New Composition levy of GST

New Composition levy of GST:

New composition levy of GST is introduced by CBIC via notification No. 2/2019 CTR dated 7th March 2019. This Composition levy is for goods and service providers. Its important to remember that normal composition levy is not for service providers. This one is introduced to cover the service providers also.

- Eligibility for new composition levy:

- Conditions to be fulfilled to avail new composition levy:

- Invoicing under new composition levy:

- Tax rates for new composition levy

This levy is for both service providers and supplier of goods. But where the supply of goods is more the taxpayer will opt for normal composition.

Eligibility for new composition levy of GST:

New composition levy will be applicable from 1st April 2019.

- It is available to all persons having turnover upto Rs. 50 Lac in preceding FY.

- It will be available upto a turnover of Rs. 50lac. Once the turnover will cross Rs. 50 lac the dealer will have to shift to normal levy.

- It is available to the dealers not eligible for composition levy of section 10. It is also important to mention here that section 10 of CGST Act is amended from 1st February 2019. Now a person in normal composition is also eligible to make supply of services upto 10% of turnover in a state and Rs. 5lac, whichever is higher. When the person is eligible for section 10 composition , he will not be eligible for this composition.

- It is also not available for person making an inter state supply.

- A person making any supply not leviable to tax is not eligible for this Composition.

- A casual taxable person and a non resident taxable person is not eligible for this levy.

- Any person making a supply via an e-commerce operator liable to deduct the TCS will not be eligible. E- commerce operators are required to deduct TCS u/s 52 of CGST Act. They need to deduct it on amount collected on behalf of supplier. It is important to note that ECO like urban clap are covered in notification issued u/s 9(5). In their case they are liable to pay tax so they don’t need to deduct TCS.

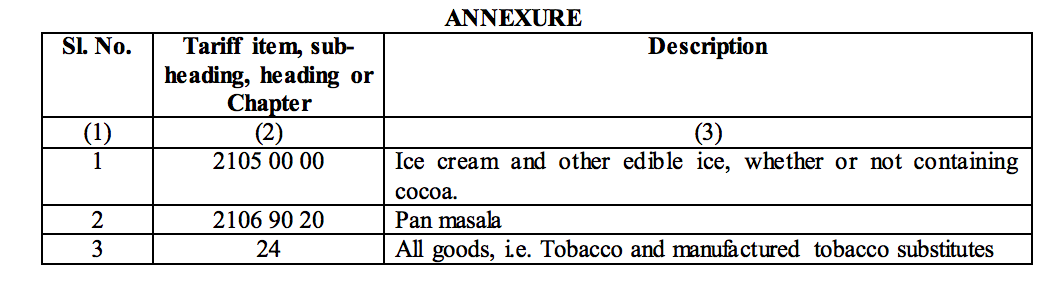

- He should not be engaged in following supplies.

2. Conditions to be fulfilled to avail new composition levy:

The composition dealer will be liable to be bind with following conditions once he take this option.

- He is liable to pay 6% tax on his entire turnover including the exempt supply.

- Composition taxpayer is not eligible for any input tax credit

- He is liable to pay reverse charge under section 9(3) and 9(4) of CGST Act.

- Composition taxpayer is not eligible to pass on the iTC of tax paid by him.

- The amount of supply by way of extended deposits by ay of interest will not be included in Rs. 50lac.

- His entire turnover will be considered for Rs. 50 ac threshold but for taxability only the turnover after registration will be considered.

3. Invoicing under new composition levy of GST:

The invoicing under this composition levy is also different.It is with following conditions:

- The supplier will not be eligible to issue a tax invoice. He will be liable to issue a bill of supply.

- He will have to mention the following words at the top of bill of supply.

‘taxable person paying tax in terms of notification No. 2/2019-Central Tax (Rate) dated 07.03.2019, not eligible to collect tax on supplies’“

Thus a composition dealer is required to change his invoice format.

4. Tax rates for new composition levy of GST

The tax rate for this supply will be 3% of CGST and 3% of SGST. No inter state supply is allowed so there is no question of IGST.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.