New FAQs on E-way bill

New FAQs on E-way bill

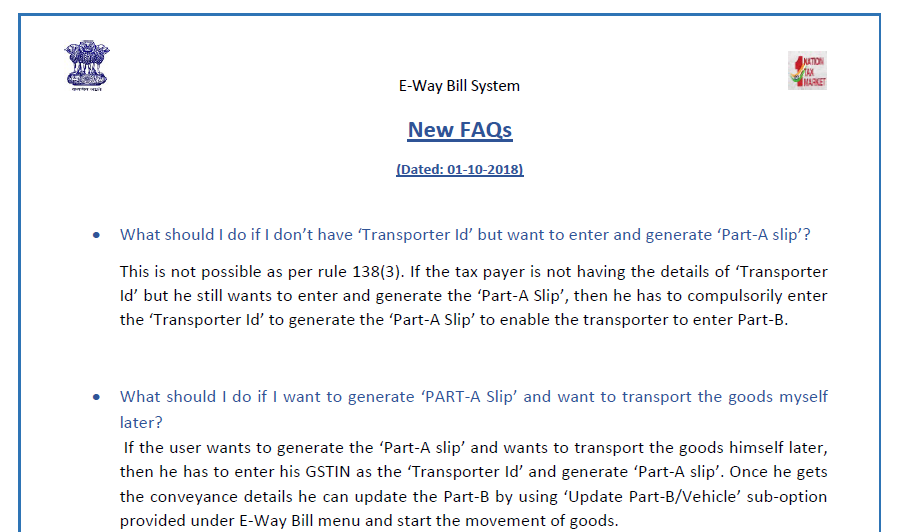

The department has issued the new FAQs e-way bill for the changes to be updated from 1st October 2018. Following are the new FAQs on E-way bill:

What should I do if I don’t have ‘Transporter Id’ but want to enter and generate ‘Part-A slip’?

This is not possible as per rule 138(3). If the taxpayer is not having the details of ‘Transporter Id’ but he still wants to enter and generate the ‘Part-A Slip’, then he has to compulsorily enter the ‘Transporter Id’ to generate the ‘Part-A Slip’ to enable the transporter to enter Part-B.

What should I do if I want to generate ‘PART-A Slip’ and want to transport the goods myself later?

If the user wants to generate the ‘Part-A slip’ and wants to transport the goods himself later, then he has to enter his GSTIN as the ‘Transporter Id’ and generate ‘Part-A slip’. Once he gets the conveyance details he can update the Part-B by using ‘Update Part-B/Vehicle’ sub-option provided under E-Way Bill menu and start the movement of goods.

When to extend the validity of E Way Bill?

The Generator or Transporter can extend the validity of the e-Way Bill, if the consignment is not being reached the destination within the validity period due to following circumstances:

- Delay due to vehicle breakdown.

- Natural calamity

- Law & order issue on the transit

- Accident of conveyance

- Trans-shipment delay etc.

The Generator or Transporter can extend the validity of e-Way Bill only between 8 hours before and 8 hours after the expiry time of the existing E Way Bill validity.

For example, if the validity of the E- Way Bill is till midnight of 2nd Oct 2018, then the user can extend the same after 4 PM on 2nd Oct 2018 or before 8 AM on 3rd Oct 2018.

Download the full pdf on New FAQs on E-way bill by clicking the below image:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.