New scheme of claiming ITC in GST w.e.f. 01-09-2023

Table of Contents

New mechanism to report ITC in GSTR 3B

A new mechanism was introduced by notification no. 14/2022 read with circular no. 170/2/2022. This mechanism will ensure the proper reporting of ITC in GSTR 3B.

How it works?

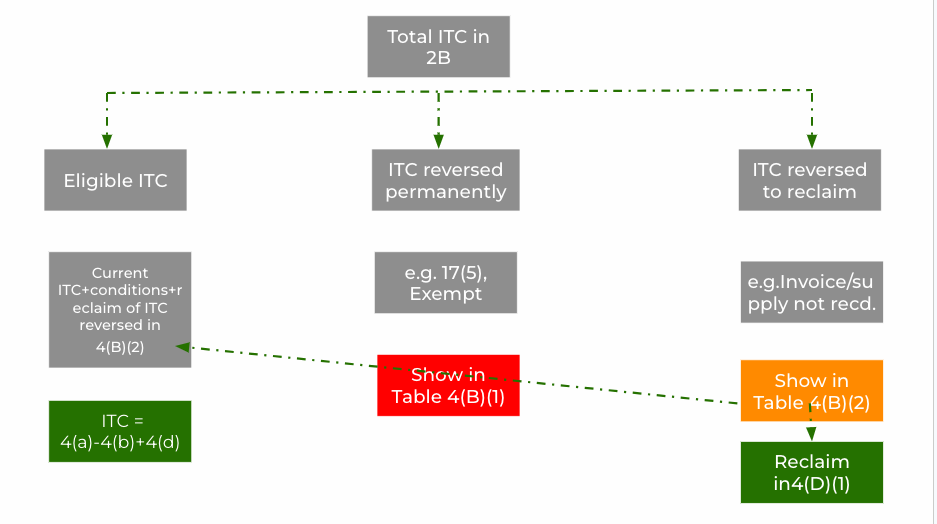

As per this provision the total ITC appearing in 2B should be accounted for the ITC should be entered in part A of table 4. Any ITC reversed in earlier period should be disclosed in Table 4(A)(5)- Any other ITC.

The ITC required to be reversed should be divided into two parts,

- The ITC permanently reversed

- The ITC which we are reversing with a view to reclaim it.

The ITC permanently reversed like 17(5) will be shown in table 4(B)(1). But the ITC we want to reclaim at a later date will be shown in table 4(B)(2).

The examples for those kind of ITC will be , when we didn’t received the supply or we don’t have invoice.

We are not eligible to claim it right then but will be able to claim t at a future date

When the condition is fulfilled we can claim it by showing in table no. 4(A)(5)- Any other ITC(add in figure of current Month ITC) and in Table 4(D)(1)

Illustrations

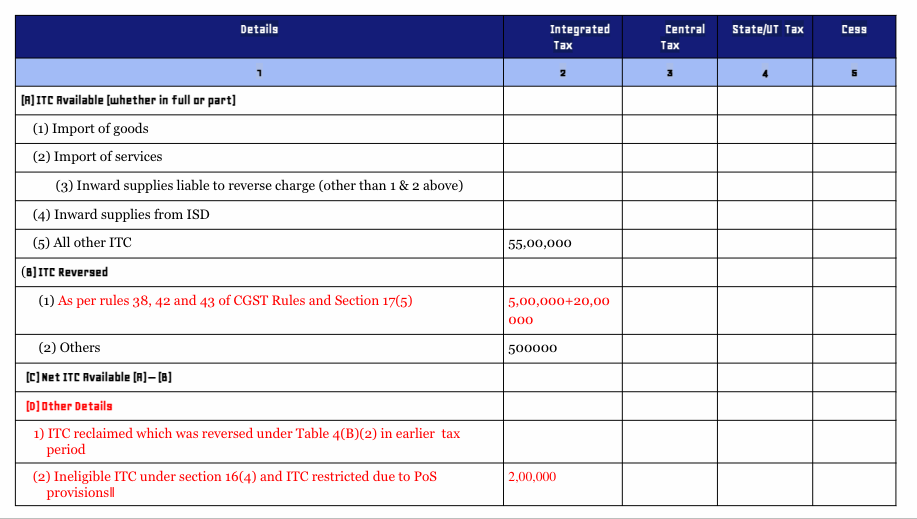

ITC in 2B=55,00,000

ITC of Motor vehicle=5,00,000

ITC attributable to the exempted sales= 20,00,000

ITC related to the stock in transit= 5,00,000

ITC related to the return filed by supplier for the period whose ITC is time barred by sec 16(4)= 2,00,000

How the return will be filed by the taxpayer under scheme of new GSTR 3B

(Assuming all entries in IGST)

When the stock will be received the ITC reversed here will be claimed in table 4(A)(5) and will be shown in Table 4(D)(1)

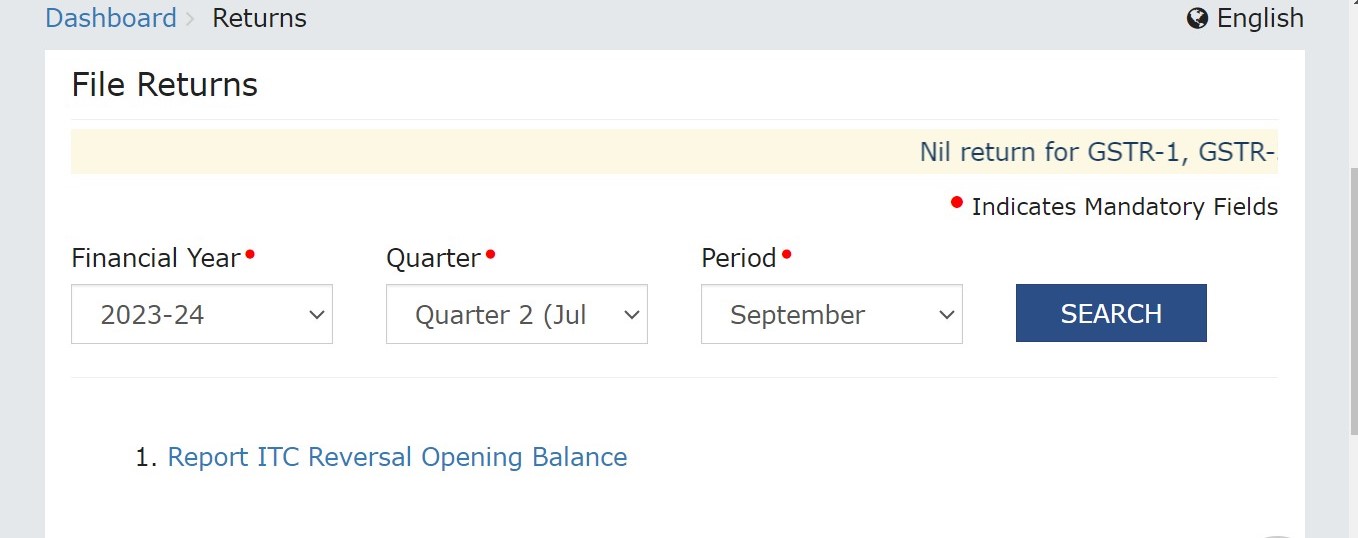

Declaration of opening balance of ITC reversed-

Every taxpayer is required to give the amount of opening balance for ITC reversed till date. The time limit given for this declaration is one month. It can be amended thrice. But if it is not filed within time , option to amend is also not available. Only the taxpayers who filed it on time will be able to amend later. You can give this declaration at returns dashboard clicking on the option given below.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.