M/s. Rishi Graphics Pvt. Ltd. by the Hon’ble Calcutta high court.

Table of Contents

Citations:

- Siddharth Enterprises vs. Nodal Officer

- Schwing Stetter India Private Limited vs. Commissioner of GST and Central Excise, Chennai & Others

- Kusum Enterprises Pvt. Ltd. & Anr. vs. Union of India & Others

- Blue Bird Pure Pvt. Ltd. vs. Union of India & Others

- Adfert Technologies Pvt. Ltd. vs. Union of India

- M/s. Samrajyaa and Company vs. Deputy Commissioner of GST & Central Excise

Case Covered:

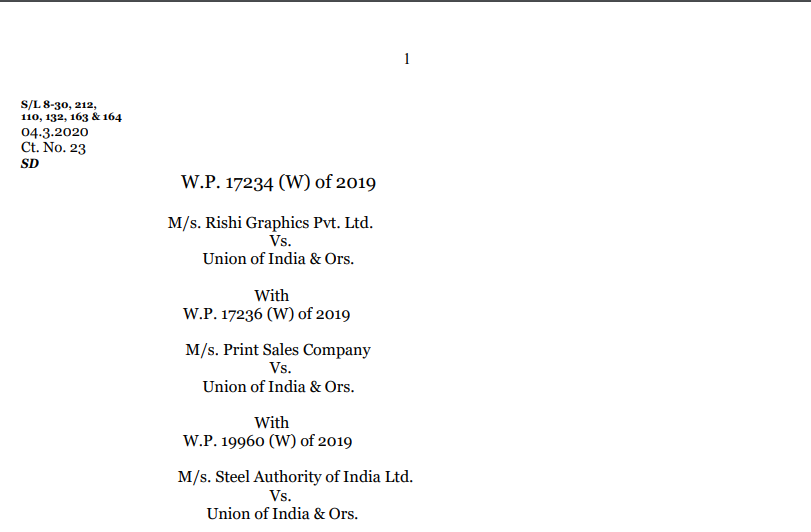

M/s. Rishi Graphics Pvt. Ltd.

Vs.

Union of India & Ors.

Facts of the case:

- In these writ petitions, the issue involved is similar in nature and accordingly, the same is being taken up together.

2. The petitioners have approached this court with a prayer for allowing them to file/upload in GST TRAN-1. The petitioners intend to file TRAN-1 Form and/or revised TRAN-1 Form.

3. Though the time-limit for uploading of TRAN-1 is extended till March 31, 2020, sub-rule 1A of Rule 117 extends this benefit only to those registered persons who could not upload the form in time on account of technical difficulties on the common portal and in respect of whom, the GST Council forwards a recommendation for an extension. In the present case, the request of the petitioners has not been accepted by the respondent authorities and, therefore, the benefit of the extension till March 31, 2020, is not available to these petitioners.

4. According to me, the request of the petitioners before the authorities along with the averments made in the writ petitions to the effect that they faced technical glitches are sufficient. I am of the view that assessees transitioning into a new procedure set out under the GST regime are bound to face complications and in some cases may be completely unable to carry out the new procedure.

5. The issue involved in these writ petitions has been considered by the Gujarat High Court in Siddharth Enterprises vs. Nodal Officer reported in 2019 (29) G.S.T.L. 664 (Guj.) wherein the question was whether the claim for the transition of credit is only a procedural requirement or a mandatory one.

Observations of the court:

6. After an exhaustive discussion of the matter, the Gujarat High Court held as follows:-

“42. Article 300A provides that no person shall be deprived of property saved by the authority of law. While the right to the property is no longer a fundamental right but it is still a constitutional right. Cenvat credit earned under the erstwhile Central Excise Law is the property of the writ-applicants and it cannot be appropriated for merely failing to file a declaration in the absence of Law in this respect. It could have been appropriated by the government by providing for the same in the CGST Act but it cannot be taken away by virtue of merely framing Rules in this regard.”

7. The Gujarat High Court directed the petitioner to file a declaration in Form TRAN1 so that they could file the transitional credit of eligible duties as prayed for. The same view has been taken by the Madras High Court, Delhi High Court and High Court of Punjab & Haryana at Chandigarh in the cases of Schwing Stetter India Private Limited vs. Commissioner of GST and Central Excise, Chennai & Others reported in (2019) 68 GSTR 46 (Mad), Kusum Enterprises Pvt. Ltd. & Anr. vs. Union of India & Others reported in (2019) 68 GSTR 338 (Delhi), Blue Bird Pure Pvt. Ltd. vs. Union of India & Others reported in (2019) 68 GSTR 340 (Delhi) and Adfert Technologies Pvt. Ltd. vs. Union of India reported in 2020 (32) G.S.T.L. 726 (P&H) respectively.

8. It has also been brought to my notice that the judgment in the case of Adfert Technologies Pvt. Ltd. (supra) was taken up in appeal before the Supreme Court by way of a Special Leave Petition wherein the Supreme Court has been pleased to dismiss the Special Leave Petition.

9. Mr. Abhratosh Majumdar, learned Additional Government Pleader appearing on behalf of the State, submits that in certain cases relating to the same issue, the Supreme Court has issued a notice in the Special Leave Petitions. 10. One may further refer to a very recent unreported judgment passed by the Madras High Court by Anita Sumanth, J. dated January 21, 2020, in M/s. Samrajyaa and Company vs. Deputy Commissioner of GST & Central Excise (in WP No.35714 of 2019) wherein the Hon’ble Judge has considered the entire matter and thereafter come to the following conclusion:-

“5. All in all, what appears clear to me is this: (i) the era of GST is in a nascent stage and both the Department as well as assessees are still learning the ropes (ii) a rigid view should thus not be taken in matters involving procedural requirements such as availing of credit; (iii) it is common knowledge that assessees pan India are facing difficulties in accessing the system and uploading Forms to seek transition of credit, and (iv) three Division Benches have taken the view that the timelines set out for transition of credit cannot be very firmly enforced in so far as they are not mandatory.

6. Taking into account the aforesaid, I am of the view that the petitioner in this case, without it being a precedent in other cases, should be permitted to upload Tran-1 declaration and avail of the transition of credit.

7. This is also for the reason that the availment of credit by an assessee in distinct from the utilization of the same, the latter being a matter of assessment.

8. This writ petition is disposed of directing the respondent to permit the petitioner to access the portal for uploading of Tran-I, forthwith. No costs. Consequently, the connected miscellaneous petition is closed.”

Judgement of the court:

11. I find no reason to take a different view from that of the judgments cited above. In my view, a procedural law should not take away the vested rights of persons that are provided to them by statute.

12. Needless to mention, this vested right is subject to scrutiny by the Department. Therefore, the petitioners should be allowed to upload the TRAN-1/revised TRAN-1 so that their claim of transfer of available credit may be considered by the authorities in accordance with the law.

13. In view of the above reasons discussed hereinabove, I direct the GSTN authorities (Authority that manages the portal) to open the portal for the petitioners till March 31, 2020. This order shall not create any equity in favor of any of the petitioners in so far as their claim is concerned and the same shall be subject to scrutiny by the concerned authority.

14. With the above observations, all the writ petitions are disposed of.

15. There will be no order as to costs.

16. Urgent photostat certified copy of this order, if applied for, be given to the parties upon compliance of all necessary formalities.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.