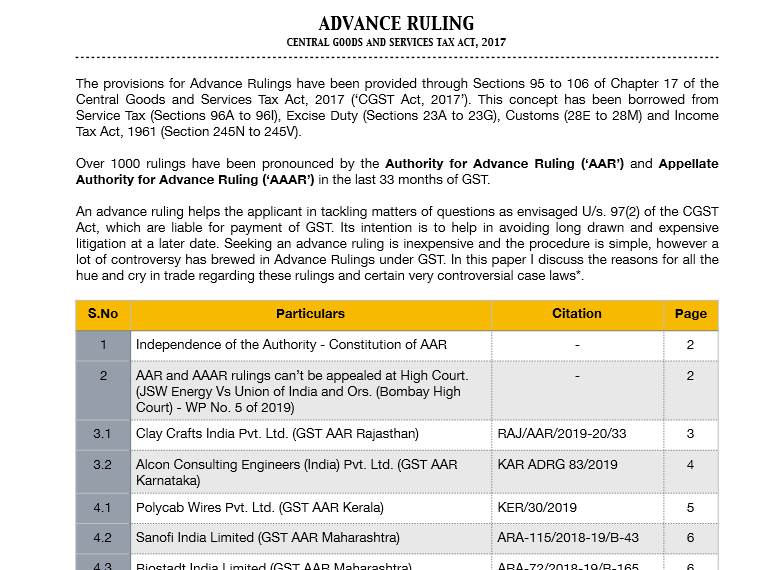

| S. No. | Particulars | Citations | Page |

| 1 | Independence of the Authority – Constitution of AAR | – | 2 |

| 2 | AAR and AAAR rulings can’t be appealed at High Court. (JSW Energy Vs Union of India and Ors. (Bombay High Court) – WP No. 5 of 2019) |

– | 2 |

| 3.1 | Clay Crafts India Pvt. Ltd. (GST AAR Rajasthan) | RAJ/AAR/2019-20/33 | 3 |

| 3.2 | Alcon Consulting Engineers (India) Pvt. Ltd. (GST AAR Karnataka) | KAR ADRG 83/2019 | 4 |

| 4.1 | Polycab Wires Pvt. Ltd. (GST AAR Kerala) | KER/30/2019 | 5 |

| 4.2 | Sanofi India Limited (GST AAR Maharashtra) | ARA-115/2018-19/B-4 3 | 6 |

| 4.3 | Biostadt India Limited (GST AAR Maharashtra) | ARA-72/2018-19/B-16 5 | 6 |

| 4.4 | Chennai Port Trust (GST AAR Tamil Nadu) TN/32/AAR/2019 6 | TN/32/AAR/2019 | 6 |

| 5 | Moksh Agarbatti Co. (GST AAR Gujarat) | GUJ/GAAR/R/2019/14 | 6 |

| 6 | Sonal Products V/s. State of Gujarat (Gujarat High Court) ` | C/SCA/6248/2019 | 7 |

| 7 | J.J Fabrics V/s. Kerala AAR (Kerala High Court) | W.P. (C) NO. 8886 OF 2018 | 7 |

| 8.1 | Siemens Ltd. (GST AAR West Bengal) | 18/WBAAR/2019-20 | 8 |

| 8.2 | Tarun Realtors Pvt. Ltd. (GST AAR Karnataka) | KAR ADRG 103/2019 | 8 |

| 8.3 | Chowgule Industries Pvt. Ltd. (GST AAR Maharashtra) | ARA-18/2019-20/B-12 1 | 8 |

| 8.4 | Chowgule Industries Pvt. Ltd. (GST AAR Goa) | GOA/ 2018-19/4796 | 9 |

| 8.5 | T & D Electricals (GST AAR Karnataka) | KAR ADRG 18/2020 | 9 |

| 9 | Opinion | – | 9 |

Advance Rulings are binding only on the applicant and the department (Section 103 of CGST Act, 2017). They have no impact on anyone else/ any other assessee whatsoever. One can always choose to ignore the unfavorable rulings if they opine that it clouds their judgment and understanding of the law. However, in my humble opinion reading and analyzing such rulings gives us a department’s perspective about whats coming in departmental audits in the near future and helps us in tackling them.

1. INDEPENDENCE OF THE AUTHORITY – CONSTITUTION OF AAR

Constitution of AAR (Income Tax V/s. GST)

| Particulars | CGST Act, 2017 | Income Tax Act, 1961 |

| Provisions for Constitution of the Authority | Rule 103 of CGST Rules, 2017 | Section 245O |

| Composition of the Authority | “The Government shall appoint officers not below the rank of Joint Commissioner as member of the Authority for Advance Ruling” | 1) Chairman – Judge of HC and SC with a minimum of 7 years experience 2) Vice-Chairman – Judge of HC 3) Revenue members from IRS etc. 4) Law members with certain qualifications |

The Composition of AAR is its own departmental officers. The constitution of this forum in GST, which consists only of revenue officers and not having an independent judicial member could be one of the biggest reasons for the outcome of many controversial decisions.

On the other hand the composition of Advanced Rulings under the Income Tax Act, 1961 is a mix of Judges, Law Members, and Revenue Officers who are masters of interpretation of statutes thus eliminating the departmental bias.

A strong impression in Trade and Industry is getting popular as to why one should even approach the Advance Ruling Authority, when they are likely to decide the matter against the assessee and when practically there is no appeal mechanism against the said order (discussed in para 2 of this article). On the other hand, if the assessee opts the route of adjudication, the doors of the tribunals under the GST Act and further the courts would always be open to seeking relief. Given this, it appears that the whole objective of creating this forum to provide speedy resolution of issues, instead of going through the long-drawn litigation route, is getting defeated.

2. AAR AND AAAR RULINGS CAN’T BE APPEALED AT HIGH COURT

If the applicant or the revenue is aggrieved by the orders of the AAR, the remedy is to appeal such order in the AAAR U/s. 103 of the CGST Act. However, if any party to the ruling is not satisfied with the order of AAAR, there is no further recourse available in the CGST Act. Thus as per the CGST Act, 2017 any order passed by the AAAR or AAR (where an order is not appealed at AAAR) is final and binding order.

The moot question is, can we seek further relief in Courts against impugned orders of AAR and AAAR? The Indian Constitution gives powers to the Hon’ble Supreme Court and the Hon’ble High Court, to issue writs for enforcement of any of the fundamental rights conferred by Part III of the Constitution of India under Articles 32 and 226. Article 32 in the Indian Constitution deals with constitutional remedies that an Indian citizen can seek from the Supreme Court and High Court against the violation of his/her fundamental rights. The same article gives the Supreme Court power to issue writs for the enforcement of rights whereas the High Court has the same power under Article 226. Indian Tax laws normally provide for relief in the form of appeals, revisions, etc. In cases where there is no recourse through further appeal, the party aggrieved by the impugned order is left to seek relief through writ petitions

However, the Hon’ble Bombay High Court in the case of JSW Energy Ltd. [2019-VIL-276-BOM] ruled as under:

“Bench makes it clear that it does not propose to examine the impugned orders on their substantive merits or demerits, merely because Statutes in question have not provided for any further appeal against the decision of the Appellate Authority and that any such attempt, would virtually amount to converting these proceedings under Article 226/227 of the Constitution of India,…….”

The case was then remanded back to the AAAR for fresh consideration on merits and in accordance with the law. The Court further noted that any attempt of examining the merits of the case would tantamount to converting proceedings under Article 226 of the Constitution, which are essentially proceedings to seek judicial review, into an appellate proceeding.

Hon’ble High court took cognizance of the following decision:

“In Appropriate Authority and another vs. Smt. Sudha Patil (1999) 235 ITR 118 (SC), the Supreme Court has held that merely because no appeal is provided for, against the order of appropriate authority directing compulsory acquisition by the Government, the supervisory power of the High Court does not get enlarged nor can the High Court exercise an appellate power.”

Based on the above judicial precedents, it can be opined that the order passed by the AAAR cannot be appealed in the High Court. It can only be challenged in case the AAAR goes beyond its jurisdictional limits and breaches principles of natural justice and has made apparent mistakes of law; etc.

Considering the above, taxpayers should cautiously examine the issue before making a decision in respect of filing an application for an advance ruling.

After a lot of hues and cry and appreciate the need of the industry, the Budget 2019, tried to address this issue by introducing the National Appellate Tribunal for Advance Ruling under Section 101A of the CGST Act, 2017. The major problem with AAR and AAAR rulings was the lack of independence and departmental bias, the same has been solved by introducing a judicial member in this authority. However, appeal U/s. 101B can be made only against divergent views of AAR and AAAR in different states only by distinct persons U/s. 25. Thus it’s of not much use to most of the assesses in general.

Therefore even after the constitution of NAAR U/s. 101A, the AAAR is the last appeal forum for registered persons. Thus, only after careful assessment of risks about independence and taking into consideration the decision-making process of the forum, we should approach AAR.

3.1 CLAY CRAFTS INDIA PVT. LTD. (GST AAR RAJASTHAN)

| Particulars | Analysis |

| Question before AAR | “Whether GST is payable under Reverse Charge Mechanism (RCM) on the salary paid to Directors of the Company, who is paid a salary as per contract.” |

| Applicants Submissions | The applicant used the following arguments against the applicability of RCM on remunerations paid to directors: 1) Section 9(3) of CGST Act, 2017 read with Notification 13/2017 – Central Tax (Rate) dated 28.06.2017 2) Section 7 of CGST Act, 2017 read with Clause 1 of Schedule III 3) Sections 2(94) of Companies Act, 2013 4) Sections 269, 2(24), and 2(26) of Companies Act, 1956 were also quoted. 5) Cambridge definition of the word “employee” 6) Articles published in Economic Times newspaper relating to “Cross Charge under GST” 7) Memorandum of Association and Articles of Association of the Company 8) Hon’ble Supreme Court case of Ram Pershad vs Commissioner of Income Tax [1972 1973 AIR 637] 9) Relevant sections of EPF and ESI Act 10)That he already pays GST on RCM on commission income 11)Regional Director vs Sarathi Lines (P) Ltd on 29th January 1997 (1998) ILLJ 28 Ker All the above references were used by the Applicant to prove the Employer-Employee relation between a Director and the Company to subject such remunerations under Clause 1 of Schedule III. |

| Advance Ruling |

“The consideration paid to the Directors by the applicant company will attract GST under reverse charge mechanism as it is covered under entry No. 6 of Notification No. 13 /2017 Central Tax (Rate) dated 28.06.2017 issued under Section 9(3) of the CGST Act, 2017” |

| The basis for Authority’s Ruling |

The Authority based its ruling on the following parameters: 1) Section 2(31) and 2(93) of CGST Act, 2017 |

| Facts not adjudicated by the Authority |

1) On careful reading of Para 5.10 of the ruling stated supra, it is clear that all the case laws were ignored while the judgment was passed by the authority stating it to be irrelevant. In the section “Comments of the Jurisdictional Officer” (Para 4) and “Findings, Analysis and Conclusion” (Para 5) only Sections relevant to CGST Act, 2017 (refer section “authority ruling” above) were stated by the officers. No reference whatsoever was made to various provisions of Companies Act, EPF, ESI, and various landmark judgements passed by the Hon’ble Supreme Court to determine the status of Employer and Employee. 2) No reference was made to Para 2.9.1 and Para 2.9.2 of the Education Guide issued by CBEC during the Service Tax period (“Only services that are provided by the employee to the employer in the course of employment are outside the ambit of services”) |

| Future Litigations |

Such analysis by AAR opens a plethora of possible litigations under RCM (regarding services provided by a Director to the Company): 1) Guarantees given by the Director on Bank Loans of the Company. 2) Renting of Immovable Property to the Company 3) Providing Professional and Technical services to the Company. 4) Charging commission on the Company’s sales. Whether the above-mentioned services are “services provided by directors” or in their individual capacity (as landlord/ Guarantor/ Professional etc.) is to be considered before applying RCM rules. |

3.2 M/S ALCON CONSULTING ENGINEERS (INDIA) PVT. LTD. (GST AAR KARNATAKA)

| Particulars | Analysis |

| Questions before AAR | Among other questions, the following question was raised by the applicant: “Whether RCM is applicable on remuneration paid to directors” |

| Authority Ruling | “The remuneration paid to the Director of the applicant company is liable to tax under reverse charge mechanism under sub-section (3) of section 9 in the hands of the applicant company as it is covered under entry no. 6 of Notification No. 13/2017Central Tax (Rate) dated 28.06.2017.” |

Opinion: The case of M/s. Alcon Consulting Engineers is the same as Clay Craft. In both the rulings, it was adjudicated that remuneration paid to directors is subject to RCM. If this decision is taken into account assuming it was right, all the Companies in India would have to bear a financial burden of GST at 18% on all the remuneration payable for FY 2017-18 and FY 2018-19 for a revenue-neutral item.

But it is safe to say that both the cases have been disposed of by authorities without much deliberation into establishing the employer-employee relationship. Such rulings only raise eyebrows everywhere. This is where we need to introspect whether a ruling which is only applicable to the applicant and the department needs to be shared in public and create unnecessary panic. Also, it is worrying to see the view of the department in this case and one can expect similar adjudication will be done at the time of assessment and audits for all assesses.

Thus, it is imperative that we equip ourselves with all the relevant director employment contracts, relevant documents, and case laws to deal with such notices in the future for our clients.

4.1 POLYCAB WIRES PVT. LTD. (GST AAR KERALA)

| Particulars | Analysis |

| Questions before AAR | “1) Determination of GST Liability with respect to goods provided free of cost by the distributors of M/s. Polycab for reinstating connectivity in flood ridden areas in Kerala and admissibility of ITC on such goods 2) Applicability of section 17(5) on CSR Expenditure” |

| Advance Ruling | “The applicant distributed electrical items like switches, fans, cables, etc. to flood affected people under CSR expenses on a free basis without collecting any money. For these transactions, the input tax credit will not be available as per Sec.17(5)(h) of the KSGST and CGST Act.” |

| The basis for Authority Ruling | As per Sec. 17(5)(h)’, Input Tax Credit shall not be available in respect of goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples |

| Facts not adjudicated by Authority | • Section 135 of Companies Act, 2013 mandates CSR expenditure by certain Companies. •Mumbai Tribunal in the case of Essel Propack Ltd. Vs. Comm. of CGST, Bhiwandi (2018-VIL-621-CESTAT-MUM-ST) held that by doing CSR activities a companies image is improved in the corporate world and thus is a part of business activities”. • Section 16(1) – words used are “be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business“. The term “furtherance of business” is a very wide term and has to be interpreted as such. •Section 17(5)(h) – “disposed of by way of gift or free samples”. •In common parlance disposed means “to get rid off” and gift means “giving something out of love and affection on an occasion”. Consequently, CSR does not involve companies “getting rid off” material or services by “giving it out of love”. They do it to comply with Section 135 of Companies Act, 2013. |

| Future Litigations | 1) CSR Activities done by Companies during these unprecedented times of Coronavirus (providing facilities to stay for migrant workers, supplying ventilators, masks, sanitizers, etc.) will be disallowed if interpretation by the department is done this way and they will have to approach courts for natural justice 2) The word “gift” used in Section 17(5)(h) is not defined in the GST Act, surely leading to a lot of controversy and litigation In the future. 3) Interpretation of the words “furtherance of business” has a huge impact on the whole functioning of GST. |

4.2 SANOFI INDIA LIMITED (GST AAR MAHARASHTRA

| Particulars | Analysis |

| Question before Authority | “Question: -1. Whether input tax credit is available on the GST paid on expenses incurred towards promotional schemes of Shubh Labh Loyalty Program?” |

| Ruling | Answer: – Answered in the negative. |

| Question before Authority | “Question: – 2. Whether input tax credit is available of the GST paid on expenses incurred towards promotional schemes goods given as brand reminders?” |

| Ruling | Answer: – Answered in the negative |

4.3 BIOSTADT INDIA LIMITED (GST AAR MAHARASHTRA)

|

Particulars |

Analysis |

|

Question before Authority |

“The question or issue before Your Honor for determination is whether Input Tax Credit (“ITC”) can be claimed by the applicant on procurement of Gold coins which are to be distributed to the customers at the end of the scheme period for achieving the stipulated lifting or payment criteria?” |

|

Ruling by Authority |

“In view of the discussions made above the applicant cannot claim ITC on procurement of Gold coins which are to be distributed to the customers” |

4.4. CHENNAI PORT TRUSTS (GST AAR TAMILNADU)

The Hon’ble Authority held that no Input Tax Credit on inward supply of medical, diagnostic equipment, apparatus, instruments consumables disposable spares and repair services through the provision of free medical care mandatory as is as per the regulations made under Major Port trust act 1963

Opinion: In all the cases of Paras 4.1, 4.2, 4.3 and 4.4, it is very clear that the form of AAR may not have considered and critically analyzed the definitions of the words “gift”, “disposed” and “furtherance of business”. If similar cases were adjudicated by the courts, there would have been a deeper interpretation of the words using various landmark cases of erstwhile laws read with the intent of GST (seem-less credit) and the judgement could’ve been very different. The forum has passed a pro revenue judgement citing the provisions of the CGST Act, 2017.

We also need to take the assessee friendly decision about the vires of Section 17(5) of CGST Act, 2017 by the Hon’ble Orissa High Court in the case of M/.s Safari Retreats Private Limited (W.P. (C) No. 20463 of 2018 decided on April 17, 2019) while dealing with such litigations in future. Although the department has challenged this decision in the Supreme Court and the outcome of which is one of the most awaited decisions in GST.

5. MOKSH AGARBATTI CO. (GST AAR GUJARAT)

|

Particulars |

Analysis |

|

Questions before Advance Ruling |

“1) The taxpayer offers one unit of Dhoop with a pack of Agarbatti (consisting of 10 pieces of Agarbatti). Can the taxpayer claim credit for taxes paid on inputs? 2) As part of the Sales Promotion campaign, the taxpayer offers its distributors target based monetary and non-monetary incentives. Can they avail credit on the non-monetary incentives like say Pressure Cooker on purchase of 100,000 Agarbatti Packets? Can this qualify as a supply of goods to the distributor? 3) The taxpayer offers one unit of Agarbatti free on purchase of 1 Carton Box full of Agarbatti. Can credit of the Agarbatti given free of cost be availed as credit by the taxpayer?” |

|

Advance Ruling |

All the above questions have been answered in negative by the authority, thus pronouncing a pro revenue decision |

|

Facts not adjudicated |

Sections 16(1), 17(5)(h) of CGST Act, 2017, and definition of “disposal” and “gift”, interpretation of the word “furtherance of business”. (as discussed in 4.1, 4.2, 4.3, 4.4 above) |

|

Impugned Circular |

Similar Points as adjudged by the forum were clarified by Circular No. 105/24/2019 dated 28.06.2019 issued by CBIC. However vide Circular No. 112/31/2019–GST dated 3rd October 2019, Circular 105/24/2019 was withdrawn |

|

Implication on Trade |

The taxability of post-sales discounts is one of the hottest topics in GST. It can be decided if such discounts have any impact on GST only by analyzing Section 7,9, 15(3)(b), 17(5)(h), etc. of the CGST Act, 2017. |

|

Opinion |

It is important that every incentive/ discount and post-sales adjustments are analyzed using relevant contracts with suppliers. Proper documentation in this respect has to be maintained to comply with the above-mentioned sections so the same can be used at the time of departmental audits and adjudication. It is very clear from this advance ruling and the circular, how the department plans to move ahead in this regards. |

6. SONAL PRODUCTS V/S. STATE OF GUJARAT

Section 98(6) of the CGST Act, 2017 reads “The Authority shall pronounce its advance ruling in writing within ninety days from the date of receipt of application “

Thus the authority SHALL pronounce its judgement within 90 days of application. Practically most of the cases are not adjudicated within 90 days. This defeats the very purpose of the ruling. Assessee’s go-to advance ruling so that they can avoid delay of adjudication U/s. 73/ 74 of CGST Act, 2017 and save interest and penalty cost for 3-5 years. All one can say here is “Justice delayed is justice denied”.

In one such case, the applicant (M/s. Sonal Products) approached the high court citing the delay U/s. 98(6) of the CGST Act, 2017

Notice was issued as under:

“2. It is pointed out that subsection (6) of section 98 of the Central Goods and Service Tax Act, 2017 provides that the authority shall pronounce its advance ruling in writing within 90 C/SCA/6248/2019 ORDER days from the date of receipt of application. It was submitted that, in this case, the application was made on 07.10.2017 whereas, the impugned order has been passed on 22.02.2019. It was further submitted that the matter was heard by a single Member whereas, the impugned order has been signed by two Members. It was submitted that in the interregnum, between the date of application and between the date of advance ruling by the authority, various other authorities have decided the issue in favour of the applicant therein by holding that the goods would be classified as ‘papad’ in classification no.1905 90 40.”

The matter is pending in the Hon’ble High court of Gujarat for hearing. However, the notice clearly highlights the important problems with regard to the applications of Advance Ruling under GST.

7. JJ FABRICS V/S. KERALA AUTHORITY FOR ADVANCE RULING

Assessee filed an appeal in the High Court of Kerala that among the questions asked U/s. 97 of the CGST Act, 2017 at an advance ruling, Question No. 1 was not answered by the authority.

The Hon’ble High Court ruled in the favour of the assessee and directed AAR to take a decision after giving an opportunity of hearing to the petitioner within 2 months from the date of receipt of a copy of the judgement.

This judgement needs to be analyzed along with the order of Hon’ble Bombay High Court in the case of JSW Energy before approaching AAR (as discussed in para 2).

|

Para |

Ruling |

The question raised before AAR |

Advance Ruling |

|

8.1 |

Siemens Ltd Order No 18/ WBAAR/ 2019-20 |

“Whether mobilization advance received before GST for works contract is supplied on the date on which it stands credited on the supplier’s account?” |

“The Applicant is, therefore, deemed to have supplied works contract service to the extent covered by the lump-sum that stood credited to its account on that date as mobilization advance. As the supply to the extent of the above amount is deemed to have been made on 01/07/2017 and tax is leviable thereon accordingly, the value of the supply of works contract service in the subsequent invoices as and when raised should, therefore, be reduced to the extent of the advance adjusted in such invoices.” Controversy: Can it be said that taxability of mobilization advances received before 2017, arises on July 1, 2017 (appointed date under GST) unless the same is appropriated towards supply of services and thus, not constituting consideration under GST? In the above case, taxability of mobilization advance, ideally, must arise at the time of appropriation of such amount against the estimated expenditure and not on July 1, 2017, considering the time of supply provisions under GST. |

|

8.2 |

M/S. Tarun Realtors Pvt Ltd KAR ADRG 103/2019 |

“Whether taxes paid for installation of transformers, sewage treatment plants, Electrical Wiring and Fixtures, Surveillance systems, D.G. Sets, Lifts, Air Handling Units, etc. etc qualify as ‘Plant’ or ‘Machinery’ under the CGST Act, 2017 and accordingly taxes paid should not be regarded as blocked credits in terms of Section 17(5)(d) of the CGST Act, 2017?” |

“The provision of facilities like transformers, sewage treatment plants, Electrical Wiring and Fixtures, Surveillance systems, etc. are sine-qua-non for a commercial mall and hence cannot be considered separate from the building or civil structure. The provisions of these are either statutory for a building or defines the nature of the building as a commercial mall. Hence the input tax credit on the inward supplies of goods or services involved in the construction of immovable property which is a civil structure or building is not available to the applicant and hence blocked.” Controversy: It may be noted here that the Hon’ble High Court of Orissa in the case of M/s Safari Retreats Pvt. Ltd. [W.P. (C) No. 20463 of 2018 decided on April 17, 2019] has read down Section 17(5)(d) of the CGST Act. Moreover, it needs to be seen, whether the Hon’ble Supreme Court would agree with the above view or not. Also, does transformers, surveillance systems, D.G Sets, Lifts, and Air handling units form part of the building as adjudicated by the authority? AAR rules “when incorporated in the construction (Plant/ Machinery) becomes part and parcel of the building and civil structure and no longer has a separate existence.” |

|

8.3 |

Chowgule Industries Pvt. Ltd. (AAR Maharashtra )GST-ARA18/2019-20/ B-121 |

Whether the applicant is entitled to avail Input tax credit charged on inward supply of Motor Vehicle which are used for Demonstration purpose in the course of business of supply of Motor Vehicle as an input tax credit on capital goods and whether the same can be utilized for payment of output tax payable under this Act? |

“The Demo Vehicles are sold after two years also and thereafter, the said vehicles are sold after paying the applicable taxes on sale value at that point of time. Since the applicant will be making further supplies of the Demo vehicles, and there is no time limit prescribed in the GST Act for making such further supplies, we are of the opinion that they will be eligible to avail ITC in the subject case.” |

|

8.4 |

Chowgule Industries Private Limited (GST AAR Goa)GOA/ GAAR/07 of 2018-19/479 6 |

Whether the applicant is entitled to avail Input tax credit charged on inward supply of Motor Vehicle which are used for Demonstration purpose in the course of business of supply of Motor Vehicle as an input tax credit on capital goods and whether the same can be utilized for payment of output tax payable under this Act? |

“In the instant case, the applicant purchases demo vehicles against tax invoices from the supplier after paying taxes. The demo vehicle is an indispensable tool for promotion of sale by providing trail run to the customer. The applicant capitalizes the purchase of such vehicles in the books of accounts. The capital goods which are used in the course or furtherance of business is entitled for Input Tax Credit.” Controversy: Same situation, contradictory rulings. Maharashtra AAR bases its decision on the premise that the demo vehicle will be sold, however, Goa AAR bases it on “furtherance of business”(similar stance can be taken in paras 4.1 to 4.4) |

|

8.5 |

T & D Electricals (AAR Karnataka) ( KAR ADRG 18/2020) |

“Whether separate registration is required in Karnataka state? If yes, whether the agreement would suffice as address proof since nothing else is with the assessee and service recipient will not provide any other proof?”* *among many other questions |

“In the instant case, the applicant intends to supply goods or services or both from their principal place of business, which is located in Rajasthan. The applicant has only one principal place of business, for which registration has been obtained and does not have any other fixed establishment other than the principal place of business, as admitted by the applicant. Therefore the location of the supplier is nothing but the principal place of business which is in Rajasthan. Thus there is no requirement for separate registration in Karnataka for the execution of the contract referred supra.” Controversy: This is an AAR that (if we’re correct in law) changes the complete understanding of the law and thus a must-read for a wider interpretation of the law. It gives a different perspective to various sections in registration, input credit, and place of supply provisions. This is a pro assessee judgement however more questions arise out of this judgment than answers: 1) What will be the impact of credit of IGST paid by Karnataka in Rajasthan? 2) What happens to the blockage of CGST and SGST Credit of Karnataka in Rajasthan? (Also refer AAR case of IMF Cognitive) 3) Does such a transaction fall under “Bill to Ship to Model”? 4) AAR cant take decisions on Place of Supply as per law. However, in this case, the authority ruled the taxes to be levied on various types of supplies! 5) What happens to the concept of Destination based tax? As Karnataka (the state where all the activities take place) stands to lose revenue in this transaction? |

Opinion:

Apart from the rulings written about, there are many other rulings passed by AAR and AAAR which are very controversial and debatable and mostly pro revenue. The independence and departmental bias in these rulings have been questioned as well. Delay in getting these rulings is also a matter of concern. Add to that, the High court won’t admit appeal against such an AAAR case. In such cases one needs to be very sure before approaching an advance ruling as the decision of the ruling would be binding on the assessee and the revenue and there is no recourse from there.

We should also consider some brilliant decisions passed by AAR and AAAR which have helped assesses ease compliance under GST. Thus we should weigh in all the positives and the negatives before we approach the AAR with a question.

Download the copy: